A.5 Financing landscape

A.5.1 Finance mechanisms

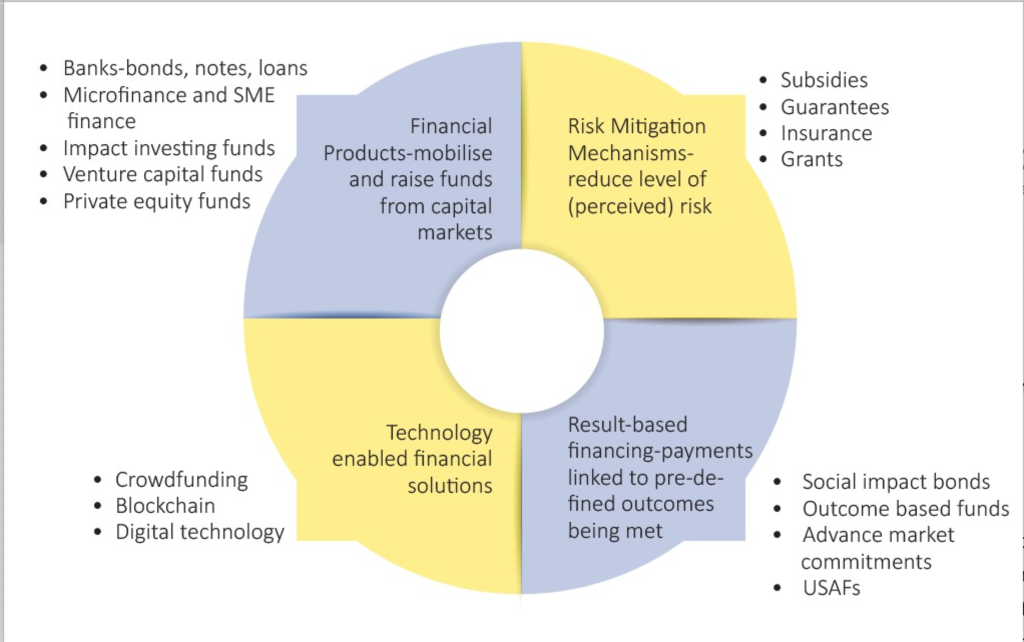

There are a number of funding mechanisms that can be applied to universal access and service interventions broadly described in Figure 12, including:

- Standard financial products such as loans, microfinance and SME finance, impact investing funds, and private equity funds. Innovative financial products include venture capital funds, social impact funds, green bonds and digital bonds.

- Risk mitigation mechanisms, which seek to reduce the high levels of perceived risk that often hold back private capital – these include subsidies, guarantees and insurance.

- Result-based financing, also known as outcome-based aid, such as social impact bonds and advance market commitments.

- Technology enabled funding via blockchain, crowdfunding and other digital technologies.

