A closer look at South Asia

by Michael Minges and Pratikshya Simkhada*

Introduction

South Asia, which comprises Bangladesh, Bhutan, India, the Maldives, Nepal,

Pakistan, and Sri Lanka, has a combined population of over 1.3 billion people

(see Table 1). India is by far the largest South Asian country, in

terms of population, economy, and telecommunications network. For a region that

makes up over one fifth of the total world population, South Asia accounts for

only 2 per cent of world Gross Domestic Product (GDP) and 2.4 per cent of the

total telephone subscribers (fixed and mobile). The region has one of the lowest

per capita incomes in the world, about one tenth the world average and is home

to four least developed countries (LDC). With 29 per cent of its population

living in urban areas, South Asia remains predominantly rural.

Table 1 – Basic indicators for South

Asia (2001)

|

| |

Population |

GDP in 2000

(USD) |

Total telephone subscribers |

| Total (million) |

Rural (%) |

Total (billion) |

Per capita |

Total (000s) |

Per 100 inhabitants |

| Bangladesh |

131.27 |

|

74 |

|

45.5 |

|

351 |

|

1084.90 |

|

0.83 |

|

| Bhutan |

0.69 |

|

92 |

|

0.5 |

|

715 |

|

17.6 |

|

2.54 |

|

| India |

1027.02 |

|

72 |

|

464.6 |

|

459 |

|

44 967.70 |

|

4.38 |

|

| Maldives |

0.27 |

|

72 |

|

0.5 |

|

1978 |

|

46.1 |

|

16.83 |

|

| Nepal |

22.74 |

|

88 |

|

5.3 |

|

239 |

|

315.3 |

|

1.39 |

|

| Pakistan |

144.97 |

|

67 |

|

60.3 |

|

427 |

|

4193.00 |

|

2.89 |

|

| Sri Lanka |

18.73 |

|

70 |

|

16.3 |

|

882 |

|

1496.90 |

|

7.99 |

|

South

Asia |

1345.69 |

|

72 |

|

593 |

|

448 |

|

52 121.60 |

|

3.87 |

|

| Less India |

318.67 |

|

72 |

|

128.4 |

|

411 |

|

7153.90 |

|

2.24 |

|

|

Source: ITU World Telecommunication

Indicators Database.

|

Telecommunications scenario

With a total of 43.7 million fixed lines in operation and 8.5 million mobile

subscribers, South Asia accounted for 4 per cent of the world’s fixed lines

and less than 1 per cent of cellular subscribers in the year 2001. South Asia’s

average fixed-line teledensity was 3.2 and the mobile teledensity was 0.63. The

compound annual growth rate of fixed lines and mobile subscribers in the period

1996–2001 has been 20 and 78 per cent respectively, while during the same

period the world growth rate was only 7 and 48 per cent. When compared with the

rest of the world, South Asia is one of the fastest growing markets despite its

low telephone penetration.

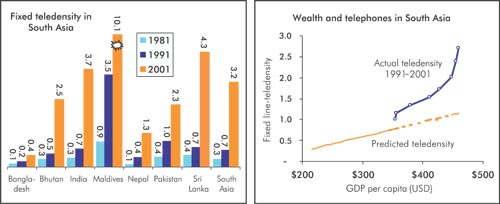

In 1981, South Asia had a fixed-line teledensity of 0.31, which increased to

0.65 in 1991. Another decade later, this teledensity had increased by over

fivefold, reaching 3.2. The telephone network growth rate in South Asia has

accelerated for every five-year period for the last two and half decades. For

example, between 1976 and 1981, the annual average growth rate was 7 per cent;

between 1986–1991 it was 11 per cent and from 1996 to 2001 it was 20 per cent.

This continually increasing growth rate is beginning to impact the

long-established correlation between GDP per capita and fixed-line teledensity.

