Page 32 - Digital Financial Services security assurance framework

P. 32

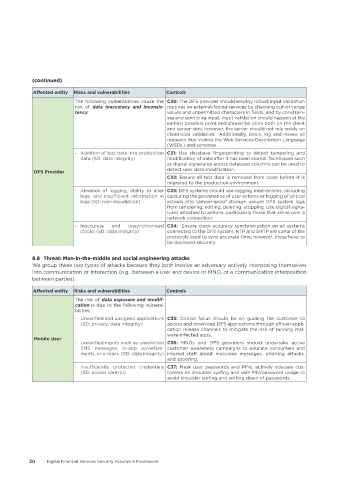

(continued)

Affected entity Risks and vulnerabilities Controls

The following vulnerabilities cause the C30: The DFS provider should employ robust input validation

risk of data inaccuracy and inconsis- routines on external-facing services by checking out-of-range

tency: values and unpermitted characters in fields, and by constrain-

ing and sanitizing input. Input validation should happen at the

earliest possible point and should be done both on the client

and server-side, however, the server should not rely solely on

client-side validation. Additionally, block, log and review all

requests that violate the Web Services Description Language

(WSDL) and schemas.

- Addition of test data into production C31: Use database fingerprinting to detect tampering and

data (SD: data integrity) modification of data after it has been stored. Techniques such

as digital signatures across database columns can be used to

DFS Provider detect user data modification.

C32: Ensure all test data is removed from code before it is

migrated to the production environment.

- Absence of logging, ability to alter C33: DFS systems should use logging mechanisms, including

logs, and insufficient information in capturing the provenance of user actions or logging of critical

logs (SD: non-repudiation) actions into tamper-proof storage, secure DFS system logs

from tampering, editing, deleting, stopping. Use digital signa-

tures attached to actions, particularly those that arrive over a

network connection.

- Inaccurate and unsynchronised C34: Ensure clock accuracy synchronization on all systems

clocks (SD: data integrity) connected to the DFS system. NTP and SNTP are some of the

protocols used to sync accurate time; however, these have to

be deployed securely.

8�8 Threat: Man-in-the-middle and social engineering attacks

We group these two types of attacks because they both involve an adversary actively interposing themselves

into communication or interaction (e.g., between a user and device or MNO, or a communication interposition

between parties).

Affected entity Risks and vulnerabilities Controls

The risk of data exposure and modifi-

cation is due to the following vulnera-

bilities:

- Unverified and unsigned applications C35: Critical focus should be on guiding the customer to

(SD: privacy, data integrity) access and download DFS applications through official appli-

cation release channels to mitigate the risk of running mal-

ware-infected apps.

Mobile User

- Unverified inputs such as unsolicited C36: MNOs and DFS providers should undertake active

SMS messages, in-app advertise- customer awareness campaigns to educate consumers and

ments, or e-mails (SD: data integrity) internal staff about malicious messages, phishing attacks,

and spoofing.

- Insufficiently protected credentials C37: Mask user passwords and PINs, actively educate cus-

(SD: access control) tomers on shoulder surfing and safe PIN/password usage to

avoid shoulder surfing and writing down of passwords.

30 Digital Financial Services Security Assurance Framework