Page 318 - The Digital Financial Services (DFS) Ecosystem

P. 318

ITU-T Focus Group Digital Financial Services

Ecosystem

went entirely digital and stopped sending out paper checks in 2013. Recipient identities are digitized and

1

remain with the government.

Electronic payments are often unavailable to bulk payers in less developed payment ecosystems. Many

recipients lack bank accounts and records may not be sufficiently digitized. In many countries with limited

payments infrastructure, payers are forced to send physical cash to recipients.

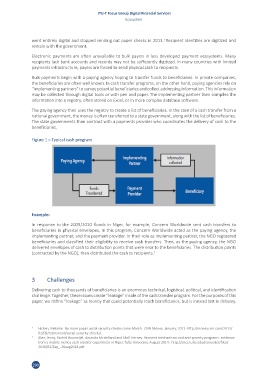

Bulk payments begin with a paying agency hoping to transfer funds to beneficiaries. In private companies,

the beneficiaries are often well known. In cash transfer programs, on the other hand, paying agencies rely on

“implementing partners” to survey potential beneficiaries and collect addressing information. This information

may be collected through digital tools or with pen and paper. The implementing partner then compiles the

information into a registry, often stored on Excel, or in more complex database software.

The paying agency then uses the registry to create a list of beneficiaries. In the case of a cash transfer from a

national government, the money is often transferred to a state government, along with the list of beneficiaries.

The state governments then contract with a payments provider who coordinates the delivery of cash to the

beneficiaries.

Figure 1 – Typical cash program

Example:

In response to the 2009/2010 floods in Niger, for example, Concern Worldwide sent cash transfers to

beneficiaries in physical envelopes. In this program, Concern Worldwide acted as the paying agency, the

implementing partner, and the payment provider. In their role as implementing partner, the NGO registered

beneficiaries and classified their eligibility to receive cash transfers. Then, as the paying agency, the NGO

delivered envelopes of cash to distribution points that were near to the beneficiaries. The distribution points

(contracted by the NGO), then distributed the cash to recipients. 2

3 Challenges

Delivering cash to thousands of beneficiaries is an enormous technical, logistical, political, and identification

challenge. Together, these issues create “leakage” inside of the cash transfer program. For the purposes of this

paper, we define “leakage” as money that could potentially reach beneficiaries, but is instead lost in delivery.

1 Hicken, Melanie. No more paper social security checks come March. CNN Money. January, 2013. http:// money. cnn. com/ 2013/

01/ 09/ retirement/ social- security- checks/ .

2 Aker, Jenny, Rachid Boumnijel, Amanda Mcclelland and Niall Tierney. Payment mechanisms and anti-poverty programs: evidence

from a mobile money cash transfer experiment in Niger. Tufts University. August 2014. http:// sites. tufts. edu/ jennyaker/ files/

2010/ 02/ Zap_- 26aug2014. pdf

290