Page 243 - The Digital Financial Services (DFS) Ecosystem

P. 243

ITU-T Focus Group Digital Financial Services

Ecosystem

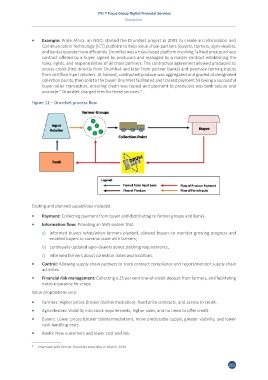

• Example: Pride Africa, an NGO, started the DrumNet project in 2003 to create an Information and

Communication Technology (ICT) platform to help value chain partners (buyers, farmers, agro-dealers,

and banks) operate more efficiently. DrumNet was a rules-based platform involving “a fixed price purchase

contract offered by a buyer, signed by producers and managed by a master contract establishing the

roles, rights, and responsibilities of all chain partners. The contractual agreement allowed producers to

access credit (first directly from DrumNet and later from partner banks) and purchase farming inputs

from certified input retailers. At harvest, contracted produce was aggregated and graded at designated

collection points, then sold to the buyer. DrumNet facilitated and tracked payment following a successful

buyer-seller transaction, ensuring credit was repaid and payment to producers was both secure and

accurate.” DrumNet charged fees for these services. 9

Figure 11 – DrumNet process flow

Existing and planned capabilities included:

• Payment: Collecting payment from buyer and distributing to farmer groups and banks.

• Information flow: Providing an SMS system that:

a) informed buyers what/when farmers planted, allowed buyers to monitor growing progress and

enabled buyers to communicate with farmers;

b) continually updated agro-dealers about stocking requirements;

c) informed farmers about collection dates and locations.

• Control: Allowing supply chain partners to track contract compliance and report/monitor supply chain

activities.

• Financial risk management: Collecting a 25 per cent line-of-credit deposit from farmers, and facilitating

micro-insurance for crops.

Value propositions vary:

• Farmers: Higher prices (broker disintermediation), fixed price contracts, and access to credit.

• Agro-dealers: Visibility into stock requirements, higher sales, and no need to offer credit.

• Buyers: Lower prices (broker disintermediation), more predictable supply, greater visibility, and lower

cash handling costs.

• Banks: New customers and lower cost and risk.

9 Interview with former DrumNet executive in March, 2016.

215