Page 8 - FIGI Digital Financial Services Consumer Competency Framework

P. 8

Executive Summary

Digital financial services (DFS) has the potential to strong competencies, so they can manage shocks

increase financial inclusion for vulnerable popula- and navigate the world of DFS more securely and

tions, including women, and to close the gender gap confidently.

in access to financial services in low- and middle-in- The DFS Consumer Competency Framework

come countries (LMICs), which is key to achiev- identifies the knowledge, skills and attitudes con-

ing the United Nations Sustainable Development sumers need to participate actively, safely and have

Goals (SDGs) – i.e. the fifth goal on gender equality. trust in the digital financial services ecosystem. The

However, although the number of people with a DFS DFS Consumer Competency Framework is intended

account has been rising over the years, usage has not for use by public authorities, regulators, DFS provid-

kept pace. DFS usage still poses some challenges for ers and policymakers when developing consumer

consumers. DFS consumers must be able to use the education/training programmes for digital financial

new technologies for financial transactions in a secure services. The DFS Consumer Competency Frame-

manner, and also must have the necessary compe- work will provide guidance to policymakers, national

tences to understand the risks and make informed regulators and DFS providers when developing con-

decisions when using digital financial services. This sumer awareness and literacy programmes as part of

has a direct impact on consumer trust and usage of the DFS/financial inclusion strategy. Regulators and

DFS. Consumer competencies and strong institution- DFS providers can select from the skills that are crit-

al frameworks in times of crises have proven particu- ical and which are most relevant to their consumer

larly critical. Given the unprecedented shock caused awareness and literacy programmes.

COVID-19, across sectors and particularly in DFS, we These consumer competency guidelines are not

are witnessing new types of fraudulent schemes and intended to substitute the suitability requirements or

other issues which may challenge consumer compe- other obligations of the service provider.

tencies. Today more than ever, consumers and finan-

cial authorities worldwide should invest in building

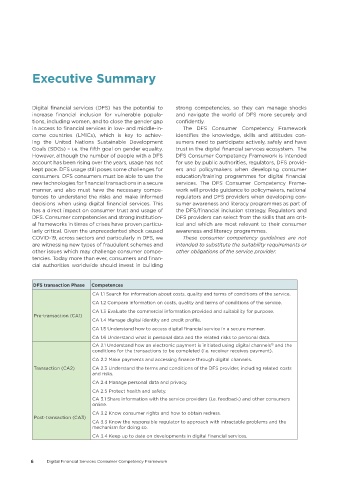

DFS transaction Phase Competences

CA 1.1 Search for information about costs, quality and terms of conditions of the service.

CA 1.2 Compare information on costs, quality and terms of conditions of the service.

CA 1.3 Evaluate the commercial information provided and suitability for purpose.

Pre-transaction (CA1)

CA 1.4 Manage digital identity and credit profile.

CA 1.5 Understand how to access digital financial service in a secure manner.

CA 1.6 Understand what is personal data and the related risks to personal data.

CA 2.1 Understand how an electronic payment is initiated using digital channels and the

15

conditions for the transactions to be completed (i.e. receiver receives payment).

CA 2.2 Make payments and accessing finance through digital channels.

Transaction (CA2) CA 2.3 Understand the terms and conditions of the DFS provider, including related costs

and risks.

CA 2.4 Manage personal data and privacy.

CA 2.5 Protect health and safety.

CA 3.1 Share information with the service providers (i.e. feedback) and other consumers

online.

CA 3.2 Know consumer rights and how to obtain redress.

Post-transaction (CA3)

CA 3.3 Know the responsible regulator to approach with intractable problems and the

mechanism for doing so.

CA 3.4 Keep up to date on developments in digital financial services.

6 Digital Financial Services Consumer Competency Framework