In the second half of 2008, the financial cycle of bust and boom has made another dramatic turn, and stocks and shares, pension funds and company profits are once again plunging in value. For much of the world, especially developing countries, the mid-2000s saw an extended period of growth. But the current financial crisis is now forcing a downgrade in future growth estimates. The OECD area is now officially in recession (two consecutive quarters of negative growth) and prices for property, raw materials and energy are all falling. Global trade is projected to fall in 2009 for the first time since 1982. Multi-billion dollar economic bailouts are on the international agenda and famous name companies are teetering on the brink of bankruptcy.

The ICT sector is not immune to the current crisis and is suffering at both "ends" of the market:

The supply side of the ICT sector is seeing a downturn in investment, as there is less confidence in the economy and less readily-available cash to invest in longer-term infrastructure projects; The demand side of the ICT sector is also suffering, as consumers postpone plans to upgrade their mobile phone or broadband connection and become more cost conscious when making calls.

A bit of history

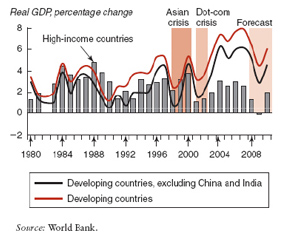

In such circumstances, it is logical to turn to the historians to tell us what happened in past financial crises as a guide to what to expect from the current crisis. Figure 1 gives an overview of the world economy over the past 30 years or so as well as some forecasts for 2009-2010. The effects of the two most recent financial crises are highlighted - the Asian crisis of the late 1990s and the dot.com bust of the early 2000s.

A couple of trends stand out from this chart:

Figure 1: Financial crises, past and present percentage change in real GDP in high-income and developing countries, 1980-2010

The current crisis originated in the high-income world, represented by the OECD economies. The current credit crunch began with a loss of confidence in the US sub-prime mortgage lending market and the subsequent development of "innovative" financial instruments for the securitization of housing market debt that were then sold on to over-leveraged financial institutions. The crisis has since spread to other parts of the world, especially smaller economies such as Iceland that are dependent on investment income. However, whereas during previous crises, the growth rate in developing countries has moved more or less in synchronization with high income countries, this time the developing world appears to be sustaining a growth rate that is much higher than that in the OECD area. Indeed, current growth in GDP in the developing world is now at a much higher rate than in the past, even compared with the booms that preceded the Asian financial crisis or the dot.com bust. For instance, the projected GDP growth rate in 2009 for the developing countries (including China and India) is expected to be almost five per cent higher than in 2008. In other words, in the developing world, the current nadir in growth is more or less the same as the zenith of the economic cycle in both 1997 and 2000. The period since the last slump is around six years, which shows a longer period of sustained growth than before the previous two economic downturns. The recent growth phase is comparable with that between 1992 and 1997. This implies that, although the current crisis represents a greater systemic shock, on the other hand, the world economy as a whole is larger and healthier, and should be in a better position to withstand this crisis, rather than previous downturns. Indeed, the current slowdown may actually be beneficial in reducing energy prices and slowing down global warming.

ICT sector growth as cause and consequence of financial crisis

The Information and Communication Technology (ICT) sector now accounts for a significant chunk of the global economy and an even higher proportion of its growth. It is not unexpected therefore that the ICT sector has played a major role in both the last two financial crises. But that role has been as both villain and hero: acting as a leading indicator of decline, but also as an engine of subsequent recovery. Furthermore, the ICT sector reflects trends in the wider economy, with the developing world now significantly outperforming the developed world.

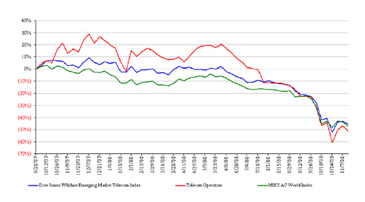

The role of the ICT sector can be illustrated by comparing the stock prices of telecom operators against other sectors in the global economy (Figure 2). In emerging markets, telecom operators were generally outperforming the general stock market before the start of August 2008. However, after that date, telecom operators' share prices entered red territory and fell in step with the overall market decline. By the start of October 2008, telecom stock was declining at a faster rate than the rest of the economy, as the crisis of confidence caused by the collapse of famous names - such as Lehman Brothers - began to bite. But the reality is that, since telecom shares were doing better than the general market for most of the earlier period, they have further to fall when times get tough.

Figure 2: Performance of emerging market indices and telecom operators, Sept 2007-Aug 2008

Percentage change in share price

What can be learned from previous crises and their impact on the ICT sector? Probably the clearest message is "don't panic". The Asian financial crisis, from approximately 1997 to 1999, had a noticeable effect on the ICT sector in that region, with the growth rate in new subscriber additions slowing in two successive years before picking up again (Figure 3). But it never fell into negative territory and Asia remained above the global average throughout the period. By 2001, six of the world's top ten most profitable telecom operators were from Asia, suggesting that the region rebounded further than it sank, at least for the ICT sector.

