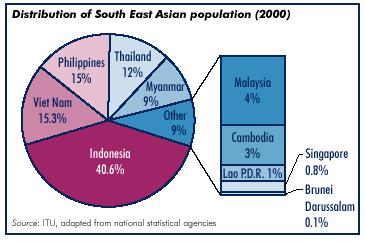

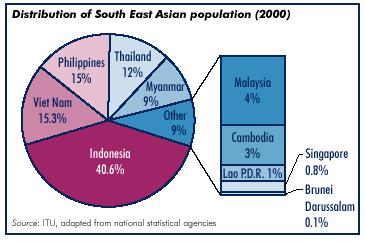

The ten countries that make up the Association of South East Asian Nations (ASEAN) — Brunei Darussalam, Cambodia, Indonesia, Lao P.D.R., Malaysia, Myanmar, Philippines, Singapore, Thailand and Viet Nam — are home to 523 million inhabitants, 8.6 per cent of the world’s population. Indonesia, with 212 million people, is the world’s fourth most populous country and accounts for 41 per cent of ASEAN’s population. ASEAN members range from some of the world’s wealthiest nations to least developed countries (LDC). For example, in 2000, oil rich Brunei had a gross national income (GNI) per capita of USD 24 630 and city state Singapore 24 740, while Cambodia had USD 260 and Lao P.D.R. 290.

|

|

|

The Asian financial crisis began in July 1997 in Thailand and spread to many of the other large ASEAN members. Economies contracted and exchange rates tumbled. The telecommunication sector was not immune. After growing at annual double-digit rates throughout the 1990s, telecommunication revenues hardly budged in 1998 and 1999. In the year 2000, telecommunication revenues finally revived to reach USD 13.3 billion in the region, up 10.6 per cent in real terms over the previous year.

Network development also slowed in the post-1997 period. In the first part of the 1990s, the South East Asia region had some of the fastest growing fixed telephone networks in the world. Annual growth averaged 19.5 per cent from 1991 to 1997 and the number of fixed telephone subscribers almost tripled from 6.7 to 19.5 million. Fixed telephone subscriber growth dropped sharply after 1997, averaging just 8 per cent a year between 1997 and 2000. Nevertheless, the number of fixed telephone subscribers per 100 inhabitants in the region tripled between 1991 and 2000, rising from 1.5 to 4.8.

Mobile networks have weathered the financial crisis better. Between 1991 and 1997, cellular mobile subscribers grew on average by 63 per cent a year compared to 43 per cent a year following the financial crisis. There was a sharp rise in growth in 2000 at 75 per cent, the largest increase since 1995. The number of mobile subscribers per 100 inhabitants increased almost 50 times since 1991. It rose from 0.09 in 1991 (when there were still four ASEAN countries without a mobile network) to 4.2 in 2000, almost the level of fixed-line subscribers.

Although telecommunication revenue in the South East Asia region is beginning to recover in the wake of the financial crisis, the same is not true for network investment. Capital expenditures for telecommunication equipment have plunged from USD 8.5 billion at the end of 1997 to 3.5 billion at the end of 2000.

The sharp fall in investment is ironic since most major operators remain profitable. Of South East Asia’s top ten

telecommunication operators — measured by revenue — only one lost money in 2000. The region’s top ten operators had

cumulative profits of USD 2.3 billion in 2000, representing 22 per cent of revenue. Normally, a significant portion of these

earnings would have been ploughed back into network development. However, the regional financial crisis saw exchange rates drop

sharply, driving up the cost of foreign debt. Many operators in the region have to pay significantly more in loans, diverting

funding from infrastructure construction.

The sharp fall in investment is ironic since most major operators remain profitable. Of South East Asia’s top ten

telecommunication operators — measured by revenue — only one lost money in 2000. The region’s top ten operators had

cumulative profits of USD 2.3 billion in 2000, representing 22 per cent of revenue. Normally, a significant portion of these

earnings would have been ploughed back into network development. However, the regional financial crisis saw exchange rates drop

sharply, driving up the cost of foreign debt. Many operators in the region have to pay significantly more in loans, diverting

funding from infrastructure construction.