The correlation would have predicted that South Asia’s fixed teledensity

would be 1.2 in 2001. Yet it was almost three times higher, at 3.2 (see Figure

1). The figure is all the more astounding considering it does not factor in

mobile penetration. This is evidence that old assumptions about

telecommunication development no longer apply.

Despite South Asia’s high telecommunication growth rate over recent years,

the official waiting list for a fixed telephone line did not decrease

significantly. During the period 1996–2001, while main telephone lines in

operation in South Asia grew at 20 per cent a year, waiting lists decreased by

only 7 per cent a year. Overall, South Asia’s waiting list stood at 2.6

million at the end of 2001, down from 3.8 million at the end of 1996. In some

countries, the waiting lists have actu ally increased. This suggests a high

level of suppressed demand in South Asian countries where teledensity is very

low. Ironically, the waiting list probably grew because of the rapid

telecommunication growth. People who had never signed on before because they did

not believe they would ever get a telephone began to change their thinking.

Economics also played a role. Per capita incomes grew, raising demand. At the

same time, prices dropped in relative terms, also increas ing demand.

Figure 1 — Fast growth, broken relations

Source : ITU World Telecommunication Indicators Database

|

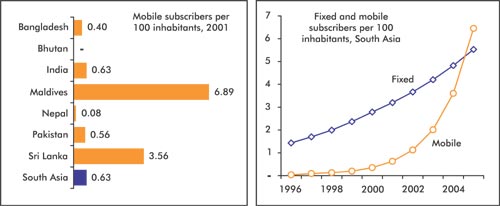

The phenomenon of mobile phones surpassing fixed telephone lines has not yet

generally occurred in South Asia, except in Bangladesh and the Maldives.

Ironically, the former has the region’s lowest fixed-line teledensity while

the latter has the highest. In the Maldives, mobiles could be said to have been

supplementing fixed lines. Mobile tariffs are relatively high and fixed lines

are available on demand on densely populated islands. The introduction of

pre-paid service in September 2001 has begun to shift mobile demand from

supplement to substitute. In Bangladesh, where there are few fixed telephone

lines relative to the population, mobiles are a substitute for telephone

service.

Public call office in Nepal

A Nepali entrepreneur providing public telephone and e-mail service from

his photo shop. The incumbent telephone operator has around 200 or so “recognized”

public call offices around the country, which get a modest reduction on

long-distance call charges and in some cases a monthly subsidy. There are around

1000 or so unlicensed public call centres (PCC) around the country, mainly in

Kathmandu and its surroundings, which seem to offer the main hope for extending

access. PCCs offer a range of services including long distance and international

telephone, fax, call-back, photocopy, Internet and e-mail.

|

In other countries in the region, mobile subscriber growth rates are much

higher than the fixed lines growth rate hence it is only a matter of time before

the former surpasses the latter. The region will be relatively late to achieve

this crossover with several factors holding mobile penetration back. One is a

late start with only Pakistan and Sri Lanka having mobile networks in the early

1990s. Another is market structure. India experimented with regional duopolies

that proved to be a constraint. Only recently has consolidation occurred,

providing the needed economies of scale. In Nepal, mobile service is a monopoly

and thus not benefiting from the lower prices and wider coverage achieved

through competition. Bhutan has yet to launch a mobile service. Another

constraint has been unfriendly billing practices such as Receiving Party Pays,

pre-paid cards with less than their face value and short validity dates and

national roaming charges. The introduction of Calling Party Pays in Pakistan in

2001 gave a boost to its cellular market, growing it over 100 per cent.

During the past decade there has been a phenomenal increase in the number of

public telephone facilities in South Asia. In 2001 the number of public

telephone facilities exceeded the one million mark, while only a decade ago

there were just over 100 000. In 2001, public telephone facilities

accounted for 2.7 per cent of the main lines in operation in the region. Public

calling facilities represent a significant contributor to expanding access to

telecommunication services.

