Page 95 - ITU-T Focus Group Digital Financial Services – Interoperability

P. 95

ITU-T Focus Group Digital Financial Services

Interoperability

5 International evidence and trends

The purpose of this Section is to show global data on access-to-payment infrastructures issues. A number of

specific cases studies are then presented in Annex I.

The data shown in this Section have been obtained from the World Bank Group’s Global Payment Systems

Survey (GPSS). Most recent data was publicly released in 2014 and shows information as of end-2012, and is

therefore referred to below as the "GPSS 2012".

A. Access to RTGS systems

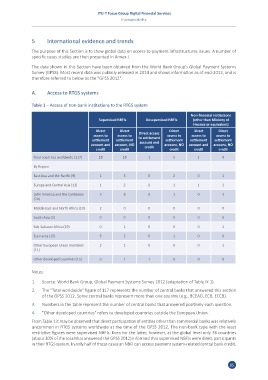

Table 1 – Access of non-bank institutions to the RTGS system

Non-financial institutions

Supervised NBFIs Unsupervised NBFIs (other than Ministry of

Finance or equivalent)

Direct Direct Direct Direct Direct

access to access to Direct access access to access to access to

settlement settlement to settlement settlement settlement settlement

account and account, NO account and account, NO account and account, NO

credit credit credit credit credit credit

Total countries worldwide (117) 18 18 1 5 1 9

By Region

East Asia and the Pacific (9) 1 3 0 2 0 1

Europe and Central Asia (13) 1 2 0 1 1 3

Latin America and the Caribbean 3 8 0 1 0 3

(24)

Middle East and North Africa (10) 2 0 0 0 0 0

South Asia (3) 0 0 0 0 0 0

Sub-Saharan Africa (19) 0 1 0 0 0 1

Euro area (15) 3 2 0 1 0 0

Other European Union members 2 1 0 0 0 1

(11)

Other developed countries (13) 6 1 1 0 0 0

Notes:

1. Source: World Bank Group, Global Payment Systems Survey 2012 (adaptation of Table IX.1).

2. The "Total worldwide" figure of 117 represents the number of central banks that answered this section

of the GPSS 2012. Some central banks represent more than one country (e.g., BCEAO, ECB, ECCB).

3. Numbers in the table represent the number of central banks that answered positively each question.

4. "Other developed countries" refers to developed countries outside the European Union.

From Table 1 it may be observed that direct participation of entities other than commercial banks was relatively

uncommon in RTGS systems worldwide at the time of the GPSS 2012. The non-bank type with the least

restrictive figures were supervised NBFIs. Even for the latter, however, at the global level only 36 countries

(about 30% of the total that answered the GPSS 2012) informed that supervised NBFIs were direct participants

in their RTGS system. In only half of those cases an NBFI can access payment system-related central bank credit.

85