Page 39 - Digital Financial Services security assurance framework

P. 39

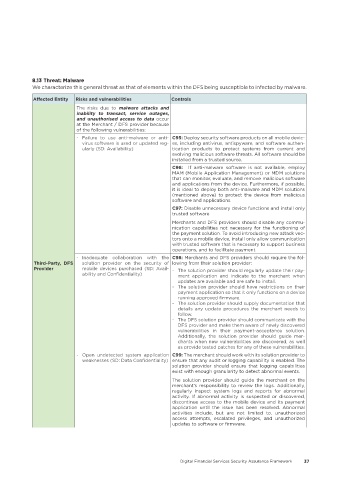

8�13 Threat: Malware

We characterize this general threat as that of elements within the DFS being susceptible to infected by malware.

Affected Entity Risks and vulnerabilities Controls

The risks due to malware attacks and

inability to transact, service outages,

and unauthorised access to data occur

at the Merchant / DFS provider because

of the following vulnerabilities:

- Failure to use anti-malware or anti- C95: Deploy security software products on all mobile devic-

virus software is used or updated reg- es, including antivirus, antispyware, and software authen-

ularly (SD: Availability) tication products to protect systems from current and

evolving malicious software threats. All software should be

installed from a trusted source.

C96: If anti-malware software is not available, employ

MAM (Mobile Application Management) or MDM solutions

that can monitor, evaluate, and remove malicious software

and applications from the device. Furthermore, if possible,

it is ideal to deploy both anti-malware and MDM solutions

(mentioned above) to protect the device from malicious

software and applications.

C97: Disable unnecessary device functions and install only

trusted software

Merchants and DFS providers should disable any commu-

nication capabilities not necessary for the functioning of

the payment solution. To avoid introducing new attack vec-

tors onto a mobile device, install only allow communication

with trusted software that is necessary to support business

operations, and to facilitate payment.

- Inadequate collaboration with the C98: Merchants and DFS providers should require the fol-

Third-Party, DFS solution provider on the security of lowing from their solution provider:

Provider mobile devices purchased (SD: Avail- - The solution provider should regularly update their pay-

ability and Confidentiality) ment application and indicate to the merchant when

updates are available and are safe to install.

- The solution provider should have restrictions on their

payment application so that it only functions on a device

running approved firmware.

- The solution provider should supply documentation that

details any update procedures the merchant needs to

follow.

- The DFS solution provider should communicate with the

DFS provider and make them aware of newly discovered

vulnerabilities in their payment-acceptance solution.

Additionally, the solution provider should guide mer-

chants when new vulnerabilities are discovered, as well

as provide tested patches for any of these vulnerabilities.

- Open undetected system application C99: The merchant should work with its solution provider to

weaknesses (SD: Data Confidentiality) ensure that any audit or logging capability is enabled. The

solution provider should ensure that logging capabilities

exist with enough granularity to detect abnormal events.

The solution provider should guide the merchant on the

merchant’s responsibility to review the logs. Additionally,

regularly inspect system logs and reports for abnormal

activity. If abnormal activity is suspected or discovered,

discontinue access to the mobile device and its payment

application until the issue has been resolved. Abnormal

activities include, but are not limited to, unauthorized

access attempts, escalated privileges, and unauthorized

updates to software or firmware.

Digital Financial Services Security Assurance Framework 37