Another explanation for the drop in investment is that infrastructure is becoming less expensive. This is due to the fact that a major portion of investment in the region is going towards wireless networks, which are cheaper to build. Many South East nations are also switching to Internet Protocol (IP)-based networks that are less costly to install. For instance, operators in Malaysia, Thailand, Singapore and Viet Nam are using IP for long-distance calling.

Reduced telecommunication investment is also a result of network development obligations imposed by governments and coming to an end in several large economies. In the Philippines, international service providers and mobile operators were obligated to install 4.4 million lines between 1994 and 1999. In Thailand, two franchises were required to install 4.1 million lines between 1993 and 1997. Many of these lines are lying idle. In the Philippines, fixed telephone capacity utilization is one of the lowest in the world at 44 per cent. At the same time, there has been a shift towards wireless networks. As a result, capacity utilization of the region’s fixed networks has dropped from 77 per cent in 1991 to 67 in 2000.

|

|

The mobile boomSouth East Asia. At the end of the year 2000, there were 22 million mobile subscribers in the region, up from just 3 million five years earlier. At the end of 2000, half of the ASEAN countries — Brunei Darussalam, Cambodia, Malaysia, Philippines and Singapore — had more mobile than fixed telephone subscribers. Thailand joined this group in 2001 and by year-end, there will be more mobile than fixed telephone subscribers in the region as a whole. Under the most conservative estimate — an annual growth rate of just over 10 per cent a year — there will be a minimum of 100 million mobile subscribers by the end of 2010 for a penetration of 16 per cent of the region’s population. As elsewhere around the world, mobile cellular communications is booming in Mobile is a supplement to conventional fixed telephones in the region’s wealthier nations such as Brunei and Singapore; and to a lesser extent in Malaysia. In Singapore, 51 per cent of households had a mobile phone in 1998 even though 98 per cent already had a fixed telephone. Mobiles are a substitute for voice communications in other countries such as Cambodia and the Philippines. In these two countries, a minority of households have a fixed telephone line and mobile phones outnumber fixed telephones. Both have had a greater number of nationwide mobile operators than other countries in the region. Mobile Internet development in the region has been slow. One factor working in the region’s favour is that all the countries have adopted the digital GSM standard. Common standards should help simplify the migration to 2.5 and to third generation (3G) mobile networks. Although most countries have introduced wireless application protocol (WAP) and several have introduced or are launching higher speed GPRS networks, take-up has been lukewarm. This is due to consumer indifference. In some Indochina peninsula countries, there have been problems in adopting native languages to mobile phone text applications. So far, only Singapore has licensed 3G mobile operators. In the other countries, recent GSM licensing and the launch of 2.5 generation systems is likely to delay the introduction of 3G. The Philippines has been at the forefront of short messaging services (SMS). In December 2000, Filipinos were sending almost 50 million text messages a day or around nine per subscriber. They are the world leader in per capita SMS usage, accounting for some 10 per cent of all worldwide SMS messages.

|

|

|

|

|

The Kingdom of Cambodia is located in South East Asia in the south-western part of the Indochina Peninsula. Its national census in 1998 counted a population of 11.4 million. The majority of Cambodians live in rural areas, with only 16 per cent residing in urban areas. Some 55 per cent of the population is under 19.

In 2000, Cambodia had a gross national income per capita of USD 260. It is officially classified by the United Nations

as an LDC. Cambodia is a textbook example of wireless boosting telecommunication development. It was the first country in the

world where mobile telephone subscribers overtook fixed ones back in 1993. Cambodia began the millennium with more than four out

of five telephone subscribers using a wireless phone, the highest ratio in the world. Thanks to mobile, Cambodia’s teledensity

— telephone subscribers per 100 inhabitants — reached 1 in the year 2000, a significant achievement for an LDC. While mobile

has contributed to the bulk of Cambodia’s telecommunication progress over the last decade, wireless fixed lines have also

helped and accounted for 5 per cent of all telephone subscribers at the beginning of 2001.