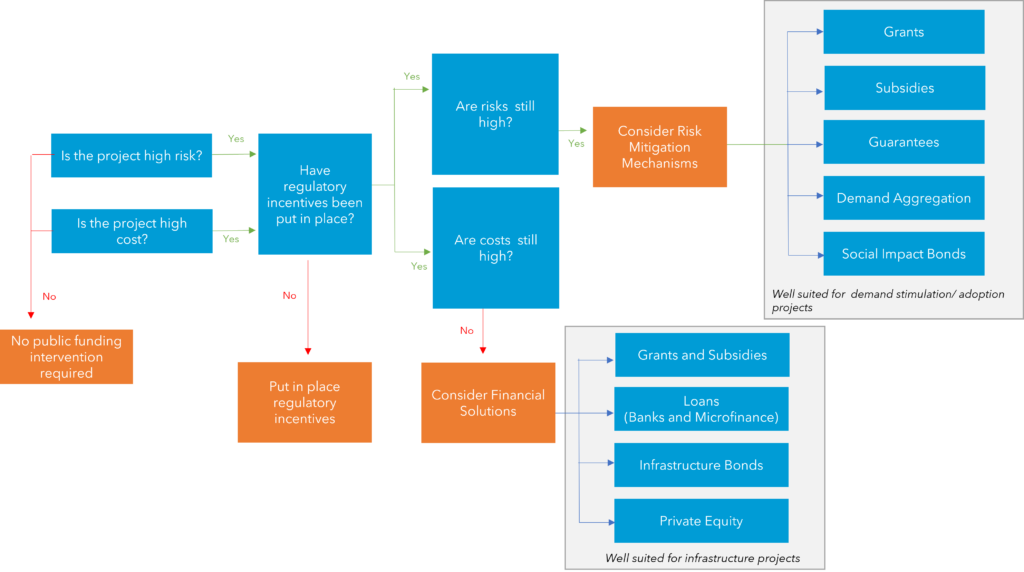

The decision tree below provides guidance for key questions that policy-makers, regulators, and universal service fund administrators must answer: when and how to apply funding? It shows that public investment intervention should, in the main, serve two purposes: to mitigate risk and/or to reduce cost, and depending on the “problem” identified, different financial solutions may be applicable.

Funding decision tree

A.5.2 Financing models

Traditional finance models

Capex, vendor finance and project finance models, where operators are responsible for infrastructure investment and team up with vendors (vendor finance) or banks and private equity firms (project finance) to finance the extension and upgrading of networks. These models are suitable for use in commercially viable areas. The extent of public support, if any, would be in the form of regulatory and policy risk mitigation mechanisms, and in some cases ‘smart’ subsidies in order to kickstart the project, which can become sustainable and viable without public intervention after the initial subsidy.

Funding type: Standard financial products, can be enhanced by risk mitigation products

Source of funding: Private equity, debt (banks), vendor finance

Case Study: Telefónica export credit deal to receive Ericsson vendor financing

In 2013, Telefónica (Spain) secured a USD 1 billion (€ 770 million) export credit deal to purchase infrastructure equipment from Ericsson. The agreement is backed by two Swedish export authorities. The credit facility, better known as vendor financing, will see Ericsson supplying network equipment and commissioning services for various Telefónica subsidiaries around the world. This offer of financial support follows recent deals by Telefónica to use Ericsson equipment in LTE deployments in Brazil, Chile, and the United Kingdom. Telefónica signed a similar vendor financing agreement for USD 472 million in 2010 to buy Ericsson equipment, with the backing of the same two Swedish export agencies–the Swedish National Export Guarantee Board and the Swedish Export Credit Corp. Source: Fierce Wireless

State ownership / public utility models, include all aspects of network deployment and operation that are managed and financed by the public sector, which provides a capital contribution without receiving any guarantee or repayment; in so doing, governments acquire project ownership. This type of model can be a national open access network for which private operators may offer retail services using the public network at regulated prices or as a national open access alternative carrier, which would be a new government-built network aimed at breaking down bottleneck prices and reducing duplication, thus creating efficiencies and lowering costs. For either model, government has an equity stake and is directly involved in network deployment. Such an approach aims to respond to the high cost of broadband deployments in rural and underserved areas and seeks to ensure achievement of the goal of leaving no one behind. Not all state-owned broadband networks have had the desired impact. Many have struggled to compete with other broadband operators in the market, owing to the fact that they do not necessarily address a market gap and do not always constitute effective investment.

Funding type: Risk mitigation, result- based

Source of funding: Government, private

Case study: Australia’s national broadband network (NBN)

National broadband networks, such as those rolled out in Australia, Malaysia, South Africa, and Tanzania were a common feature of countries’ broadband policies and strategies following the global financial crisis of 2008. By mid-2018, over 60 per cent of all premises in Australia could access national broadband network (NBN) services, with the project due for implementation in 2020. The national broadband network project looked into the social and economic impacts of network rollout and found that access to the network helped to drive an estimated USD 1.2 billion in additional economic activity in 2017 and to create up to 5 400 businesses and 9 700 new jobs.

Public-private partnership (PPP) models are also traditional investment and financing models for infrastructure in the telecommunications and now digital infrastructure space. There is a lot of literature on PPP models used for underserviced areas where private capital has not deployed networks due to high levels of perceived risk, or high costs (versus the level of demand in the area). PPPs may be national or regional level arrangements and include concessional models used in lower-risk projects, operator models applied for very-high-risk projects where market demand is very low, such as in remote and sparsely populated areas, and cooperation models for projects involving both shared and 100 per cent public funding which have a medium to high risk level.

