Page 597 - AI for Good Innovate for Impact

P. 597

AI for Good Innovate for Impact

Use Case- 7: Strengthening Financial Integrity and International

Trust: UAE’s FATCA/CRS Framework 4.6: Finance

Country: United Arab Emirates

Organization: Ministry of Finance

Contact Person(s):

Hana Akram, hhakram@ mof .gov .ae

Asma Alzarooni, amalzarooni@ mof .gov .ae

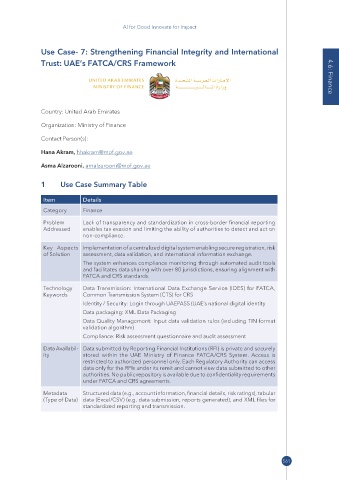

1 Use Case Summary Table

Item Details

Category Finance

Problem Lack of transparency and standardization in cross-border financial reporting

Addressed enables tax evasion and limiting the ability of authorities to detect and act on

non-compliance.

Key Aspects Implementation of a centralized digital system enabling secure registration, risk

of Solution assessment, data validation, and international information exchange.

The system enhances compliance monitoring through automated audit tools

and facilitates data sharing with over 80 jurisdictions, ensuring alignment with

FATCA and CRS standards.

Technology Data Transmission: International Data Exchange Service (IDES) for FATCA,

Keywords Common Transmission System (CTS) for CRS

Identity / Security: Login through UAEPASS (UAE’s national digital identity

Data packaging: XML Data Packaging

Data Quality Management: Input data validation rules (including TIN format

validation algorithm)

Compliance: Risk assessment questionnaire and audit assessment

Data Availabil- Data submitted by Reporting Financial Institutions (RFI) is private and securely

ity stored within the UAE Ministry of Finance FATCA/CRS System. Access is

restricted to authorized personnel only. Each Regulatory Authority can access

data only for the RFIs under its remit and cannot view data submitted to other

authorities. No public repository is available due to confidentiality requirements

under FATCA and CRS agreements.

Metadata Structured data (e.g., account information, financial details, risk ratings), tabular

(Type of Data) data (Excel/CSV) (e.g. data submission, reports generated), and XML files for

standardized reporting and transmission.

561