For the telecommunications industry, the business of providing international telephone calls has historically been a type of paradise. Rising volumes of international traffic were fuelled by globalization and the replacement of telex by fax for text communication. Falling costs and high prices, sustained by a monopoly environment, generated lucrative income that often helped subsidize less profitable areas of the telecommunication business such as local calling. But recent trends suggest there is trouble in paradise.

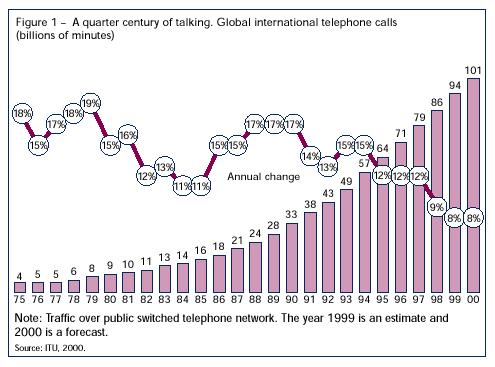

Growth in international telephony has been like a roller coaster over the last quarter century, always positive but subject to wide swings (see Figure 1).

Research has shown that the ups and downs have been quite closely related to economic, social, regulatory and technological changes in the wider economy. The growth periods can be split into three:

Between 1975 and 1982, international calling expanded at an impressive rate, tied to the growth of network infrastructure and the global economy. For example, a sharp fall in world output in 1982 resulted in a decline in the growth rate of international calls.

A second period covered the boom years from the mid-1980s to the mid-1990s. Fax took off and world trade, travel and tourism rose. While this period saw the beginnings of competition, in markets such as the United States, the United Kingdom and Japan, demand was to avert price competition and, in continental Europe at least, incumbent public telecommunication operators continued to hold sway.

The period since mid-1995 has been much less exciting. Volume growth has declined to single digits and revenues have started to fall in many markets. What has gone wrong?

As we enter the millennium, the linkage between international telephone traffic growth and economic growth seems to have become weaker. Growth in overseas calling has been declining over the last half decade, despite a fairly rigorous global economy.

What is behind this slowing growth? One factor is the relatively inelastic nature of demand. The growth rate in the

local access network (i.e., the number of fixed and mobile telephone subscribers) exceeded international calling growth

for the first time in 1997. As a result, international minutes per telephone subscriber have been declining. Many of

these new subscribers are from developing countries, where incomes are low and the propensity to make international

calls is small. But even in developed markets, cheaper prices have tended to generate smaller telephone bills not

necessarily longer calls or more of them. A second factor appears statistical. Technological and market changes are

impacting the measurement of international traffic. For example, overseas calls routed over private leased lines and the

Internet may be showing up as national rather than international traffic. It may be that traffic continues to grow, but

is just not being measured.

Ironically, growth in international calling has been declining even though prices have been falling sharply. One of

the main reasons is because of drops in settlement rates - the per minute charges to which international carriers

agree for carrying each other's calls. Settlement rates have been tumbling not only because of competition and

alternative routing but also because of political pressure, especially from the United States. Countries that do not

negotiate lower settlement rates may find their incoming international calls routed via third countries where rates are

lower or over the Internet, where there are no per minute termination charges. Politically, countries are under pressure

to move their accounting rates to the levels proposed by the United States Federal Communications Commission (FCC)

Benchmark Order and the ITU Focus Group (for more information on the Reform of the International Accounting Rate System

see www.itu.int/intset).

The fall in settlement rates has been accelerating. Figures from an annual ITU survey show that, while rates fell by 4 per cent per year between 1992 and 1996, the rate of decline accelerated to 12 per cent per year between 1996 and 1998 and has subsequently increased to more than 20 per cent per year. Rates between competitive markets have fallen even faster. As a result, the average price of a one-minute call to the United States fell from over two US dollars per minute in 1990, to a milestone of less than one dollar in 1997 and to a little over 50 US cents today. Based on these trends, the average price of a call to the United States will be under 20 US cents five years from now (see Figure 2).

