Page 293 - The Digital Financial Services (DFS) Ecosystem

P. 293

ITU-T Focus Group Digital Financial Services

Ecosystem

Table 1

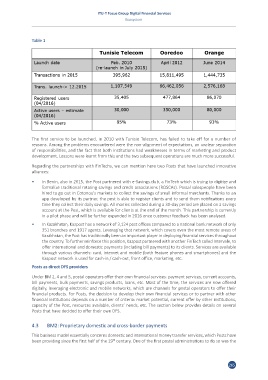

The first service to be launched, in 2010 with Tunisie Telecom, has failed to take off for a number of

reasons. Among the problems encountered were the non-alignment of expectations, an unclear separation

of responsibilities, and the fact that both institutions had weaknesses in terms of marketing and product

development. Lessons were learnt from this and the two subsequent operations are much more successful.

Regarding the partnerships with FinTechs, we can mention here two Posts that have launched innovative

alliances:

• In Benin, also in 2015, the Post partnered with e-Savings.club, a FinTech which is trying to digitize and

formalize traditional rotating savings and credit associations (ROSCAs). Postal salespeople have been

hired to go out in Cotonou’s markets to collect the savings of small informal merchants. Thanks to an

app developed by its partner, the post is able to register clients and to send them notifications every

time they collect their daily savings. All monies collected during a 30-day period are placed on a savings

account at the Post, which is available for clients at the end of the month. This partnership is currently

in a pilot phase and will be further expanded in 2016 once customer feedback has been analysed.

• In Kazakhstan, Kazpost has a network of 3,124 post offices compared to a national bank network of only

351 branches and 1917 agents. Leveraging that network, which covers even the most remote areas of

Kazakhstan, the Post has traditionally been an important player in deploying financial services throughout

the country. To further reinforce this position, Kazpost partnered with another FinTech called Intervale, to

offer international and domestic payments (including bill payments) to its clients. Services are available

through various channels: card, internet and mobile (both feature phones and smartphones) and the

Kazpost network is used for cash-in / cash-out, front office, marketing, etc.

Posts as direct DFS providers

Under BM 2, 4 and 5, postal operators offer their own financial services: payment services, current accounts,

bill payments, bulk payments, savings products, loans, etc. Most of the time, the services are now offered

digitally, leveraging electronic and mobile networks, which are channels for postal operators to offer their

financial products. For Posts, the decision to develop their own financial services or to partner with other

financial institutions depends on a number of criteria: market potential, current offer by other institutions,

capacity of the Post, resources available, clients’ needs, etc. The section below provides details on several

Posts that have decided to offer their own DFS.

4.3 BM2: Proprietary domestic and cross-border payments

This business model essentially concerns domestic and international money transfer services, which Posts have

th

been providing since the first half of the 19 century. One of the first postal administrations to do so was the

265