Page 602 - AI for Good Innovate for Impact

P. 602

AI for Good Innovate for Impact

REQ-05: It is expected that the system enables Regulatory Authorities to upload a log of

penalties applied as part of enforcement actions. It is expected that Competent Authority

users have access to view all enforcement actions logged by the Regulatory Authorities.

REQ-06: It is critical that the system applies strict validations on key fields such as Tax Identification

Numbers (TINs), Global Intermediary Identification Numbers (GIINs), and account details. All

mandatory fields are checked for completeness and conformance with OECD and IRS XML

schema standards before data is accepted into the system. It is critical that the TIN validation

algorithm compares TIN formats against 120+ jurisdictions as per specifications published by

OECD. It is critical that the system packages XMLs by tax residency of account holders and

transmits them to the respective partner jurisdictions.

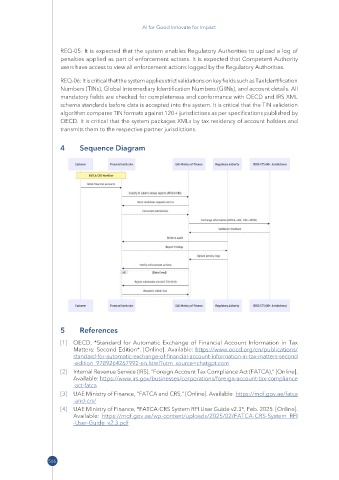

4 Sequence Diagram

5 References

[1] OECD, *Standard for Automatic Exchange of Financial Account Information in Tax

Matters: Second Edition*. [Online]. Available: https:// www .oecd .org/ en/ publications/

standard -for -automatic -exchange -of -financial -account -information -in -tax -matters -second

-edition _9789264267992 -en .html ?utm _source = chatgpt .com

[2] Internal Revenue Service (IRS), “Foreign Account Tax Compliance Act (FATCA),” [Online].

Available: https:// www .irs .gov/ businesses/ corporations/ foreign -account -tax -compliance

-act -fatca

[3] UAE Ministry of Finance, “FATCA and CRS,” [Online]. Available: https:// mof .gov .ae/ fatca

-and -crs/

[4] UAE Ministry of Finance, *FATCA-CRS System RFI User Guide v2.3*, Feb. 2025. [Online].

Available: https:// mof .gov .ae/ wp -content/ uploads/ 2025/ 02/ FATCA -CRS -System _RFI

-User -Guide _v2 .3 .pdf

566