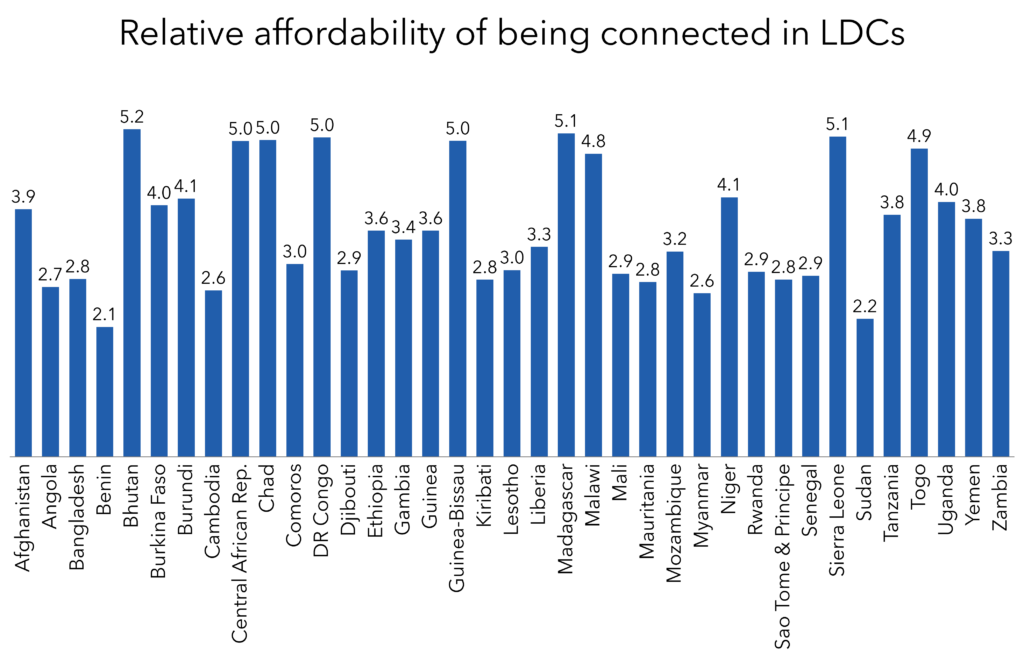

One of the key components of affordability for mobile Internet is related to data bundles. The UN Broadband Commission has set a target to make entry-level data services less than 2 per cent of monthly GNI per capita by 2025.

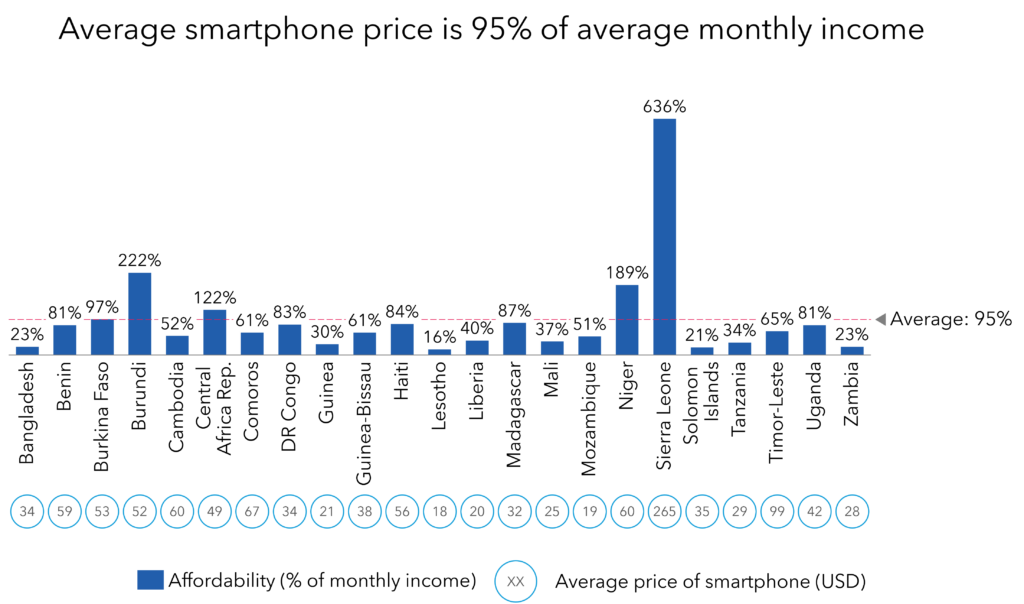

Another major component is the affordability of Internet-enabled devices. In this context, it is important to consider the affordability of the cheapest such device (whether a smartphone or feature phone), measured as the cost relative to monthly income per capita. Despite improvements in affordability, the cost of a device will remain a barrier for many of the people who are offline, particularly those on the lowest incomes. For many potential users, even a phone priced at USD 20 represents a significant one-off cost. In sub-Saharan Africa, for example, the median cost of an entry-level Internet-enabled handset amounted to more than 120 per cent of monthly income for the poorest 20 per cent of the population in 2019 [34]

Key issue: Broadband plans

The affordability indicator is the monthly price of broadband plans as percentage of GNI per capita. The target set by the Broadband Commission for Sustainable Development is for this to be less than 2 per cent of GNI per capita by 2025. At the time of writing, mobile broadband plans are priced at a level that is well above the aspirational target, especially in the LDCs.

