Page 15 - FIGI - Use of telecommunications data for digital financial inclusion

P. 15

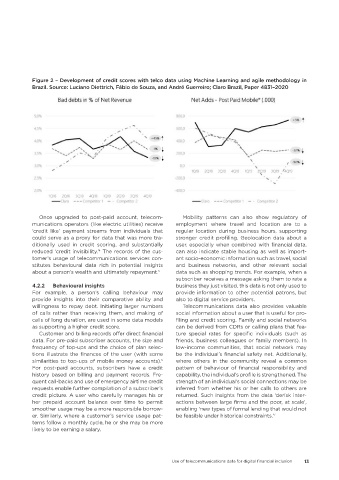

Figure 2 – Development of credit scores with telco data using Machine Learning and agile methodology in

Brazil. Source: Luciano Diettrich, Fábio de Souza, and André Guerreiro; Claro Brazil, Paper 4831–2020

Once upgraded to post-paid account, telecom- Mobility patterns can also show regulatory of

munications operators (like electric utilities) receive employment where travel and location are to a

‘credit like’ payment streams from individuals that regular location during business hours, supporting

could serve as a proxy for data that was more tra- stronger credit profiling. Geolocation data about a

ditionally used in credit scoring, and substantially user, especially when combined with financial data,

reduced ‘credit invisibility.’ The records of the cus- can also indicate stable housing as well as import-

4

tomer’s usage of telecommunications services con- ant socio-economic information such as travel, social

stitutes behavioural data rich in potential insights and business networks, and other relevant social

about a person’s wealth and ultimately repayment. 5 data such as shopping trends. For example, when a

subscriber receives a message asking them to rate a

4.2.2 Behavioural insights business they just visited, this data is not only used to

For example, a person’s calling behaviour may provide information to other potential patrons, but

provide insights into their comparative ability and also to digital service providers.

willingness to repay debt. Initiating larger numbers Telecommunications data also provides valuable

of calls rather than receiving them, and making of social information about a user that is useful for pro-

calls of long duration, are used in some data models filing and credit scoring. Family and social networks

as supporting a higher credit score. can be derived from CDRs or calling plans that fea-

Customer and billing records offer direct financial ture special rates for specific individuals (such as

data. For pre-paid subscriber accounts, the size and friends, business colleagues or family members). In

frequency of top-ups and the choice of plan selec- low-income communities, that social network may

tions illustrate the finances of the user (with some be the individual’s financial safety net. Additionally,

similarities to top-ups of mobile money accounts). where others in the community reveal a common

6

For post-paid accounts, subscribers have a credit pattern of behaviour of financial responsibility and

history based on billing and payment records. Fre- capability, the individual’s profile is strengthened. The

quent call-backs and use of emergency airtime credit strength of an individual’s social connections may be

requests enable further compilation of a subscriber’s inferred from whether his or her calls to others are

credit picture. A user who carefully manages his or returned. Such insights from the data ‘derisk inter-

her prepaid account balance over time to permit actions between large firms and the poor, at scale’,

smoother usage may be a more responsible borrow- enabling ‘new types of formal lending that would not

er. Similarly, where a customer’s service usage pat- be feasible under historical constraints.’ 7

terns follow a monthly cycle, he or she may be more

likely to be earning a salary.

Use of telecommunications data for digital financial inclusion 13