Page 72 - A U4SSC deliverable - Guidelines on tools and mechanisms to finance Smart Sustainable Cities projects

P. 72

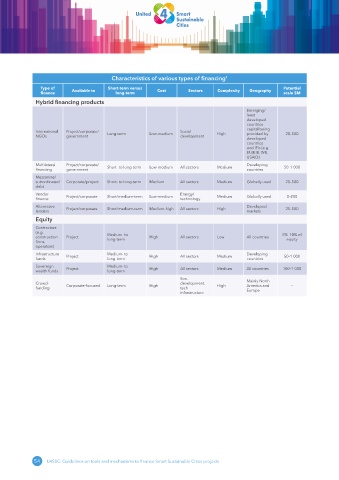

Characteristics of various types of financing 1

Type of Available to Short-term versus Cost Sectors Complexity Geography Potential

finance long-term scale $M

Hybrid financing products

Emerging/

least

developed

countries –

capital being

International Project/corporate/ Long-term Low-medium Social High provided by 20–500

NGOs government development

developed

countries

and IFIs (e.g.

EU/EIB, WB,

USAID)

Multilateral Project/corporate/ Short- to long-term Low-medium All sectors Medium Developing 50–1 000

financing government countries

Mezzanine/

subordinated Corporate/project Short- to long-term Medium All sectors Medium Globally used 20–500

debt

Vendor Project/corporate Short/medium-term Low-medium Energy/ Medium Globally used 0–200

finance technology

Alternative Project/corporate Short/medium-term Medium-high All sectors High Developed 25–500

lenders markets

Equity

Contractors

(e.g. Medium- to 5%–10% of

construction Project long-term High All sectors Low All countries equity

firms,

operators)

Infrastructure Project Medium- to High All sectors Medium Developing 50–1 000

funds long-term countries

Sovereign Project Medium- to High All sectors Medium All countries 100–1 000

wealth funds long-term

Soc.

Crowd- Corporate-focused Long-term High development, High Mainly North –

America and

funding tech Europe

infrastructure

54 U4SSC: Guidelines on tools and mechanisms to finance Smart Sustainable Cities projects