Page 218 - The Digital Financial Services (DFS) Ecosystem

P. 218

ITU-T Focus Group Digital Financial Services

Ecosystem

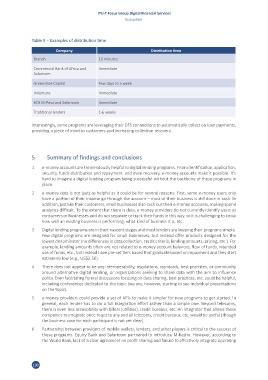

Table 9 – Examples of distribution time

Company Distribution time

Branch 10 minutes

Commercial Bank of Africa and Immediate

Safaricom

Greenshoe Capital Few days to a week

InVenture Immediate

KCB M-Pesa and Safaricom Immediate

Traditional lenders 1-6 weeks

Interestingly, some programs are leveraging their DFS connections to automatically collect on loan payments,

providing a piece of mind to customers and increasing collection recovery.

5 Summary of findings and conclusions

1 e-money accounts are tremendously helpful to digital lending programs. From identification, application,

security, funds distribution and repayment, and even recovery, e-money accounts make it possible. It’s

hard to imagine a digital lending program being successful without the backbone of these programs in

place.

2 e-money data is not (yet) as helpful as it could be for several reasons: First, some e-money users only

have a portion of their income go through the account – most of their business is still done in cash. In

addition, just like their customers, small businesses also cash out their e-money accounts, making spend

analytics difficult. To the extent that there is data, e-money providers do not currently identify users as

consumers or businesses and do not separate or track their funds in this way, so it is challenging to know

how well an existing business is performing, what kind of business it is, etc.

3 Digital lending programs are in their nascent stages and most lenders are keeping their programs simple.

Few digital programs are designed for small businesses, but instead offer products designed for the

lowest denominator (no differences in data collection, credit criteria, lending amounts, pricing, etc.). For

example, lending amounts often are not related to e-money account balances, flow of funds, intended

use of funds, etc., but instead have pre-set tiers based that graduate based on repayment and they start

extremely low (e.g., US$2.50).

4 There does not appear to be any interoperability, regulations, standards, best practices, or community

around alternative digital lending, or organizations seeking to share data with the aim to influence

policy. Even facilitating formal discussions focusing on data sharing, best practices, etc. could be helpful,

including conferences dedicated to the topic (we are, however, starting to see individual presentations

on the topic).

5 e-money providers could provide a set of APIs to make it simpler for new programs to get started. In

general, each lender has to do a full integration effort rather than a simple one. Beyond telecoms,

there is even less accessibility with billers (utilities), credit bureaus, etc. An integrator that allows these

companies to integrate once to get to any and all telecoms, credit bureaus, etc. would be useful (though

the business case for each participant is not yet clear).

6 Partnership between providers of mobile wallets, lenders, and other players is critical to the success of

these programs. Equity Bank and Safaricom partnered to introduce M-Kesho. However, according to

the World Bank, lack of a clear agreement on profit sharing and failure to effectively integrate operating

190