Introduction

The world economy is moving into a recession which is expected to be the worst for many years. As growth stalls or turns negative there is widespread concern about its effect on the future of broadband. Up to now broadband has been one of the fastest growing new technologies the world has ever seen. As such it has been an important driver of overall economic growth, not only through the demand it generates directly but also through its role in improving economic performance and creating new consumer markets. Thus concerns about the future of broadband extend far beyond the telecoms industry to influence many aspects of government policy and to affect the planning of many different industries.

The world economy is moving into a recession which is expected to be the worst for many years. As growth stalls or turns negative there is widespread concern about its effect on the future of broadband. Up to now broadband has been one of the fastest growing new technologies the world has ever seen. As such it has been an important driver of overall economic growth, not only through the demand it generates directly but also through its role in improving economic performance and creating new consumer markets. Thus concerns about the future of broadband extend far beyond the telecoms industry to influence many aspects of government policy and to affect the planning of many different industries.

Point Topic has been tracking the growth of broadband worldwide since 1999 and is in a strong position to analyse past trends and provide informed forecasts for the new environment. So we are very pleased to have been asked by the International Telecommunications Union to provide our assessment of the impact of the recession on broadband growth to date and our projections for the future.

In brief, our main conclusion is that the broadband market is proving robust in the face of recession. The rate of growth of the installed base has certainly been affected, in some countries at least, but the impact is relatively small and underlying growth is still continuing. On the other hand, this view must be qualified with some caution. A number of factors could yet emerge to cut the growth rate of broadband much more sharply, or even to put it into reverse in some countries, particularly if the recession is as deep and long as the more pessimistic commentators expect.

In this paper we set out Point Topic's estimates for the effect of the recession to date and its likely impact in future. We explain the basis for our estimates and why we believe they will provide a useful tool for tracking the actual effects of the recession going forward. We also look at the risk of worse outcomes and the role of public policy in minimising the bad effects and using the opportunities which recession provides.

The UK as a case study

Being based in London, Point Topic is able to track and forecast what is happening in the UK more closely than anywhere else. Our results show that after resisting the effects of economic slowdown for months, UK broadband was finally hit by the arrival of a real recession in Q3 of 2008. The number of new broadband lines added in the July to September quarter was a clear 18% below earlier expectations.

In April 2008 Point Topic forecast that Britain would add another 800,000 broadband lines in the second half of 2008 26. This was later supported by the actual numbers for June 2008 which were slightly ahead of the forecast.

Even our original forecast showed a sharp reduction in the number of lines added per half year, down from 1.4 million in the first half of 2007 for example. The shrinkage is nothing to do with the recession but rather because of the disappearing pool of users who rely on dial-up access to the internet. Until recently, broadband in Britain grew largely by converting dial-up users to the faster service. But now few dial-up users remain and growth depends on the much slower process of converting "no-net" homes and businesses into internet users.

Then in Q3 of 2008 the market was hit by recession. To keep on track with the forecasts, and taking account of seasonal effects, Britain needed to add 390,000 broadband lines in the July to September quarter. Point Topic estimates that the actual number was only 321,000 - 18% down on our pre-recession projections.

Local loop unbundling - where ISPs such as Carphone Warehouse and Sky install their own equipment in BT's telephone exchanges - was the main driver of continuing growth in broadband, adding 323,000 lines in the quarter. Virgin Media, the cable network, added another 63,000 cable modem customers while BT and its wholesale customers together lost 65,000 net.

As a result, Point Topic is now forecasting that only 620,000 broadband lines will be added in the UK in the second half of 2008. The forecast for 2009 as a whole is 1.1 million, 200,000 down on the earlier forecast. By the end of 2009 there should be about 18.4 million broadband lines in Britain, 300,000 short of what was expected in April 2008. As a percentage of the installed base the difference is small but it represents a 15% fall in the number of lines due to be added in that period which can be attributed directly to the effects of the recession.

Forecast methodology

Clearly the number of broadband lines added in a period is a much more sensitive measure of broadband growth than the total size of the installed base. For this reason, Point Topic's forecasting methodology focuses on lines added rather than broadband totals. The main factor limiting the potential growth of fixed-line broadband is simply the number of households and business premises available to receive it. Thus the social structure of a country tends to set an upper limit on total broadband take-up which provides the best available guide in making forecasts.

As the market approaches saturation, the key issue for further growth is the percentage of non-user premises which can be signed up for broadband in each time period. The number of premises which can be addressed includes all homes and workplaces passed by one or more broadband services. Point Topic looks at what proportion of premises with coverage have joined the broadband community in each period in the last few years. This historic take-up rate by "no-net" premises is used as the basis for estimating take-up rates in future.

Using this approach allows us to make relatively accurate forecasts where the reasons for any deviations can be clearly identified.

______________________________

26 "UK Broadband forecasts to 2012", Point Topic UK Plus service, 1 May 2008

http://point-topic.com/content/ukplus/stats/UK_Broadband_Forecasts_0804.xls

Application to other countries

Having developed and tested our methodology for the UK, Point Topic has now applied it to forecast the number of broadband lines in the 40 biggest broadband countries in the world. The results suggest that the total number of broadband lines in these countries will grow from 393 million by the end of 2008 to 635 million by 2013. Adding in estimates for the remaining smaller countries suggests that the world will add a further 48 million broadband lines to reach 683 million in total over the period. 28

This represents a 10.8% per year compound growth rate, well down from 27.7% per year in the 2004 to 2008 period, but still substantial. One major reason for the slowdown in growth is that most of the richer countries are approaching saturation with broadband; new customers are becoming harder to find and sign up. At the same time poorer countries such as China and India have gone through the initial phase of rapid growth and are now growing steadily rather than exponentially.