The key to this model is usually that public funding can be injected to reduce risk, while the skill of the private operator and varying amounts of capital, can be called upon to ensure the deployment of reliable, high quality and sustainable networks. Public sector involvement can range from retaining full ownership to build, own and transfer models.

Funding type: Risk mitigation, result-based, standard financial products

Source of funding: government, standard financial products such as private equity, debt (banks)

Case study: BAKTI Indonesia Universal Service Obligation Fund

In 2000, the Universal Service Obligation Fund (USOF) was established in Indonesia – currently operator contributions are 1,25 per cent of gross revenue. BAKTI, the Ministry of ICT public financing arm, uses the Indonesia USOF contributions to support a number of public-private partnership (PPP) initiatives including:

- The Palapa Ring development project, which is a National Strategic Project run by BAKTI for the development of a national fibre-optic backbone network that connects all cities/districts in Indonesia with fibre-optic networks. Palapa Ring is a PPP scheme that consists of three packages: West, Central, and East. At a cost of USD 1.5 billion, the programme aims to provide more than 500 regencies across the country with 4G Internet access, featuring more than 21 747 miles of submarine and 13 000 miles of land cables. The project covers a total of 90 districts/cities, consisting of 57 districts/cities of services and 33 districts/cities for interconnection. It connects 11 provinces with a network length of about 12 thousand kilometres. Through the Palapa Ring, the government can facilitate speeds of up to 100 GB per second in even the most outlying regions of the country. The non-PPP scheme of Palapa Ring Project is carried out by PT Telkom, connecting 457 districts/cities. The Availability Payment scheme has been implemented for payments. By January 2020, Indonesia had completed this project.

- BAKTI has also built base transceiver stations (BTS) in Indonesia. As of July 2019, 1 068 BTS had been built across 24 provinces and 137 districts, particularly in rural areas where networks had not been established by private mobile operators.

- The third programme consists of Satelit Republik Indonesia (SATRIA), which is a satellite system prepared for fast Internet connectivity service throughout Indonesia. The plan, which has been implemented by a PPP scheme, started at the end of 2019 and it is expected to be launched by the end of 2022.

Source: https://digitalregulation.org/indonesias-universal-service-obligation-fund/

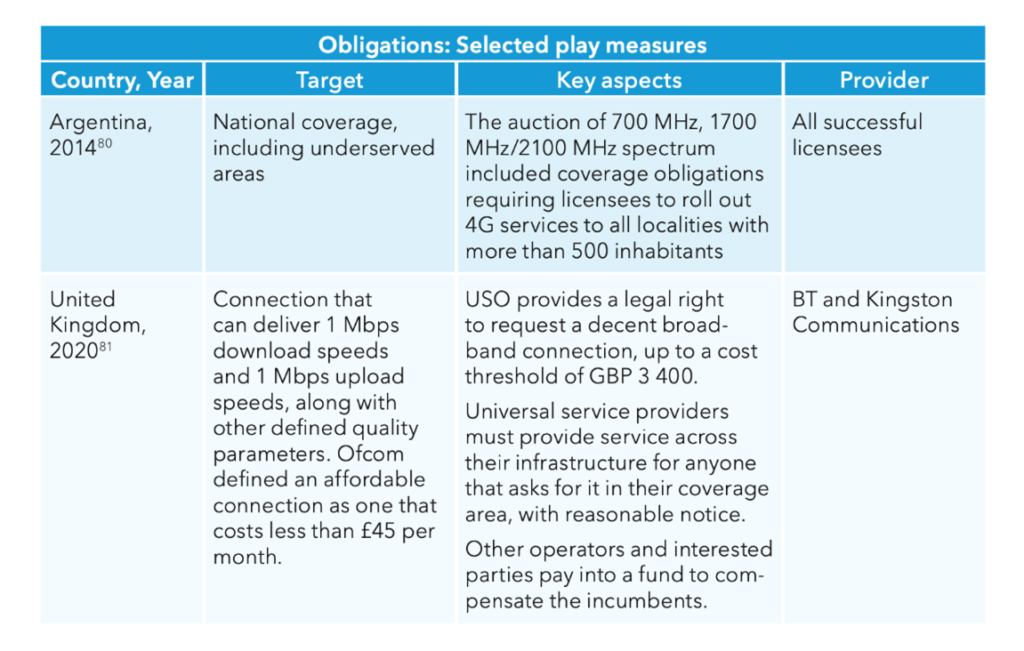

Obligations in the form of regulated universal service funds (pay) and/or licence conditions (play) models – universal service obligations, whether in cash (such as USFs) or in-kind (such as roll-out obligations), are a mainstay of the universal access framework in the ICT and digital sector. These are being reviewed and reassessed given the evidence now available about their efficacy.