The prices of international calls will converge with that of a local call. Take Switzerland for example, where a call to the United States today is one-tenth of what it was five years ago and is just 3 US cents more than a local call - and the same as a national long-distance call (see Figure 3).

if prices for international calling have fallen so dramatically, why has traffic not risen? One reason is because consumers have not necessarily increased the amount of time they spend making fixed-line calls.

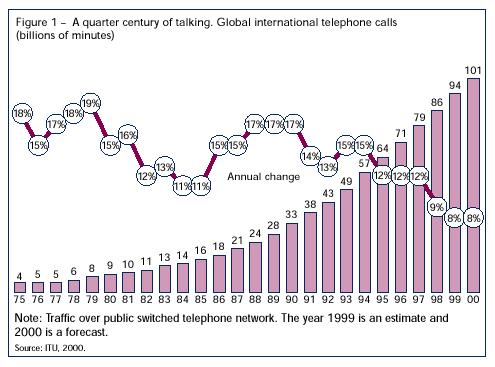

The stagnancy in the market for international telephone calls is dramatic when contrasted with other traffic streams, such as mobile communications or the Internet. For instance, in the United Kingdom, fixed telephone calls to mobiles surpassed international calls at year-end 1998 and are now one and half times greater (see Figure 4).

In the Hong Kong Special Administrative Region (SAR), minutes of dial-up Internet traffic surpassed total international traffic (incoming and outgoing calls) early in 1998 and is more than four times greater today (see Figure 5).

While minutes of dial-up Internet traffic has now surpassed outgoing international traffic in many countries, what other evidence is there that IP-based traffic and services are surpassing those of circuit-switched networks? One indicator is revenue, where turnover from international calls has been declining while those from data communications and Internet service provision have been rising. In Germany, Deutsche Telekom's international telephone revenues declined by 33 per cent in 1999 while revenues from data communications rose by 12 per cent and those from its on-line services, by 40 per cent. These new sources of revenue are now twice as much as Deutsche Telekom's international traffic revenue.

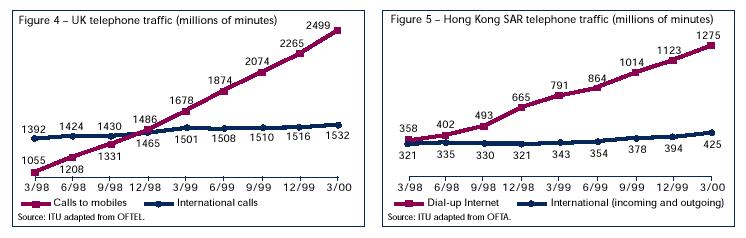

Another way of measuring the growth of Internet traffic compared to international calls is circuit usage. There are now more international private line circuits - typically used for Internet traffic - than public telephone circuits in use by United States carriers. This crossover took place during 1998. In routes to Europe, PSTN circuits are actually in de-cline though in other parts of the world, such as the Caribbean or Africa, voice traffic is still dominant (see Figure 6).

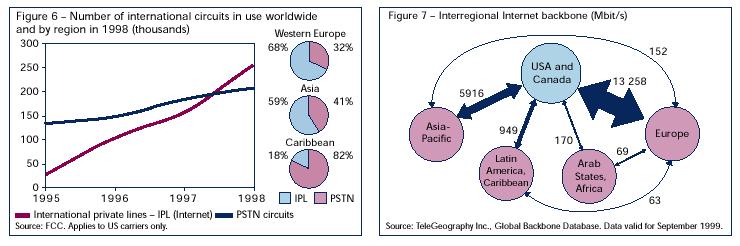

International Internet bandwidth is a further important measurement as it reflects the capacity of that network to process traffic such as e-mail and Web page browsing. The geography of Internet bandwidth - typically measured in megabits per second - reflects US dominance. More than 95 per cent of interregional Internet capacity flows to and from the United States (see Figure 7). This is a result of the historical Internet strength of the US reinforced by accelerating returns to scale. Most content is located in the US so users abroad need to have connections there to download the information.