Potential intervention: Broadband (mobile/fixed) plans

As the objective is to bring people online, it will be very important to ensure that the data plans being offered are aligned with the economic conditions of the target population. Affordable mobile broadband translates into increased Internet usage. Introducing affordable and innovative data packages and leveraging mechanisms to keep prices in affordable ranges are a few ways to attract people who are offline. It is also helpful to focus on services that are relevant for the local population.

Spotlight

Vodacom offers a “data-sharing wallet” in the DRC that enables a group of customers to buy mobile data in bulk at an affordable price of about R2200 for 100GB. [36]

Key issue: Device costs

One of the key tenets of meaningful connectivity is providing people with access to the right device at an affordable price. However, this remains one of the key barriers for people who are otherwise willing to connect to the Internet and/or in a position to use digital services.

Smartphone prices remain high in LDCs, hampering Internet take-up. According to research on smartphone prices conducted in over 180 countries, the LDCs have the least affordable devices at 53 per cent of the average monthly income.[38] Similarly, in sub-Saharan Africa, devices are 45 per cent of monthly income, and in South Asia, 40 per cent. Contrastingly, in Europe, Central Asia, East Asia, the Pacific, the Middle East and North Africa, they are merely 23-24 per cent. Latin American and the Caribbean spend approximately 10 per cent of their monthly income on devices. Most impressive is North America where devices are a mere 2 per cent of monthly income.

Satellite user terminals remain expensive but as adoption is increasing, the price factor is also seeing a major shift. In the current state, satellite user terminals remain expensive but as the adoption is on the increasing trend, the deployment model and the price factor are also seeing major shift. The most relevant model of satellite broadband connectivity is by connecting a hub either of a private player or a CSP for example and then these players use the satellite broadband backhaul to provide data connectivity. This model helps standardize the terminal cost and the end user is not burdened with high-cost devices.

Potential interventions:

A) Device ownership/financing

During the past few years, many consumers in LMICs who could not afford to purchase a mobile phone or Internet-enabled device with a single upfront payment have benefited from asset financing models (such as payment instalment plans, subsidies, loans, leases or rentals). Operators are also innovating with alternative credit-scoring models. Several operators and third-party providers (such as pay-as-you-go utility companies) have launched such initiatives.

B) Taxation/duties

It may be worthwhile to reduce customs duties for the ICT sector, especially for handsets/devices (hardware and software), and review tax policies in the sector to encourage investment and promote the adoption of the ICT services.

Spotlight

NuovoPay (an Indian company) offers a technology platform that targets consumers who do not have access to traditional financial assistance. It gives them access to smartphones while reducing the risk of telecommunications companies losing the customer from their core business. Operators lease their devices and through NuovoPay, they are able to lock the device remotely when the consumer defaults on payments. [39]

Spotlight

In 2019, KaiOS Technologies also started partnering with mobile operators to introduce smart-feature phones in several sub-Saharan African markets. This included Vodacom’s Smart Kitochi 4G phone in Tanzania, the Orange 4G Sanza in Botswana, the MTN Kamunye in Uganda and Telma Wi-Kif + 4G in Madagascar (all priced at or close to USD 20). The emergence of KaiOS and its partnerships with operators across Africa are helping to remove the affordability barrier for low-income users. [40]

Key issue: Service reliability

In many countries the reliability of ICT services is a major challenge. Ensuring continuous and stable connectivity remains a fundamental requirement; however, there are multiple factors that can cause difficulties with this, including:

- the extreme remoteness of some areas;

- limited access on some islands;

- poor network construction (making it problematic to manage cost); and

- the quality of power connectivity, especially in remote areas.

Potential intervention: Network diversity

The prime impetus will come from allowing telecom operators (private or public) to be able to build sufficient resiliency into the network design to overcome challenges. The policy and regulatory support to invest large amounts of capex is a key aspect of this. The government can be one of the enablers by investing in the infrastructure, laying a fibre network across the country, and allowing third parties to lease resources from the network or making policy changes to allow neutral infrastructure providers to be able to create and lease the required network resiliency.

Spotlight

The Palapa Ring project in Indonesia was initiated by the government to build a national infrastructure connecting seven of the archipelago’s island groupings. The effect of this project has been a significant improvement in mobile services. It has also enabled the operators to build resiliency into their own networks for better service continuity. [41]

Commit to a pledge on our Pledging Platform here. See guidelines on how to make your pledge in Pledging for Universal Meaningful Connectivity and examples of potential P2C pledges here

Footnotes

[34] GSMA. (2020). The State of Mobile Internet Connectivity 2020.

[35] The Economist Intelligence Unit. (2021). The Inclusive Internet Index.

[36] Vodacom. (2020). Vodacom SDG Report 2020.

[37] ITU. (2021). Connectivity in the Least Developed Countries: Status Report 2021.

[38] A4AI. (2021). Device Pricing 2021.

[39] NuovoPay. (2022). Smartphone leasing for Telecos with NuovoPay.

[40] KaiOS. (2021). Internet for everyone.

[41] Opensignal. (2020). Palapa Ring has successfully improved mobile connectivity in remote Indonesian islands.