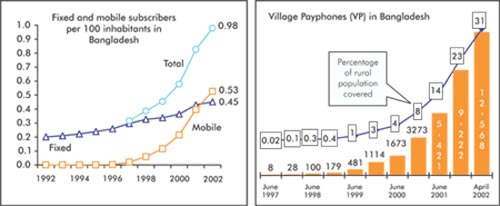

The Grameen project in Bangladesh is a well-known example. With financing

from Grameen Bank, women buy cellphones and provide telephone service in their

shops or the local market (see Mobiles in rural Bangladesh). In addition

to licensed public telephone facilities, there are numerous technically illegal

telecentres in the region reselling telephone service for community access (see Public

call office in Nepal).

In Sri Lanka alone, there are an estimated 20 000 unregulated communication

centres (compared to 5100 payphones) providing a variety of telecommunication

services and some even operating 24 hours a day.

Figure 2 – Mobile trends in South Asia

Source : ITU World Telecommunication Indicators Database

|

Regulatory environment

Sector reform has transformed the telecommunication landscape

of South Asia. Governments of most countries in the region have, in recent

years, made significant changes in their approaches to infrastructure

development. In particular, private sector participation has been or is being

introduced. At present, five out of the seven South Asian countries have granted

operating licences for fixed and cellular operations to private operators. Table

2 summarizes the basic structure of the telecommunication services market of

South Asia.In total, there are 51 telecommunication operators in the region,

including 18 basic service operators and 37 cellular service operators. Out of

the seven South Asian countries the Maldives and Sri Lanka, the countries with

the highest teledensity in the region, have incorporated strategic investors in

their respective incumbent telecommunication operators. Sri Lanka, India and

Bangladesh have liberalized their local service sectors by allowing private

operators to compete with the incumbents. However, complete competition has yet

to occur. The international long-distance sector has not been opened up to

competition except India. In the cellular services sector, competition has been

widespread. All governments, except Nepal and Bhutan, have taken steps to

liberalize this sector.

Mobiles in rural Bangladesh

Grameen Telecom (GT) is dedicated to extending the benefits of

telecommunications to the rural people of Bangladesh. It is a not-for-profit

company and holds 32 per cent of Grameen Phone that was awarded a nationwide

licence for GSM 900 cellular services in 1996. Grameen Phone has expanded

rapidly since launching service in March 1997. By December 2001, it had 464 000

subscribers around 70 per cent of the country total. GT hopes to extend

telecommunication services to rural areas by leveraging its part ownership of

Grameen Phone.

Village Phone (VP) is the mechanism GT is using. Under a micro credit

programme provided by a GT sister institution (Grameen Bank), a villager can

purchase a mobile phone and become the VP operator in their village. The

operator’s income is derived from the difference between the air time charges

paid by the customers and the amount due to GT. In addition, there is a flat

service charge rate for each incoming call.

The programme was started with eight VPs in March 1997. The number of Village

Phones was 12 568 on 24 April 2002. GT estimates that the current VPs

are providing telephones access to over 30 per cent of the rural population. GT’s

goal is to provide a telephone in each of Bangladesh’s villages. The average

usage of VPs is about 2061 minutes per month, of which 935 minutes are outgoing

calls. In June 2001, the average monthly bill was USD 121.

Figure 3 — Mobile access in Bangladesh

Source :left : ITU World Telecommunication Indicators Database.

Right :ITU adapeted from Grameen Telecom

|

GT’s shared access model has several implications. A person may not own a

telephone but may have access to one nearby. Almost 50 per cent of Bangladesh’s

rural households are landless, thus many seek non-farming in come opportunities

inside or outside their villages. VP serves as an attrac tive source of

revenue. Increased labour mobility resulting in increased rural-urban migration

as well as immigration has led to an enhanced demand for telephone services. A

study on the ben efits of VPs claims that the predomi nant economic benefit of

using VPs is the facilitation of the flow of income and wealth between overseas

workers or workers in urban cities like Dhaka and their families in rural

villages.1 VPs can also be used to improve overall living standards as

telephones provide access to services such as police, health assistance,

agricultural information and family planning offices. VPs can also be used to

obtain market information that allows villagers to negotiate bet ter prices for

their products. Access to the Internet, electronic fund transfer and other

value-added services are in the pipeline.

