Page 96 - ITU-T Focus Group Digital Financial Services – Interoperability

P. 96

ITU-T Focus Group Digital Financial Services

Interoperability

On the other hand, direct participation of unsupervised NBFIs and of non-financial institutions other than the

Ministry of Finance (e.g., mobile network operators or "MNOs") was practically inexistent. Only about 5% of

countries informed that unsupervised NBFIs can become direct participants in their RTGS system. This number

raises slightly to 9% for the case of non-financial institutions.

From a regional perspective, direct access to the RTGS system by supervised NBFIs is more common in Latin

America and the Caribbean and in developed countries outside the European Union. About 50% of the central

banks in these two regions informed that they give NBFIs direct access to their RTGS system. In contrast, such

access is zero or close to zero in South Asia and Sub-Saharan Africa.

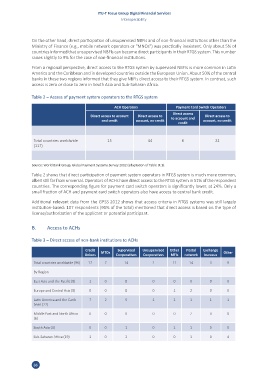

Table 2 – Access of payment system operators to the RTGS system

ACH Operators Payment Card Switch Operators

Direct access

Direct access to account Direct access to to account and Direct access to

and credit account, no credit account, no credit

credit

Total countries worldwide 15 44 6 22

(117)

Source: World Bank Group, Global Payment Systems Survey 2012 (adaptation of Table IX.1).

Table 2 shows that direct participation of payment system operators in RTGS system is much more common,

albeit still far from universal. Operators of ACHs have direct access to the RTGS system in 51% of the respondent

countries. The corresponding figure for payment card switch operators is significantly lower, at 24%. Only a

small fraction of ACH and payment card switch operators also have access to central bank credit.

Additional relevant data from the GPSS 2012 shows that access criteria in RTGS systems was still largely

institution-based: 107 respondents (91% of the total) mentioned that direct access is based on the type of

license/authorization of the applicant or potential participant.

B. Access to ACHs

Table 3 – Direct access of non-bank institutions to ACHs

Credit Supervised Unsupervised Other Postal Exchange

Unions MTOs Cooperatives Cooperatives MFIs network bureaus Other

Total countries worldwide (96) 17 7 14 2 11 14 3 9

By Region

East Asia and the Pacific (8) 1 0 0 0 0 0 0 0

Europe and Central Asia (8) 0 0 0 0 1 2 0 0

Latin America and the Carib- 7 2 5 1 2 1 1 1

bean (22)

Middle East and North Africa 0 0 0 0 0 2 0 0

(6)

South Asia (4) 0 0 1 0 1 1 0 0

Sub-Saharan Africa (19) 1 0 2 0 0 1 0 4

86