Yoshio Utsumi (in the centre), accompanied by his wife Masako, admires the 256-line capacity

exchange at Runukat, which can work in rough environments without air-conditioning

Yoshio Utsumi (in the centre), accompanied by his wife Masako, admires the 256-line capacity

exchange at Runukat, which can work in rough environments without air-conditioning

Photo: Alain de Ferron (ITU 000014)

India, the seventh largest country in the world, is today being driven by a new spirit of transformation to become an information technology (IT) super power. This spirit is bringing sweeping changes in its wake and unleashing the vast potential of the Indian economy. The government's policies are now relatively simple, transparent and geared towards creating a world-class information infrastructure.

The country's 24.3 million-line telephone network is one of the largest in the world and the third largest among emerging economies. Given the low telephone penetration rate of 2.4 lines per 100 inhabitants, India plans to achieve a teledensity of 9 lines per 100 inhabitants by the year 2007, offering a vast scope for growth and investment. A demand of additional direct exchange lines of 67.4 million is foreseen in the period 1997-2007.

The telecommunications initiative in the country is being steered by the Ministry of Communications through the Department of Telecommunications (DoT) and the Department of Telecom Services (DTS).

DTS operates one of Asia's second largest telecommunication networks, with net switching capacity of 29438405 lines of which 24303030 represent connections in service. There are 25 093 telephone exchanges in the country and the network is growing at a rate of more than 20 per cent per annum, using switches designed by the Centre for Development of Telematics (C-DOT), Siemens, Alcatel, Fujitsu and Ericsson.

The transmission systems for interconnecting exchanges throughout the country are built on the latest state-of-the-art technologies. The transmission media available for interconnecting these exchanges include a 91397-km route of microwave, a 122124-km route of OFC cable and a 30957-km route of coaxial cable, as well as satellite Earth stations working via Indian National Satellites (INSAT).

Until 1994, DTS along with its undertakings, Mahanagar Telephone Nigam Limited and Videsh Sanchar Nigam Limited, were the sole providers of telecommunication services in the country. The National Telecom Policy of 1994 paved the way for the private sector to join in the provision of these services and for the introduction of cellular and value-added services.

Private operators are allowed to operate basic telephone services to supplement DoT's efforts in providing telephone connections. Indian registered companies with a maximum foreign equity of up to 49 per cent are allowed to operate basic telephone services.

Following bids, nine companies were issued with a Letter of Intent to operate basic telephone services in 30 telecommunication "circles". So far, six companies have signed licences and interconnect agreements for six of the circles. Two companies have already started operations. Incentives, such as a five-year tax break (or tax holiday), have been introduced to encourage private sector participation in telecommunications.

Private sector entrepreneurs have been permitted to provide value-added services. These include electronic mail, voice mail/audiotex, closed user-group domestic 64 kbit/s data network services via INSAT, videotex, videoconferencing, credit card authorization and the Internet.

Licences have been awarded to 13 Indian companies for the operation of cellular mobile telephone and radio paging services. These services are already being provided to some 1 650 000 subscribers in selected cities of the country.

The Government of India, as part of the information technology policy, is encouraging private entrepreneurs to provide Internet services. So far, 60 Internet service providers (ISP) have already started operations. DTS and its public sector companies, Mahanagar Telephone Nigam Limited and Videsh Sanchar Nigam Limited, are the major ISPs. The companies are also being allowed to install gateways.

The Telecom Regulatory Authority of India (TRAI), which was established through an Act of Parliament in early 1997 to regulate telecommunication services, was reconstituted at the beginning of 2000. TRAI now has three full-time members and several part-time members. An appellate authority for settlement of disputes is also to be established, and is expected to generate confidence and bring transparency to the companies operating in India.

DoT has put in place a training infrastructure to cater for the needs of human resources development in telecommunications. At present, there are 44 telecommunication training centres, two of which are apex institutions: the Advanced Level Telecommunication Training Centre (ALTTC) in Ghaziabad, and the Bharat Ratna Bhim Rao Ambedkar Institute of Telecommunication Training (BRBRAITT) in Jabalpur. These two centres provide training to foreign participants upon the request of governments, as well as through fellowships from the Asia-Pacific Telecommunity (APT), or fellowships jointly sponsored by the Ministry of External Affairs and DTS.