As Grameen Phone expands its network throughout the nation, GT will spread

its operation to more villages. When GP completes its network expansion by the

year 2004, 50 000 VPs will be in operation, covering most of the country. GT’s

novel idea of connecting villages through mobile phones is a concept that could

be replicated in many developing countries, where cellular telephony may be the

solution for uni versal access to telecommunications.

|

Universal access

In the last decade, as the region witnessed liberalization

and privatization, it became necessary to share the responsibility of meeting

the universal access targets between the incumbent government-owned monopolies

and new entrants. A country’s commitment to the availability of communication

services is usually manifested in the incorporation of universal access goals in

its National Telecom Acts, or equivalents, and the establishment of regulatory

mechanisms that ensure the fulfillment of these goals. A growing number of

regulatory agencies in South Asia oversee the telecommunication sector. Most

national telecommunication regulatory agencies have some kind of stated

universal access policy goal. In most cases, a rural roll-out obligation or

contribution conditions applicable to all licensed telecommunication operators

accompanies the universal access policy guidelines. Furthermore, provisions

are made so that policy tools such as revocation of licences or imposition of

penalties can be used to enforce the universal access conditions.

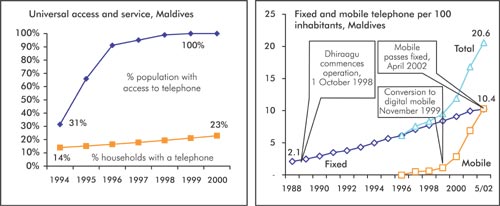

Additionally, most have scheduled specific targets for achieving universal

access. In the case of the Maldives, the target was set for 2000, but it was

able to provide 100 per cent universal access ahead of schedule by May 1999 (see

Leveraging on post offices). Overall, the regulatory framework

for universal access provision in the region is already in place. What are

lacking are concrete efforts to implement, enforce and monitor developments.

|

ITU 020171/A. de Ferron

Microwave antenna in Malé (Maldives)

|

Table 2 – Status of competition in South Asia

telecommunication markets

Situation as of April 2002, number of operators in parenthesis |

| |

Bangladesh |

Bhutan |

India |

Maldives |

Nepal |

Pakistan |

Sri Lanka |

| Local fixed |

M (1) (Urban)

D (2) (Rural) |

M (1) |

C (7)* |

M (1) |

M (1)** |

M (1)** |

C (3) |

| National long distance |

M (1) |

M (1) |

C (4)*** |

M (1) |

M (1) |

M (1) |

M (1)***** |

| International long distance |

M (1) |

M (1) |

C (4)***,**** |

M (1) |

M (1) |

M (1) |

M (1) |

| Cellular |

C (4) |

NA |

C (35)****** |

M (1) |

M (1) |

C (4) |

C (4) |

M Monopoly

C Competition

D Duopoly

NA Not Applicable

* Providers registered with the Telecommunication Regulatory

Authority of India (TRAI). Some 33 licences have been issued.

** Legally, rural telecommunication operators are allowed but none exist.

*** Licences issued.

**** PC-phone Internet telephony also permitted.

***** Local fixed operators are allowed to route long-distance calls

within their own network.

****** Providers registered with TRAI. |

|

Source: ITU |

| |

The Maldives: Dhiraagu delivers

Although the Maldives has the smallest population of

the South Asian countries, its citizens are spread out on 200 of the

more than 1000 islands that form the archipelago. Dhiraagu,

the incumbent telecommunication operator — 55 per cent owned by the

government of the Maldives and 45 per cent by Cable and Wireless of the

United Kingdom — has faced the huge challenge of providing service to

the 90 000 km² country.² Since commencing operation in October 1988,

Dhiraagu has increased the number of telephone lines by a factor of nine

(from 3000 to 27 000) at a cost of USD 84 million. This works out to

around USD 3800 per line or more than twice the world average, attesting

to the higher costs of installing telecommunications in rural and remote

areas.