Furthermore, it is often cheaper to use an Internet connection to the US to route traffic to other countries than to have a direct connection to those countries. One sore point is that, unlike international telephone traffic circuits where costs are shared, most non-US Internet Service Providers must pay the full cost of a leased circuit to the US. In the future, measurement of international bandwidth may be a more relevant measure of international telecommunication flows than minutes. That is because international voice calls will just be one more stream of bits routed over the Internet. As IP-networks expand and the Internet grows, ITU hopes to compile more of these types of indicators that help to measure the true extent of the digital divide.

The international telephone traffic analysis in this INDICATORS UPDATE is based on presentations made by ITU staff at the second annual Telenor Carrier Venue, held in Svolvær (Norway) from 29 to 31 August 2000. Svolvær is not your typical conference venue. It is a small fishing port in the Lofoten islands, north of the Arctic Circle and accessible by ferry or small plane from the Norwegian mainland. The event attracted over 100 participants from telecommunication carriers around the world. Telenor Global Services defines its business as "WorldWide Termination": that is, the routing of calls that neither originate nor terminate in Norway. These modern day commodity traders, buying and selling international telephone minutes, reflect the dramatic transformation of the telecommunication industry. In the past, telephone companies in each country negotiated with their correspondents in every other country to agree on a price to exchange each other's telephone traffic. Rates changed infrequently. Today, a company's direct correspondents may be fewer in number but there are dozens of companies that offer to get your traffic where it needs to go and prices change daily. Routing changes that once took months to fix can now be undertaken almost instantaneously. Least cost routes are becoming increasingly convoluted, with voice traffic following almost as many hops as IP traffic.

For example, when Cuba temporarily closed direct international telephone circuits to the United States, traffic was quickly rerouted from the United States to Switzerland, forwarded to Chile and then sent on to Cuba. For the minutes' traders in Lofoten, business was good. But how soon will it be before their jobs are performed by computer chips that trade automatically on international bandwidth exchanges to get the best routing deals? For the moment, human relationships still matter in this business and Telenor is working hard to make sure that it can stay ahead of the game.

The ITU has been collaborating

with the international telephone traffic consultancy, TeleGeography Inc., for a number of years. Cooperation includes

sharing of international traffic data and joint work on the Direction of Traffic series of reports on

international traffic trends. The first was produced in 1994. The latest, published in late 1999 on the theme of trading

telecom minutes, is the third. TeleGeography, based in Washington, D.C., produces an annual report on international

telecommunications. The company has recently become more involved in Internet analysis and in early 2000 produced an

Internet report entitled Hubs and Spokes. Befitting its name, TeleGeography also designs maps showing global

traffic flows and submarine fibre cable and satellite infrastructure (see www.telegeography.com/).

The ITU has been collaborating

with the international telephone traffic consultancy, TeleGeography Inc., for a number of years. Cooperation includes

sharing of international traffic data and joint work on the Direction of Traffic series of reports on

international traffic trends. The first was produced in 1994. The latest, published in late 1999 on the theme of trading

telecom minutes, is the third. TeleGeography, based in Washington, D.C., produces an annual report on international

telecommunications. The company has recently become more involved in Internet analysis and in early 2000 produced an

Internet report entitled Hubs and Spokes. Befitting its name, TeleGeography also designs maps showing global

traffic flows and submarine fibre cable and satellite infrastructure (see www.telegeography.com/).

The Republic of Bolivia is located in South America. Bordered by Brazil, Paraguay, Argentina, Chile and Peru, this landlocked country is home to three contrasting environments: the Andes mountains and high plains; sub-Andean valleys; and tropical flatlands. Lake Titicaca, the world's highest and fourth largest, is partially situated in Bolivia.