Funding type: Result based financing, risk mitigation mechanisms

Source of funding: “Play” – operators; “Pay” – operators, in some cases government, increasingly universal service and access funds, are considering increasing sources to include donors, foundations, vendors, content providers, etc.

Case study: Obligations

Demand subsidisation models: this model involves subsidies from the government to specific connectivity users (e.g., low-income users, SMEs and strategic public institutions such as schools) so that they can use broadband and digital services. The e-rate that is provided to schools (e.g. South Africa, United States) and the Lifeline programme (United States) are classic examples of this.

Funding type: Result based financing, risk mitigation mechanisms

Source of funding: Government, universal service and access funds

Case study: Togo’s CIZO off-grid electricity subsidy

The CIZO programme, launched by the government of Togo in 2018, is an electricity demand subsidy programme that leverages digital tools to increase energy access through the uptake of off-grid energy solutions. Using geo-spatial modelling, the most efficient way of providing electricity to identified rural households can be determined.

CIZO is a private sector driven deployment, with public support. The public sector is responsible for providing pay-as-you-go solar solutions, purchasing the solar kit, distribution, payment collection and maintenance. The public sector is responsible for providing access to vulnerable persons and communities through various support mechanisms, including subsides.

The Togo Electrification Strategy covers the CIZO programme which specifically refers to the deployment of over 555 000 “Solar Home Systems”, as well as the roll-out of 300 ‘mini’ grids to provide 55 000 connections and 400 000 ‘on-grid’ connections between 2018 and 2030. The aim is to reach universal access to electricity, a prerequisite for universal service and access to broadband, by 2030. Source: Togo Electrification Strategy, 2018 and GSMA.

Innovative finance models

Demand aggregation / anchor tenant models: These models include guaranteeing and / or clustering demand to make investments more attractive. This assures the investor of demand in the area in which they intend to expand the network. Classic examples include school connectivity programmes and ‘government as an anchor tenant’ models. Ideally, the presence of the guaranteed demand will encourage broader adoption in the communities in the surrounding areas thus improving universal access and increasing the returns for investors and improving the investment profile of the area.

Funding type: Risk mitigation, result-based

Source of funding: Communities, operators, donors, universal service and access funds

Case Study: Enabling connectivity through Giga, the ITU-UNICEF school connectivity initiative

The lack of Internet connectivity, supported by sustainable energy supply, can mean exclusion, lack of access to information, fewer resources to learn and limited opportunities for young people. Closing the digital divide requires global cooperation, leadership and innovation, both in terms of financing and technology. Giga is a global initiative to connect every school to the Internet and every young person to information, opportunity and choice. By using schools to identify demand for connectivity, the initiative serves as a platform for creating the infrastructure necessary to provide digital connectivity to every community and every citizen in a country. The community can benefit from the connected school while at the same time coming together and support its next generation. Through Giga’s work to connect schools in partner countries, testing new solutions and providing insights to support and fast-track government universal connectivity programmes, diverse technologies, business models, and regulatory arrangements to provide broadband connectivity to schools and communities are being explored.

Blended finance models consist of financing a project with a mix of sources of funds from funding actors with different, but complementary interests. The OECD classifies blended finance instruments as equity instruments, debt instruments, mezzanine instruments, guarantees and insurance, hedging, and grants and technical assistance. In addition, the OECD identifies four blended finance mechanisms: (1) funds, (2) syndication, (3) securitisation, and (4) public-private partnerships (PPPs).

Combining investments that require market returns with the use of funds that expect a lower return and public subsidies (generating no return) allows all parties to receive the return they require. Blended finance fits a context “(where) the public benefit of a project exceeds the returns to private investors, usually because there are externalities, market failures, affordability constraints, or information deficiencies in the market that prevent dynamic development of the private sector.” Where blended finance is applied, it should seek to develop and encourage future sustainable commercial markets.