In some dozen years, Dhiraagu has made the Maldives the

envy of other South Asian nations. Fixed teledensity crossed the landmark

of ten in 2001, the highest of South Asian nations and more than three

times the regional average. The Maldives is the only country in the region

to have attained universal access, meaning complete telephone coverage of

its 200 inhabited islands. That is a remarkable achievement for a least

developed country. Over 670 payphones have been installed, giving the

Maldives the highest payphone penetration in South Asia.

Figure 4 — Reaching universal access in the Maldives

Source :left : ITU adapted from Dhiraagu, Ministry of Planning

and National Development.

Right :ITU World Telecommunication Indicators Database.

|

Now that universal access has been reached, the

Maldives must push to higher goals. One is expanding mobile coverage,

launched relatively late in January 1997. Since the network was converted

to digital GSM network in November 1999, growth has been high and mobile

subscribers overtook fixed telephone lines in April 2002. Mobile is

available on 36 islands covering 40 per cent of the population. There is

currently a project to expand service to an additional 35 islands pushing

population coverage to over 50 per cent. Over one fifth of households had

a fixed line in 2000, twice the South Asia average. There is still plenty

of room for growth considering that some 60 per cent of Maldives homes

have a television.

If universal access can be achieved relatively quickly

within the Maldives challenging geographic context of dozens of spread out

islands, there is no reason why this should not be the case among other

South Asian nations. Perhaps the main reason for the Maldives success is

that it privatized its incumbent operator earlier than other South Asian

nations and also brought in a strategic investor. Although Dhiraagu is a

profit-seeking company, it also has a social conscience and has worked

closely with the government to pursue national telecommunication goals.

Ironically, while other South Asian nations are now wrestling with

liberalization as a method of achieving elusive universal telephone

access, the Maldives did so under a monopoly environment. In the end, it

is not the means, but the result that matters. |

Rural networks

With 71 per cent of its population in rural areas, South Asia

is an overwhelmingly rural region. Therefore ensuring access to communications

in rural areas should be a prime goal. There are several possible ways of

measuring rural access to telecommunications. These include rural teledensity;

the number of rural localities with telephone services and mobile population

coverage. Rural and urban teledensity are not always available for all

countries; however, available data suggests that rural and urban teledensity in

South Asia stands at one and nine respectively. Rural teledensity compared to

the average urban teledensity of South Asia suggests that rural areas are not

adequately served.

However, rural teledensity may not be the best way of looking

at the problem. Because incomes are lower in rural areas and the cost of

installing a line is much higher than in cities, it is more realistic to expect

that telephones in rural areas should be shared. Another way of measuring rural

access is to ascertain how many villages have a telephone. Rural South Asia is

made up of some 850 000 villages with populations ranging from 50 to 10 000

persons per village. Table 3 summarizes the rural telephone coverage in South

Asia.

The numbers are not precise but the message is clear. Some 60

per cent of rural localities in South Asia have access to some kind of

telecommunication service. In India, rural telephone access is provided through Village

Panchayat Telephones, in Sri Lanka it is available through post offices (see

Leveraging on post offices), while in Bangladesh it is provided

through the Village Payphone programme. Transposing the number of villages with

telephone service to the number of rural dwellers with access is subject to

interpretation. One limitation is that none of the countries compiles data on

how many rural inhabitants have access to telephone service. One method is to

assume that all the inhabitants of a village have access if there is telephone

service available and that the most populated villages in a country have been

served with telephones. In the latter case, not all the countries have a

breakdown of the population distribution across villages. Here we assume that

the rural population is distributed equally across villages. Based on this

assumption, some 800 million rural dwellers or 83 per cent of the rural

population — in South Asia have access to telephone service. These are rough

estimates, however they suggest that telecommunication access in rural South

Asia is not as lacking as would be reflected by the regional rural teledensity

of one.