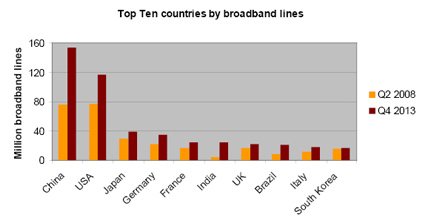

The figure shows the relative scale and proportions of the forecast growth for the ten biggest broadband countries. Looking five years ahead, China is forecast to be well in front, with 153 million broadband lines against 117 million in the USA. In fact China is expected to be already ahead of the USA by the end of 2008. India and Brazil are also expected to enter the Top 10, but Russia is forecast to be just outside at number 11

Limits on growth

Following the experience of the UK, the forecasts assumed that the recession would cut back the rate of growth in the more industrialised countries but would have little effect in the emerging economies. Where the recession was forecast to slow broadband growth its effects were expected to last through the second half of 2008 and the whole of 2009. The impact was forecast to be felt more heavily in the USA, the UK, South Korea, Australia and Hungary than in the other industrial economies.

In terms of regulation, confronted by more expensive financing and uncertain demand, operators are likely to push for regulatory holidays to justify their investments in NGN. The regulatory landscape is already undergoing a major transformation in the shift to NGN. As operators seek to share infrastructure to control costs, there will be greater need for regulation of shared infrastructure, while more M&A activity could accelerate the emergence of converged service providers and the need for converged regulatory bodies could grow.

China, Brazil, Russia and Viet Nam were expected to be relatively unaffected while India was expected to increase its relatively low take-up rate even in the recession. All the other 31 countries were expected to face a similar slowdown.

The forecasts were made before Point Topic's Global Broadband Statistics for Q3 of 2008 were published, but now they are available they support the view that, so far at least, broadband is proving fairly robust in the face of recession. Most of the developed countries, where broadband markets are already approaching saturation, look as if they will hit the forecasts for the end of the year quite closely. Projections for the USA, Japan, Germany, France and the UK are within 0.3% of the original forecasts on average. On the other hand many developing countries, and also some developed countries in the earlier stages of broadband growth, look set to exceed the forecasts quite substantially, recession or not. China, Brazil, Russia, Mexico and India all appear to be still on rising growth curves. It remains to be seen if these will be damped down as the recession deepens.

______________________________

28 "World Broadband Forecasts", Point Topic Global Broadband Statistics service, 14 Nov 2008

Danger of a hidden overhang

At the same time, Point Topic's figures may be concealing a worse situation than appears on the surface. For example, the broadband numbers reported by ISPs may include many non-performing customer accounts. Thus Carphone Warehouse, one of the leading UK ISPs, explained in its latest quarterly report that it had been necessary to exclude 93,000 "unreconciled accounts" from its broadband customer base. This included 48,000 which were on the billing schedule but not actually receiving service any more and another 45,000 from a recent acquisition who had been "identified as being at risk through the network migration process." 29

This kind of discrepancy is easily absorbed when the market is growing rapidly but becomes much more troublesome when times get difficult. It is likely that some ISPs will show reduced growth rates or actual falls as a result of the more rigorous accounting required as the recession gathers.

There is also the possibility that financial pressures will force significant numbers of people to actually cancel their broadband subscriptions. Up to now people have proved very reluctant to give up broadband once they have got it, but that could change if many homes are faced with falling real incomes. Actual net falls in broadband numbers are virtually unheard of up to now, but the broadband market is too new to have been seriously tested by recession. During the recession of 2001-2003, the broadband market was still small and growing too vigorously to be held back much by economic difficulties.

Effects and conclusions

To summarize, Point Topic is currently forecasting that the developed world will fall short by about 20% of the expected number of broadband additions in the period from mid-2008 to the end of 2009. The practical effect will be that the 40 biggest broadband countries will have only 442 million broadband lines by the end of 2009 compared with the 453 million they could expect without the recession.

The difference is small as a percentage of the total broadband base, but it will mean about 11 million homes and businesses worldwide either without internet access altogether or still relying on dial-up rather than broadband. That will mean a corresponding loss of consumer, educational and business benefits from internet access.

Governments around the world have are aiming to improve digital inclusion and to maximise the economic benefits of internet access as they strive to create modern information societies. They may wish to intervene to mitigate the effects of recession on these policies. More positively they may take the opportunity to invest in the next generation of internet access networks as a stimulus to broadband take-up and wider economic growth in the face of the recession. President-elect Obama is already proposing a central role for broadband investment in his recovery plan for the USA.

Point Topic hopes that its forecasts will continue to play a useful role in monitoring the robustness of broadband in the face of recession and the effectiveness of government or other initiatives. When the forecasts are updated, in the spring of 2009, it will be possible to make the first assessment of how much the broadband market has been affected by recession in practice. Point Topic expects that the regular comparison of short-term forecasts with actual outcomes will help to provide a better understanding of the dynamics of the broadband market.

Acknowledgements

This paper is based mainly on the data compiled and published by Point Topic's Global Broadband Statistics and UK Plus services. Thanks for making this possible are due to John Bosnell, who initiated Point Topic's tracking of broadband numbers, to Fiona Vanier, who now edits the Global Broadband References.

______________________________

29 Interim Results for the 26 weeks to 27 September 2008â, Carphone Warehouse, 18 Nov 2008

www.cpwplc.com/phoenix.zhtml?c=123964&p=irol-results