Page 290 - The Digital Financial Services (DFS) Ecosystem

P. 290

ITU-T Focus Group Digital Financial Services

Ecosystem

non-bank financial institutions and not full-fledged postal banks, with the latter – which represent less than

10% of all Posts – generally having much more experience in providing a wide range of financial services and

generally employing more knowledgeable and experienced personnel from the financial services industry.

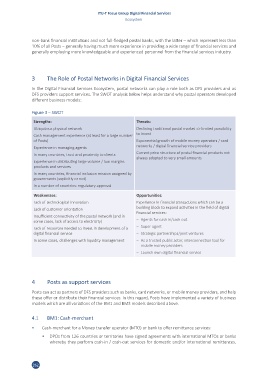

3 The Role of Postal Networks in Digital Financial Services

In the Digital Financial Services Ecosystem, postal networks can play a role both as DFS providers and as

DFS providers support services. The SWOT analysis below helps understand why postal operators developed

different business models:

Figure 3 – SWOT

Strengths: Threats:

Ubiquitous physical network Declining traditional postal market => limited possibility

Cash management experience (at least for a large number to invest

of Posts) Exponential growth of mobile money operators / card

Experience in managing agents networks / digital financial service providers

In many countries, trust and proximity to clients Current price structure of postal financial products not

always adapted to very small amounts

Experience in distributing large volume / low margins

products and services

In many countries, financial inclusion mission assigned by

governments (explicitly or not)

In a number of countries: regulatory approval

Weaknesses: Opportunities:

Lack of technological innovation Experience in financial transactions which can be a

Lack of customer orientation building block to expand activities in the field of digital

financial services:

Insufficient connectivity of the postal network (and in

some cases, lack of access to electricity) – Agents for cash in/cash out

Lack of resources needed to invest in development of a – Super-agent

digital financial service – Strategic partnerships/joint ventures

In some cases, challenges with liquidity management – As a trusted public actor, interconnection tool for

mobile money providers

– Launch own digital financial service

4 Posts as support services

Posts can act as partners of DFS providers such as banks, card networks, or mobile money providers, and help

these offer or distribute their financial services. In this regard, Posts have implemented a variety of business

models which are all variations of the BM1 and BM3 models described above.

4.1 BM1: Cash-merchant

• Cash-merchant for a Money transfer operator (MTO) or bank to offer remittance services:

• DPOs from 126 countries or territories have signed agreements with international MTOs or banks

whereby they perform cash-in / cash-out services for domestic and/or international remittances.

262