Access to telephone service is also being expanded through

the rapid deployment of mobile service, particularly as competition intensifies.

For example, the percentage of the Bangladeshi population covered by a mobile

telephone signal has increased tremendously over the last five years since the

market was opened. It is estimated that over half the population is within the

range of a mobile cellular base station. On a regional basis, roughly 750

million inhabitants of South Asia are within mobile cellular coverage.

Ironically, despite the role mobile communications can play in alleviating

telephone shortages, few of the governments in the region track mobile

population coverage.

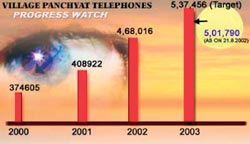

Figure 5 – Tracking village phones in India

Source: BSNL http://www.bsnl.co.in/vptstatus.htm

India is one of the few countries in the region that

regularly compiles and monitors rural telecommunication statistics. It

provides a break down of telephone lines by urban and rural areas and

compiles the number of villages with telephone service on a weekly basis.

Tracking the number of village phones has been somewhat of an obsession,

going on for over a decade. While progress in the early years seemed slow,

India is close to achieving its goal of providing all its some 600’000

inhabited villages within the next year. Already all villages in a dozen

of its 26 circles have a payphone.

|

Relay antennas in Kathmandu (Nepal)

|

Conclusion

Telecommunication infrastructure of South Asia is not as

lacking as many make it out to be. During the past five years, there has been

unprecedented telecommunications network growth in the region. Practically all

inhabitants of urban areas have access to telephone service. For example, India

reports that all of its some 5000 cities and towns have access to the telephone

network. Sri Lanka notes that telephones are available on demand in all its

cities. This suggests that the some 28 per cent of South Asia that is classified

as urban has access to telephone service. There has also been improvement in

rural access to telecommunications. Roughly 80 per cent of the rural population

has access to basic telephone services and over 50 per cent of the population is

covered by mobile signal. All together, over one billion inhabitants of South

Asia, or 88 per cent of the population, have access to telephone service.

Cellular telephone (India)

ITU 980142/Lars Aström |

These are estimated figures given that complete data is unavailable. Of

course having theoretical access or being within range of a mobile signal is not

the same as actually using telephone service. For many, telephone service still

remains unaffordable. For some, they may not even know telephone service is

close by. But what these figures do reflect is that restrictions to telephone

service are becoming more an issue of economics and awareness. These issues are

likely to become even more important as demand shifts from traditional telephone

service to Internet access.

The initial steps taken by most countries at opening up their

telecommunication markets to the private sector have produced encouraging

results in network expansion, and in some cases, in expanding rural access.

However, the full potential of the private sector to meet South Asia’s

telecommunications needs remains largely untapped. If South Asian governments

keep up their commitment to liberalization of the telecommunications sector and

universal access, we can expect further improvements. However, the governments

need to make greater effort at providing effective incentives for the private

operators to expand to less profitable rural markets. Furthermore, the need

for better monitoring of rural network expansion and access should be a

priority for governments that are genuinely committed to the development of

rural telecommunications (see Figure 5).

Table 3 – Status of telephones in South Asia

villages (2001)

|

| |

Villages |

Village population |

| Country |

Number |

Number with telephone service |

Percentage with telephone service |

Total (000s)1 |

Total with access to telephone service (000s)2 |

Percentage with access to telephone service |

| Bangladesh3 |

86 000 |

12 568 |

15 |

103 441 |

31 420 |

30 |

| Bhutan4 |

6000 |

N/A |

N/A |

636 |

N/A |

N/A |

| India5 |

607 491 |

468 016 |

77 |

741 660 |

726 827 |

98 |

| Maldives6 |

200 |

200 |

100 |

196 |

196 |

100 |

| Nepal7 |

3 914 |

1 761 |

45 |

19 457 |

8 754 |

45 |

| Pakistan8 |

125 083 |

12 000 |

10 |

97 855 |

29 357 |

30 |

| Sri Lanka9 |

23 000 |

2 475 |

11 |

13 113 |

9 834 |

75 |

| Total |

851 688 |

497 020 |

58 |

976 358 |

806 388 |

83 |

| Note:

Figures in italics refer to less

reliable estimates, secondary sources or earlier years.

