Page 22 - Technical report on SS7 vulnerabilities and mitigation measures for digital financial services transactions

P. 22

bases will allow velocity checks to be undertaken by 12.7 Regulatory activities

the bank/PSP that will check and flag whether SIM Regulators with remit over DFS may establish proce-

swap request for a number linked to the true account dures and principles for detecting, preventing, report-

owner are suspiciously close in time to a request at ing, and mitigating SS7 and related attacks. They may

the bank/PSP for adding a new (possibly fraudulent) also establish procedures that licensees may need

payment beneficiary. implement to prevent SIM swaps.

Regulatory coordination between these regulators is

12.5 Detecting, preventing and mitigating SIM card key, so as to assign specific and joint roles and responsi-

recycle bilities. This should take the form of a Memorandum Of

Once there is inactivity in a DFS account, start monitor- Understanding (MOU) between the parties. An extract

ing the IMSI associated with the account phone number, from a model MOU between a telecommunications reg-

once the SIM is deactivated the mobile operator will not ulator and a central bank that contains language outlin-

reply correctly to these queries (one query a day is suf- ing these responsibilities is shown in Annex B.

ficient). The MOU includes inter alia the need to assign indi-

When the SIM is recycled, the mobile operator will vidual and shared technical responsibilities relating

report a new IMSI for the account phone number, the to infrastructure and related security issues that may

DFS provider should block the account until the identity impact the DFS ecosystem to each of these regulators,

if the new person holding the SIM card is verified as the including reporting lines and actions relating to intru-

account holder. sions. The telecommunications regulator in particular

should also undertake continuous testing in conjunction

12.6 Embedding data within the user’s phone for with its licensees to detect IMSI catchers. A joint work-

authentication ing committee between these two regulators that meets

DFS providers can work with device manufacturers and monthly to discuss DFS-related issues and any security

MNOs to embed a hard to spoof identifier within the threats or incidents is also envisaged in the MOU.

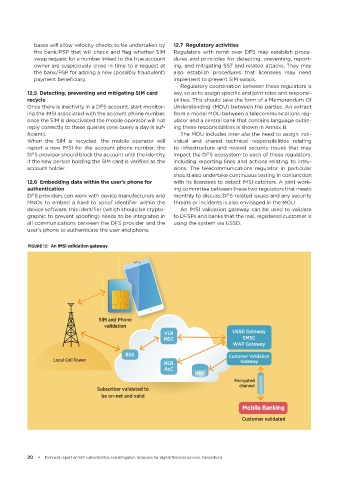

device software, this identifier (which should be crypto- An IMSI validation gateway can be used to validate

graphic to prevent spoofing) needs to be integrated in to DFSPs and banks that the real, registered customer is

all communications between the DFS provider and the using the system via USSD.

user’s phone to authenticate the user and phone.

FIGURE 12: An IMSI validation gateway

SIM and PhonePhoneMand PPhone

validation

VLR USSD Gateway

MSC SMSC

WAP Gateway

BSS Customer Validation

Local Cell Tower

HLR Gateway

AuC

IMEI

Encrypted

channel

Subscriber validated to

be on-net and valid

Mobile Banking

Customer validated

Telecom Operator

20 • Technical report on SS7 vulnerabilities and mitigation measures for digital financial services transactions