Page 33 - FIGI Digital Financial Services security assurance framework

P. 33

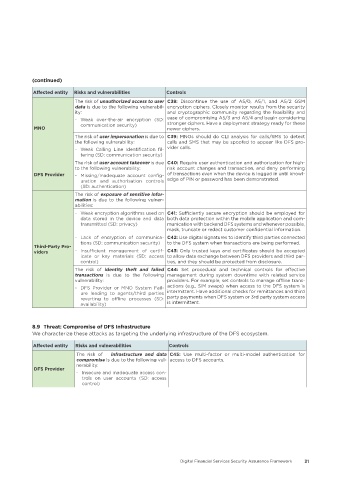

(continued)

Affected entity Risks and vulnerabilities Controls

The risk of unauthorized access to user C38: Discontinue the use of A5/0, A5/1, and A5/2 GSM

data is due to the following vulnerabil- encryption ciphers. Closely monitor results from the security

ity: and cryptographic community regarding the feasibility and

- Weak over-the-air encryption (SD: ease of compromising A5/3 and A5/4 and begin considering

communication security) stronger ciphers. Have a deployment strategy ready for these

MNO newer ciphers.

The risk of user impersonation is due to C39: MNOs should do CLI analysis for calls/SMS to detect

the following vulnerability: calls and SMS that may be spoofed to appear like DFS pro-

- Weak Calling Line Identification fil- vider calls.

tering (SD: communication security)

The risk of user account takeover is due C40: Require user authentication and authorization for high-

to the following vulnerability: risk account changes and transaction, and deny performing

DFS Provider - Missing/Inadequate account config- of transactions even when the device is logged in until knowl-

uration and authorisation controls edge of PIN or password has been demonstrated.

(SD: authentication)

The risk of exposure of sensitive infor-

mation is due to the following vulner-

abilities:

- Weak encryption algorithms used on C41: Sufficiently secure encryption should be employed for

data stored in the device and data both data protection within the mobile application and com-

transmitted (SD: privacy) munication with backend DFS systems and whenever possible,

mask, truncate or redact customer confidential information.

- Lack of encryption of communica- C42: Use digital signatures to identify third parties connected

tions (SD: communication security) to the DFS system when transactions are being performed.

Third-Party Pro-

viders - Insufficient management of certif- C43: Only trusted keys and certificates should be accepted

icate or key materials (SD: access to allow data exchange between DFS providers and third par-

control) ties, and they should be protected from disclosure.

The risk of identity theft and failed C44: Set procedural and technical controls for effective

transactions is due to the following management during system downtime with related service

vulnerability: providers. For example, set controls to manage offline trans-

- DFS Provider or MNO System Fail- actions (e.g., SIM swaps) when access to the DFS system is

ure leading to agents/third parties intermittent. Have additional checks for remittances and third

reverting to offline processes (SD: party payments when DFS system or 3rd party system access

availability) is intermittent.

8�9 Threat: Compromise of DFS Infrastructure

We characterize these attacks as targeting the underlying infrastructure of the DFS ecosystem.

Affected entity Risks and vulnerabilities Controls

The risk of infrastructure and data C45: Use multi-factor or multi-model authentication for

compromise is due to the following vul- access to DFS accounts.

nerability:

DFS Provider

- Insecure and inadequate access con-

trols on user accounts (SD: access

control)

Digital Financial Services Security Assurance Framework 31