1 Assumed to be rural population of country.

2 If population distribution by village size is known,

assumes most populated villages are served first. Otherwise, assumes all

villages are of same population. In reality, the majority of villages

account for a small portion of the population and tend to be connected

last. Therefore, the actual population covered is probably higher than

estimated.

3 The figure for villages with a telephone is for Grameen

only (April 2002) and thus could be higher. Rural population covered is

based on Grameen estimate.

4 Official data on the number of villages in Bhutan could

not be obtained. The figure is an estimate from a secondary source.

Likewise, no information could be obtained on the number of villages with

a telephone.

5 Source: Census India and BSNL. Data refer to March

2002. Rural population covered derived from ITU estimate based on 1991

Census data and the assumption that more populated villages have already

been covered.

6 For the Maldives, villages refer to islands. Source:

Dhiraagu.

7 Data from Nepal Telecommunications Corporation (September

2001). All villages are to be provided with telephone service by June

2003.

8 The number of villages for Pakistan is from the national

power company and is based on 1981 census data. The figure for villages

with a telephone refers to a 1999 figure provided by a payphone vendor.

The data for Pakistan is extremely conservative; the actual number of

villages and rural population covered is believed to be much higher than

shown. For example, over half of Pakistan’s villages are electrified.

9 The number of villages in Sri Lanka is based on secondary

sources. Villages with telephone service are derived from the number of

sub post offices with telephone service. The village population covered by

telephone service is assumed to be the same proportion of sub post offices

with telephone service.

|

|

Source: ITU. |

Leveraging on post offices Leveraging on post offices

Postal service tends to be more widespread in rural

areas than telecommunication services. Some South Asian countries are

leveraging on the greater coverage of post offices to provide

telecommunication services. For example, in Sri Lanka the government has

been encouraging telecommunication operators to provide telephone service

in post offices located in rural areas. It committed around USD 600 000

for connecting some of the remote post offices to the telephone network.

About three quarters of the 3300 rural post offices have telephone

service. One problem is that demand for telephone service extends beyond

post office working hours. The government is planning to allow

telecommunication companies to operate telephone services in post offices

if they extend the opening hours. It is also subsidizing the installation

of payphones in rural areas.

In Bhutan, ITU recently launched a three-year project

aimed at providing not only telephones but also e-mail in 38 postal

offices of which 20 are in rural parts of the country. This will help

alleviate a severe shortage of telecommunication facilities in remote

parts of Bhutan where "rural coverage is negligible." Bhutan is

also considering using Internet Protocol (IP)3 technology

to wire remote villages, thus completely bypassing the conventional

circuit-switch technology that has been the mainstay of telephone networks

since their invention.4 |

|

Notes

1 Richardson, D., Ramirez, R., Haq M. Grameen

Telecom’s Village Phone Program in Rural Bangladesh: A multimedia case

study. TeleCommons Development Group. March 2000.

www.telecommons.com/villagephone/index.html

2 This is an area larger than the land area of

two of the other South Asian nations, Bhutan and Sri Lanka and about fifty

per cent less than Bangladesh or Nepal.

3 ITU. "Bhutan to be Testbed for ITU’s

E-Post Venture with Universal Postal Union." Press Release. 26 March

2002. www.itu.int/newsroom/press_releases/2002/_page.print

4 Branscomb, H. Pushing Unlicensed Wireless to

the Limit: Aspen to Antarctica and Burning Man to Bhutan. June 2002.

itc.mit.edu/itel/meetings/jun02/Branscomb_jun02.pdf |

| * This article was

prepared by the Telecommunication Data and Statistics Unit of ITU’s

Telecommunication Development Bureau |

|