The population of Bolivia was estimated at 8.3 million in June 2000, of which 37 per cent live in rural areas. The largest urban area is La Paz _ one of the highest cities in the world at an average altitude of 3640 metres _ with 1.6 million inhabitants. Bolivia has the biggest indigenous population in Latin America. There are three official languages: Spanish, plus the Indo-American Aymará and Quechua.

Bolivia has a low per capita income compared to its neighbours and consequently poorer levels of life expectancy, school enrolment and literacy. It is imperative that it boosts economic development in order to catch up. Consequently, it has been liberalizing a number of economic sectors, including telecommunications.

The Bolivian telecommunications industry structure is quite distinct from other countries. Local service is provided by telephone cooperatives (of which there are 14 today), each with a monopoly licence for a particular geographic area. The largest telecommunication company, Empresa Nacional de Telecomunicaciones (ENTEL), has an exclusive licence for national and international long-distance services and provides local service in areas with no telephone cooperatives. ENTEL was privatized in 1995.

Unlike most other countries, where proceeds from the privatization of the telecommunication operator went to the State, ENTEL was capitalized through the sale of 50 per cent of its shares to STET International (part of Telecom Italia) for USD 610 million. This sum is to be reinvested in the company. The remaining 50 per cent is owned by all Bolivians through national pension plans.

Regulatory and policy-making decisions are the primary responsibility of the regulator, the Superintendencia de Telecomunicaciones (SITTEL). The existing industry structure, based primarily on monopoly service providers, will change in November 2001, when the six-year period of exclusivity granted to ENTEL and the cooperatives will expire.

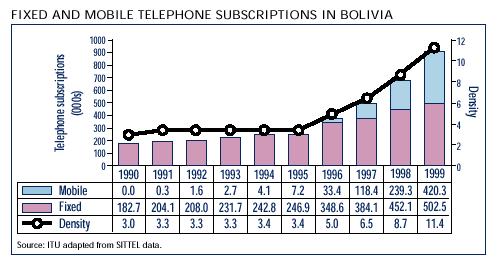

Only about six per cent of Bolivia's inhabitants have a fixed-line telephone, one of the lowest levels of teledensity in Latin America. The figure is even glimmer when considering urban-rural disparities, as about 80 per cent of all lines in service are in the three largest cities. Fixed-line growth has been low as teledensity only increased from about 5 in 1996 to 6.2 in 1999. Analogue AMPS (advanced mobile phone service _ a North American analogue standard) mobile cellular telephone service was introduced in 1991 by TELECEL, now fully owned by Luxembourg-based Millicom. ENTEL entered the market in 1996. The cellular duopoly will soon change with the newly licensed joint venture between the US company, Western Wireless, and local telephone cooperative, COMTECO, planning to launch personal communication services (PCS) in November 2000. Since the introduction of cellular competition and later, pre-paid service, the number of subscribers has increased steadily. In 1999, mobile cellular telephone density reached 5.2, only one percentage point behind fixed-line density. In Santa Cruz, the second largest city, the number of cellular subscribers has surpassed the number of fixed lines. However, the majority of cellular telephone lines are also concentrated in the three main cities and departments (about 90 per cent).

SITTEL has the important mandate of developing strategies when the market is fully opened late 2001 in order to enhance

universal access to telecommunication services. This includes responsibility for establishing an implementation plan for

the Rural Telecommunications Development Fund. Bolivia is one of the ITU Internet Case Studies; additional information

about the country can be found at www.itu.int/ti/casestudies/index.htm.

|

For more information or comments on the UPDATE, please contact: ITU/BDT, Telecommunication Data and Statistics, Place des Nations, CH-1211, Geneva 20 (Switzerland). Tel.: +41 22 730 6090. Fax: +41 22 730 6449. E-mail: indicators@itu.int |