Page 575 - AI for Good Innovate for Impact

P. 575

AI for Good Innovate for Impact

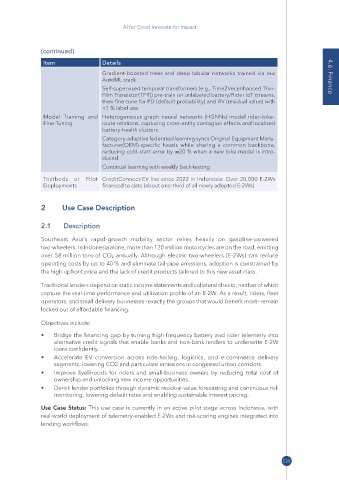

(continued)

Item Details

Gradient-boosted trees and deep tabular networks trained via our

AutoML stack 4.6: Finance

Self-supervised temporal transformers (e.g., Time2Vecenhanced Thin-

Film Transistor(TFT)) pre-train on unlabeled battery/Rider IoT streams,

then fine-tune for PD (default probability) and RV (residual value) with

<1 % label use.

Model Training and Heterogeneous graph neural networks (HGNNs) model rider–bike–

Fine-Tuning route relations, capturing cross-entity contagion effects and localized

battery-health clusters.

Category-adaptive federated learning syncs Original Equipment Manu-

facturer(OEM)-specific heads while sharing a common backbone,

reducing cold-start error by 20 % when a new bike model is intro-

duced.

Continual learning with weekly back-testing

Testbeds or Pilot CreditConnect-EV live since 2022 in Indonesia: Over 20,000 E-2Ws

Deployments financed to date (about one-third of all newly adopted E-2Ws)

2 Use Case Description

2�1 Description

Southeast Asia’s rapid-growth mobility sector relies heavily on gasoline-powered

two-wheelers. In Indonesia alone, more than 120 million motorcycles are on the road, emitting

over 58 million tons of CO₂ annually. Although electric two-wheelers (E-2Ws) can reduce

operating costs by up to 40 % and eliminate tail-pipe emissions, adoption is constrained by

the high upfront price and the lack of credit products tailored to this new asset class.

Traditional lenders depend on static income statements and collateral checks, neither of which

capture the real-time performance and utilization profile of an E-2W. As a result, riders, fleet

operators, and small delivery businesses—exactly the groups that would benefit most—remain

locked out of affordable financing.

Objectives include:

• Bridge the financing gap by turning high-frequency battery and rider telemetry into

alternative credit signals that enable banks and non-bank lenders to underwrite E-2W

loans confidently.

• Accelerate EV conversion across ride-hailing, logistics, and e-commerce delivery

segments, lowering CO2 and particulate emissions in congested urban corridors.

• Improve livelihoods for riders and small-business owners by reducing total cost of

ownership and unlocking new income opportunities.

• Derisk lender portfolios through dynamic residual-value forecasting and continuous risk

monitoring, lowering default rates and enabling sustainable interest pricing.

Use Case Status: This use case is currently in an active pilot stage across Indonesia, with

real-world deployment of telemetry-enabled E-2Ws and risk-scoring engines integrated into

lending workflows.

539