Page 56 - FIGI: Security Aspects of Distributed Ledger Technologies

P. 56

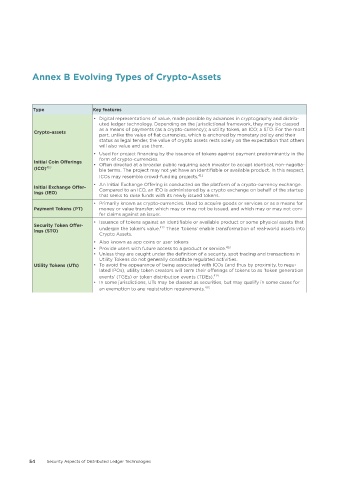

Annex B Evolving Types of Crypto-Assets

Type Key features

• Digital representations of value, made possible by advances in cryptography and distrib-

uted ledger technology. Depending on the jurisdictional framework, they may be classed

Crypto-assets as a means of payments (as a crypto-currency); a utility token, an ICO; a STO. For the most

part, unlike the value of fiat currencies, which is anchored by monetary policy and their

status as legal tender, the value of crypto assets rests solely on the expectation that others

will also value and use them.

• Used for project financing by the issuance of tokens against payment predominantly in the

form of crypto-currencies.

Initial Coin Offerings • Often directed at a broader public requiring each investor to accept identical, non-negotia-

(ICO) 410 ble terms. The project may not yet have an identifiable or available product. In this respect,

ICOs may resemble crowd-funding projects. 411

• An Initial Exchange Offering is conducted on the platform of a crypto-currency exchange.

Initial Exchange Offer-

ings (IEO) Compared to an ICO, an IEO is administered by a crypto exchange on behalf of the startup

that seeks to raise funds with its newly issued tokens.

• Primarily known as crypto-currencies. Used to acquire goods or services or as a means for

Payment Tokens (PT) money or value transfer; which may or may not be issued, and which may or may not con-

fer claims against an issuer.

• Issuance of tokens against an identifiable or available product or some physical assets that

Security Token Offer- 412

ings (STO) underpin the token’s value. These ‘tokens’ enable transformation of real-world assets into

Crypto Assets.

• Also known as app coins or user tokens

• Provide users with future access to a product or service. 413

• Unless they are caught under the definition of a security, spot trading and transactions in

Utility Tokens do not generally constitute regulated activities.

Utility Tokens (UTs) • To avoid the appearance of being associated with ICOs (and thus by proximity, to regu-

lated IPOs), utility token creators will term their offerings of tokens to as ‘token generation

events’ (TGEs) or token distribution events (TDEs). 414

• In some jurisdictions, UTs may be classed as securities, but may qualify in some cases for

an exemption to any registration requirements. 415

54 Security Aspects of Distributed Ledger Technologies