Figure 3: Bound and Rebound

The impact of the Asian Financial Crisis on ICT sector growth rates

This provides a second lesson from the Asian financial crisis: namely, that the forced retrenchment of a recession gives companies a chance to reassess and reinvest in new growth areas. In this case, the Asian financial crisis prompted the shift from narrowband to broadband markets to occur much earlier in Asia than in either Europe or North America, which were less affected by that particular financial crisis. Indeed, by 2001, Asian economies (especially the Republic of Korea) had established a clear lead in this field (Figure 4). Ironically, it was in part the failure to invest quickly enough in high-capacity networks that doomed the dreams of many Internet entrepreneurs in Europe and North America.

Figure 4: Advantage Asia

The impact of the Asian Financial Crisis on ICT sector growth rates

Of course, Europe and North America eventually caught up with the Asian economies in broadband and some smaller European economies have actually overtaken their Asian counterparts in terms of broadband penetration rates. But the point here is that the Asian financial crisis was actually beneficial in creating a Schumpeterian "gale of creative destruction" that swept through the failed telecom investment schemes of the mid-1990s (in this case based on narrowband networks) and prepared the ground for a fresh round of investment. The Republic of Korea was arguably hardest-hit by the Asian financial crisis, but it was also in the vanguard of the broadband charge, with the Government taking a leading role, alongside private enterprises.

Lessons from the bursting of the dot.com bubble

What lessons can be learned from the more recent crash associated with the dot.com bubble, which burst in early 2000? The ICT sector figured very prominently in this hectic period of economic history. As its name suggests, the dot.com bubble was caused by irrational expectations concerning the future growth prospects of Internet start-ups that added a “.com” to their business name to ride the wave surrounding the hype associated at the time with the Internet - including companies such as pets.com, mortgage.com or theGlobe.com. However, more broadly, the dot.com era was associated with scarcity and the realization that this scarcity was largely artificial gave rise to the start of the collapse of irrational exuberance:

A scarcity of bandwidth at the consumer end of the market inflated the market price of dial-up Internet providers such as AOL.com, which was valued at US$182 billion at the time of its merger with Time Warner in January 2000. The advent of consumer broadband, which had already started by that time in Asia (Figure 4), soon dented these share valuations and opened the way for more traditional telecom companies to regain some of the initiative they had ceded in the Internet market to dot.com companies. A scarcity of bandwidth at the supplier end, or what seemed to be the case as analysts routinely repeated the line that "Internet traffic is doubling every 100 days". In fact, such forecasts were based on dodgy data and, in any case, such exponential growth could not be sustained indefinitely. As it turned out, international bandwidth was far from scarce, and this led to the collapse of speculative ventures such as Project Oxygen or Teledesic and the acquisition of other infrastructure assets, such as those of Global Crossing or Iridium, at knock-down prices. A scarcity of spectrum, that forced up prices at auction for third generation (3G) mobile licences to above US$ 100 per inhabitant in the coverage area (more than US$ 5 billion per license in the UK and Germany). Ironically, at the same time that European economies were conducting 3G spectrum auctions, the ITU World Radio Conference of 2000 was making available new spectrum allocations for 3G services, thereby relieving some of the perceived scarcity of spectrum for mobile applications. A scarcity of dot.com domain names, again created artificially by Verisign's monopoly over the .com registrar function. Although Verisign's position remains essentially unaltered, the creation by ICANN of new top-level domain names, plus the wider availability of attractive country-code domain names, has helped ease this perceived shortage. The global dictionary of available names is not quite as depleted as it seemed in 2000.

A clear lesson emerging from the dot.com crisis is that scarcity may be more perceived than real. Ironically, it was the technological and other breakthroughs that converted scarcity to relative abundance that actually led to the financial crisis, because share prices had previously been sustained by their rarity. Thus, when mainstream telecommunication operators started to focus on the Internet in the early 2000s, and to commandeer its wealth generation potential, the resulting market collapse affected the whole ICT sector, and indeed the wider global economy.

The current parallel probably with 2000-2003 lies in the area of the spectrum, where scarcity is being converted into relative abundance. This is happening as a result of further technological change (e.g., the development of cognitive radio and spread spectrum techniques), allied with changes in management of spectrum (e.g., the shift towards license-exempt spectrum) and the embrace of market mechanisms (such as spectrum trading) for spectrum allocation. It is likely to create new opportunities for market entry. In the short term, this may force down the valuation of those companies, such as mobile operators, whose stock prices reflect the economic value of the spectrum they “own”. On the other hand, over the longer term, the greater availability and lower cost of spectrum is likely to spur innovation and new market opportunity, especially in the field of mobile broadband.

A similar tale holds in the area of consumer broadband. At present, services which need cheap, high-performance bandwidth in order to sell services to consumers - such as movie or audio downloads or online gaming - are constrained by the fact that fewer than half of all households in developed countries have broadband. As broadband penetration continues to expand - and fixed-line broadband passed the 400 million user mark in late 2008 - this is likely to have an adverse effect on traditional purveyors of home entertainment - such as TV channels, DVD rental or cable TV providers. On the other hand, broadband will provide a boost to other services, such as video on demand, that have thus far lacked the scale in their operations to take off. Broadband appears to be a General-Purpose Technology (GPT) enabler that will give birth to a wide variety of related services, in much the same way that electricity enabled a wide range of industries to develop. Electrical power was the platform for an earlier industrial revolution, and broadband could become the platform for a future information revolution that is more pervasive than any witnessed to date.

