Page 610 - AI for Good Innovate for Impact

P. 610

AI for Good Innovate for Impact

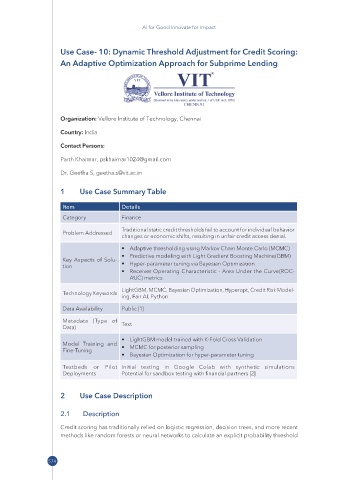

Use Case- 10: Dynamic Threshold Adjustment for Credit Scoring:

An Adaptive Optimization Approach for Subprime Lending

Organization: Vellore Institute of Technology, Chennai

Country: India

Contact Persons:

Parth Khairnar, pskhairnar1024@ gmail .com

Dr. Geetha S, geetha.s@vit.ac.in

1 Use Case Summary Table

Item Details

Category Finance

Traditional static credit thresholds fail to account for individual behavior

Problem Addressed

changes or economic shifts, resulting in unfair credit access denial.

• Adaptive thresholding using Markov Chain Monte Carlo (MCMC)

• Predictive modeling with Light Gradient Boosting Machine(GBM)

Key Aspects of Solu-

tion • Hyper-parameter tuning via Bayesian Optimization

• Receiver Operating Characteristic - Area Under the Curve(ROC-

AUC) metrics

LightGBM, MCMC, Bayesian Optimization, Hyperopt, Credit Risk Model-

Technology Keywords

ing, Fair AI, Python

Data Availability Public [1]

Metadata (Type of Text

Data)

• LightGBM model trained with K-Fold Cross Validation

Model Training and • MCMC for posterior sampling

Fine-Tuning

• Bayesian Optimization for hyper-parameter tuning

Testbeds or Pilot Initial testing in Google Colab with synthetic simulations

Deployments Potential for sandbox testing with financial partners [2]

2 Use Case Description

2�1 Description

Credit scoring has traditionally relied on logistic regression, decision trees, and more recent

methods like random forests or neural networks to calculate an explicit probability threshold

574