Funding type: Risk mitigation, result-based, technology enabled leading to standard financial products

Source of funding: Government, donors, foundations, philanthropists, private equity, debt (banks)

Guidance: Blended finance principles

In funding broadband infrastructure, the public sector should ensure that interventions are based on the following principles:

Leverage: Use of funds should be structured to attract private capital.

Impact: Investments should seek to drive social, environmental and economic progress, meet national targets and close universal access and SDG gaps.

Returns: Financial returns for private investors should be in line with market expectations, based on real and perceived risks.

Source: World Economic Forum

Venture capital models, where the SMEs and innovators are responsible for raising funds for their projects. Unlike traditional capex, private equity, bank model, this model supports more short term, ‘risky’ projects. Venture capitalists can thrive in the digital economy since they generally seek to monetize “the next big idea” by investing in innovation; and in technology-oriented entrepreneurs often through investment in incubation hubs and accelerators.

Funding type: Standard financial products

Source of funding: Venture capitalists, private investors

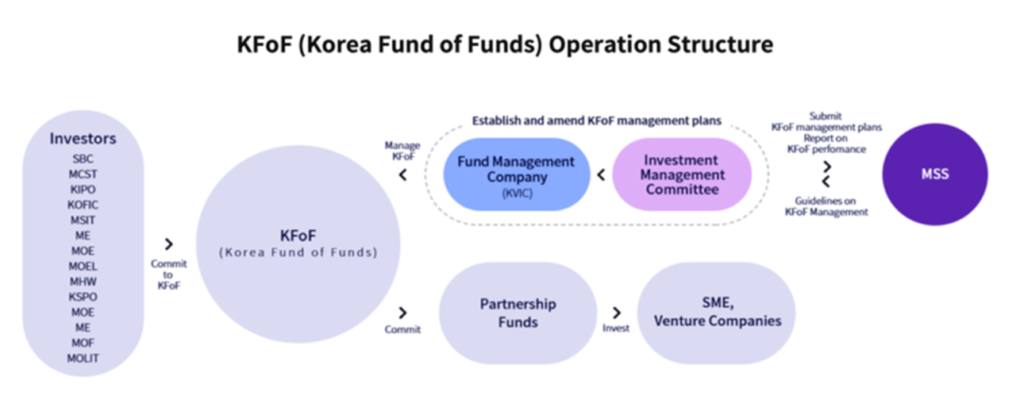

Venture capital (fund of funds) In 2005, the Government of the Republic of Korea pooled all funds that supported SME development into a single fund of funds with five funding streams: cultural content, film, broadcasting, telecommunications, and research. This fund invests in partnership funds, such as venture capital funds, which invest directly in SMEs. The concept is based on the use of public funds to mobilize private capital, which can then be invested in SMEs. In the diagram, all ‘investors’ are public entities.

Municipal and community broadband network models, in terms of which a municipality or community takes responsibility for deploying and maintaining the last-mile network.

- Municipal broadband networks: There is a case to be made for municipal broadband networks, which are fully or partially facilitated, built, operated, or financed by local governments, often in partnership with the private sector. There are three basic models for creating and operating these networks, noting however that each network must work in the unique context of the city or locality that it will serve. Municipal broadband networks can be developed through three types of business models depending on the city’s or private sector investors’ involvement in the financing and construction of the network: (i) a passive infrastructure model; (ii) a wholesale access model; and (iii) a fully integrated model. The local government can play a role in providing an enabling environment (rights of way, authorisations), financing (subsidies) or developing infrastructure.

- Community broadband networks: This grassroots, bottom-up model is reminiscent of cooperative models which saw the local community (residents and/or businesses) take control of the delivery of fixed- and wireless-broadband to their neighbourhoods. This is often done using low-cost technologies, unused spectrum such as “TV white spaces,” and unlicensed spectrum. These networks can be privately or publicly funded and display a variety of characteristics.