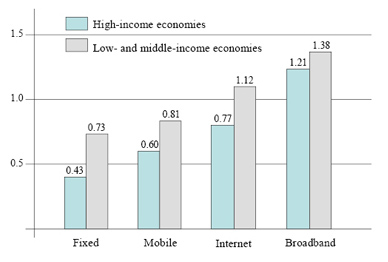

Some support for this hypothesis comes from the characteristics of broadband and its role in promoting growth in other sectors of the economy. A study of broadband in more than 130 economies shows that it is tending to double the performance / price ratio approximately every 12-15 months (Figure 5). Furthermore, although commercially-available broadband for residential consumers is only just over a decade old, it seems to be associated with much more rapid rates of economic growth that other, older ICT (Figure 6). Furthermore, this effect is more pronounced in developed economies than developed ones.

Figure 5: Cheap at half the price

Global trends in broadband prices, 2003-07

Figure 6: Figure 6: Growth effects of ICTs

Percentage point increase in GDP per capita for every ten percentage point increase in ICT penetration, 1980-2006

Conclusions

Change is rarely a comfortable part of the human condition, and although we may vote in favour of change as an abstract concept, we rarely embrace the personal reality of change unreservedly. A financial crisis portends a period of more intense change during which new opportunities are created, while old certainties are undermined. Jobs are created in a financial crisis, but rarely in the same locations as the existing jobs that have been destroyed. The most recent financial crisis of 2001 saw the ICT industry shed almost half a million jobs, mainly in the OECD countries, but since then at least that number of new jobs have been created elsewhere. It seems hard to believe now but, back in 2001, some commentators were reporting that the Internet had started to decline in size and that the mobile phone market was approaching saturation. Since then, the global total of Internet subscribers has doubled, while mobile subscribers have increased four-fold worldwide. Change is rarely a comfortable part of the human condition, and although we may vote in favour of change as an abstract concept, we rarely embrace the personal reality of change unreservedly. A financial crisis portends a period of more intense change during which new opportunities are created, while old certainties are undermined. Jobs are created in a financial crisis, but rarely in the same locations as the existing jobs that have been destroyed. The most recent financial crisis of 2001 saw the ICT industry shed almost half a million jobs, mainly in the OECD countries, but since then at least that number of new jobs have been created elsewhere. It seems hard to believe now but, back in 2001, some commentators were reporting that the Internet had started to decline in size and that the mobile phone market was approaching saturation. Since then, the global total of Internet subscribers has doubled, while mobile subscribers have increased four-fold worldwide.

AFor the ICT sector, experience from past financial crises shows that, for the world as a whole, there is little need to fear the net impact it will have, and some reasons to be optimistic. The Asian financial crisis laid the ground for the development of broadband while the bursting of the dot.com bubble allowed telecom operators to embrace the Internet and to reclaim some of the ground they had lost to new market entrants. Generally speaking, those entrants that complemented the operations of the telcos survived - such as Amazon.com or Google - but those that competed head on with the telcos did not fare so well - such as AOL or DialPad.com. In the ICT sector, deep pockets and steady cash-flows are the keys to long-term success. Financial weakness in the sector creates opportunities for cash-rich operators to acquire competitors and to purchase distressed assets at depressed prices.

But financial crises also create openings for disruptive technologies, and here, small companies hold an advantage. Google was born in 1998, in the middle of the Asian financial crisis, while Skype was born in 2003 at the very bottom of the dot.com slump. Both introduced disruptive technologies - in Internet search and Internet telephony respectively - and both have thrived while other competitors have fallen by the wayside. One reason is because they have complemented the wider ICT ecosystem, rather than cannibalizing it. Another reason is because they have relatively low start-up and running costs and have been able to take advantage of the falling prices - in computer processing power and in bandwidth respectively - that the financial crises of the time brought about.

The current global financial crisis is also likely to follow a similar pattern. In some ways, it will reassert the old order with those ICT companies that have sustainable business models, stable cash flows and deep pockets being able to regain some of the ground they have lost to new market entrants that are not so financial stable. But it will also create new opportunities for new firms with disruptive technologies to thrive. This will happen where prices are falling and where technology is changing. It might happen, for instance, in markets facilitated by the availability of lower-price, higher performance consumer broadband. Disruptive technologies may also develop where new spectrum is being released, for instance, by the switchover to digital television, or where new technology enables shared use of spectrum, such as the white spaces between TV channels. But new market entry is most likely to happen in the developing world where growth continues apace, largely unaffected by the travails afflicting the OECD economies.

There is an old saying that “it's an ill wind that blows nobody any good”, and a Schumpeterian gale of creative destruction is certainly not an ill wind. Financial crises come and go, but the basic human need to communicate continues unchanged. For this reason, the ICT sector will likely emerge from the current financial crisis as strong as ever.

|

|