In 2000, Cambodia had a gross national income per capita of USD 260. It is officially classified by the United Nations

as an LDC. Cambodia is a textbook example of wireless boosting telecommunication development. It was the first country in the

world where mobile telephone subscribers overtook fixed ones back in 1993. Cambodia began the millennium with more than four out

of five telephone subscribers using a wireless phone, the highest ratio in the world. Thanks to mobile, Cambodia’s teledensity

— telephone subscribers per 100 inhabitants — reached 1 in the year 2000, a significant achievement for an LDC. While mobile

has contributed to the bulk of Cambodia’s telecommunication progress over the last decade, wireless fixed lines have also

helped and accounted for 5 per cent of all telephone subscribers at the beginning of 2001.

Perhaps the biggest factor contributing to wireless success is that there just never were many fixed lines to begin with.

Years of conflict destroyed most of the existing fixed network and prevented the construction of new lines. At the end of 1992,

the year mobile cellular was introduced in Cambodia, there were only a little over 4000 fixed lines for a population of some 9.3

million. A year later, mobile had already surpassed fixed lines.  Another factor contributing to mobile success was the

government’s decision to liberalize the market early, allowing both foreign investment and competition. Today, MobiTel,

a GSM mobile operator, is the largest telecommunication network operator in the country with almost 95 000 subscribers at

the beginning of 2001. There are three digital and two analogue mobile operators, all with foreign investors. Two additional

digital mobile licences have been awarded but have not yet started operating. Another success factor has been pre-paid access,

with over 90 per cent of mobile subscribers opting for this service. Most Cambodians either could not afford or would not

qualify for a subscription telecommunication service. Pre-paid cards with denominations as low as USD 5, and used handsets

available for USD 20, make mobile telecommunications much more accessible. Pre-paid service has also been attractive from the

operator’s perspective because it eliminates the risk of subscriber default. Another factor contributing to mobile growth is

billing in US dollars (use of the US dollar is widespread in Cambodia), which reduces the investor’s exchange-rate risk. These

assurances have resulted in over USD 100 million being invested in Cambodia’s mobile telecommunication sector. While wireless

technology has helped Cambodia achieve a minimal level of communications, it has also created its fair share of problems. These

include a confusing mix of government shareholdings and agreements, an interconnection maze and an over-reliance on mobile

network service provision to the detriment of the fixed-line network; and therefore of the Internet.

Another factor contributing to mobile success was the

government’s decision to liberalize the market early, allowing both foreign investment and competition. Today, MobiTel,

a GSM mobile operator, is the largest telecommunication network operator in the country with almost 95 000 subscribers at

the beginning of 2001. There are three digital and two analogue mobile operators, all with foreign investors. Two additional

digital mobile licences have been awarded but have not yet started operating. Another success factor has been pre-paid access,

with over 90 per cent of mobile subscribers opting for this service. Most Cambodians either could not afford or would not

qualify for a subscription telecommunication service. Pre-paid cards with denominations as low as USD 5, and used handsets

available for USD 20, make mobile telecommunications much more accessible. Pre-paid service has also been attractive from the

operator’s perspective because it eliminates the risk of subscriber default. Another factor contributing to mobile growth is

billing in US dollars (use of the US dollar is widespread in Cambodia), which reduces the investor’s exchange-rate risk. These

assurances have resulted in over USD 100 million being invested in Cambodia’s mobile telecommunication sector. While wireless

technology has helped Cambodia achieve a minimal level of communications, it has also created its fair share of problems. These

include a confusing mix of government shareholdings and agreements, an interconnection maze and an over-reliance on mobile

network service provision to the detriment of the fixed-line network; and therefore of the Internet.

|

For more information or comments on the UPDATE, please contact: |