Funding type: Risk mitigation, result-based, technology enabled

Source of funding: Government, private equity, debt (banks), USAF

Case Study: Private LTE network for mining community, Brazil

In Latin America, mining and utility companies across the region have increasingly sought to deploy private broadband networks to accommodate remote working that has been brought about by COVID-19. In July 2020, Nokia and Telefónica partnered with a mining firm, Vale, to provide a private LTE network to the world’s largest iron ore mine, Carajas, in northern Brazil.

Case study: Municipal network – Wireless @SG, Singapore

Singapore launched a nationwide fibre to the home (FTTH) programme with a carrier-neutral network. However, affordability and quality remained problematic for many users. The city launched Wireless@SG, a Wi-Fi network in parallel, as the nationwide FTTH programme, providing free Wi-Fi access, no usage limitation, and seamless roaming between hotspots via a PPP model, which was launched in 2006 with three operators (iCELL Network, QMAX Communications, and SingTel). Infocomm Media Development Authority (IMDA), the development agency (under the Singapore Ministry of Communications and Information), temporarily provided subsidies to operators and premises owners. Between 2006 and 2009, 7 500 hotspots were created with 512 kbit/s download speed connecting 1.5 million users, at a cost of USD 30 million. By 2018, 20 000 hotspots were deployed (1 hotspot per 280 inhabitants), with 5 Mbit/s download speed. By June 2018, 2.5 million users logged into Wireless@SG each month (roughly 45 per cent of the population) with usage at approximately 11 hours per user per month. Source: White & Case and IFC.

Crowdfunding models allow the project owner to source small sums of money directly from the market without approaching traditional banks. In many ways, crowdfunding is a more inclusive financing model as it breaks down traditional funding barriers faced, for example by women. There are at least four types of crowdfunding models: (1) donor based which is possibly the most popular model where money is donated via a crowdfunding platform such as GoFundMe, with no expected returns to the investor; (2) equity based, where the funder takes an ownership stake in the business(in the United Kingdom and the United States this is regulated and there are caps on how much can be raised); (3) lending based, where the “crowd” lends money to the investor with an expectation that it will be paid back with interest (e.g. Mekar, Indonesia); and (4) reward based, which incentivises the funder to invest at an early stage through offering rewards such as early or discounted access to the product or service. All of these models provide opportunities for the funding of innovation and ‘digital ideas’.

Funding type: Technology enabled

Source of funding: Individual investors (including friends, family and social networks), non-governmental organizations (NGOs), foundations

Reference material and tools

Crowdfunding explained, European Commission

Women Unbound: Unleashing female entrepreneurial potential, PWC

USAF 2.0 and other structured funds for digital technology adoption, and innovation. USAF 2.0 is an evolved, next generation universal service fund (see Part B of the toolkit). In addition, in many countries other funds have been put in place to enable digital connectivity, including SME funds, innovation funds, and structural funds. Some of these funds and USAF 2.0 are collective investment vehicles that have a defined legal status and pool financial resources from different investors in financial or nonfinancial assets or both.

Funding type: Risk mitigation, result-based, technology enabled

Source of funding: Operators, in some cases government, increasingly funds are considering increasing sources to include donors, foundations, vendors, content providers, etc.

Case study: European structural and investment funds, a regional and national approach

Over half of EU funding is channelled through the five European structural and investment funds (ESIF). They are jointly managed by the European Commission and the EU countries. The funds are managed by the EU countries themselves, by means of partnership agreements. The purpose of all of these funds is to invest in job creation and a sustainable and healthy European economy and environment. The ESIF mainly focus on five areas:

- research and innovation;

- digital technologies;

- supporting the low-carbon economy;

- sustainable management of natural resources;

- small businesses.

Case Study: New Zealand Seed Co-investment Fund

Co-investment funds use public money to match private investment and typically focus on seed funding. The Seed Co-investment Fund (SCIF) was set up to support the development of the angel equity finance market and create more innovative, knowledge-intensive, high-value firms and start-ups to grow and scale up in New Zealand. It is both a co-investment fund and a ‘fund of funds’ given the role of the SCIF is as an intermediary of funds between investors and technology-based start-ups. This increases the depth of specialist skills needed to assess and manage early-stage investments, increasing the scale and enhancing networks for early-stage investment, catalysing investments that would not have been made without the programme, minimizing fiscal risk and covering costs.