Page 574 - AI for Good Innovate for Impact

P. 574

AI for Good Innovate for Impact

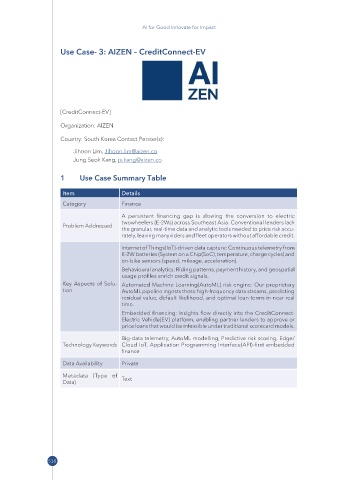

Use Case- 3: AIZEN – CreditConnect-EV

[CreditConnect-EV]

Organization: AIZEN

Country: South Korea Contact Person(s):

Jihoon Lim, Jihoon.lim@ aizen .co

Jung Seok Kang, js.kang@ aizen .co

1 Use Case Summary Table

Item Details

Category Finance

A persistent financing gap is slowing the conversion to electric

twowheelers (E-2Ws) across Southeast Asia. Conventional lenders lack

Problem Addressed

the granular, real-time data and analytic tools needed to price risk accu-

rately, leaving many riders and fleet operators without affordable credit.

Internet of Things(IoT)-driven data capture: Continuous telemetry from

E-2W batteries (System on a Chip(SoC), temperature, charge cycles) and

on-bike sensors (speed, mileage, acceleration).

Behavioural analytics: Riding patterns, payment history, and geospatial

usage profiles enrich credit signals.

Key Aspects of Solu- Automated Machine Learning(AutoML) risk engine: Our proprietary

tion AutoML pipeline ingests these high-frequency data streams, predicting

residual value, default likelihood, and optimal loan terms in near real

time.

Embedded financing: Insights flow directly into the CreditConnect-

Electric Vehicle(EV) platform, enabling partner lenders to approve or

price loans that would be infeasible under traditional scorecard models.

Big-data telemetry, AutoML modelling, Predictive risk scoring, Edge/

Technology Keywords Cloud IoT, Application Programming Interface(API)-first embedded

finance

Data Availability Private

Metadata (Type of

Data) Text

538