A large population of India lives in the villages. There are about 600 000 villages in the country, with 358 538 of them already equipped with telecommunication facilities. The equipment for rural telecommunications is mostly built in India using indigenous technology from C-DOT. Plans are under way to provide access to each village by March 2002 and should help increase the teledensity in rural areas from 0.4 to 4 by 2010.

India has been engaged in the development of switching and transmission systems which can cater for the specific requirements of developing countries with diverse climatic conditions and needs. C-DOT was set up to concentrate on R&D and has developed switches with a capacity ranging from 128 to 40 000 lines. Switches of 128 and 256 lines are developed to meet the requirements of rural areas. Exchanges equipped with these switches can work without air-conditioning in remote and rural areas.

C-DOT has also developed medium capacity (1500 lines) and large capacity main automatic exchanges (up to 40 000 lines), intelligent network services, remote switching units, asynchronous transfer mode (ATM) switches and wireless local loop (WLL), fibre access systems, 64 kbit/s integrated voice and data VSAT (very small aperture terminal) in Ku-band, photonic amplifiers and products of the synchronous digital hierarchy (SDH) family.

At present, 90 per cent of the total exchanges in service in the country are designed by C-DOT. Other institutions engaged in R&D of state-of-the-art technology include: the Indian Institute of Science in Bangalore, Indian Institute of Technology, Tata Institute of Fundamental Research and In-house R&D Labs of Indian Telephone Industries, Hindustan Teleprinter Ltd., and Center Electronics Ltd.

The National Telecom Policy of 1999, which was announced by the government, is a culmination of major reforms and restructuring of the Indian telecommunications sector which were set in motion by the National Telecom Policy of 1994. This new policy is seen as a resolute effort to remove the bottlenecks faced by the Indian telecommunications industry and investors in telecommunication services.

The policy envisages a rapid growth in the telecommunication sector and aims to achieve a target teledensity of 7 by 2005 and 15 by 2010. This implies that some 75 million telephone connections have to be provided by 2005 and 175 million by 2010.

Yoshio Utsumi (in the centre), accompanied by his wife Masako, admires the 256-line capacity

exchange at Runukat, which can work in rough environments without air-conditioning

Yoshio Utsumi (in the centre), accompanied by his wife Masako, admires the 256-line capacity

exchange at Runukat, which can work in rough environments without air-conditioning

Photo: Alain de Ferron (ITU 000014)

In February 2000, ITU Secretary-General, Yoshio Utsumi, visited India at the invitation of the Department of Telecommunications. During the visit, he held high-level talks with the Minister of State for Communications, the Secretary of DoT, the Secretary of the Department of Telecom Services, and Members of the Telecom Commission. Discussions were centred around India's participation in ITU activities, the establishment of the Asia-Pacific Telecommunication Standards Institute (ATSI), Indian Foreign Investment Policy and Incentives, pilot projects in progress and in the pipeline with the assistance of ITU.

In a panel session, telecast nationwide, the Secretary-General and Indian officials discussed the convergence of telecommunications, IT and broadcasting services, IMT-2000 systems and services and ITU's future plans to protect the interests of developing and least developed countries, as well as policy aspects of Internet-related services and e-commerce.

Mr Utsumi visited the Institution of Electronics and Telecommunication Engineers, where he found the Institution's efforts in electronics development and IT and telecommunication engineering laudable.

He was particularly impressed with the 256-line capacity C-DOT exchange at Runukat on the Agra Delhi Highway. He noted that the locally made system can work in a rough environment without air-conditioning and commended the Centre for Development of Telematics for developing technology that is specially suited for developing countries like India.

From clothes to cars and from housing toholidays, electronic commerce is increasingly taking hold. In 1999, Members of the International Telecommunication Union celebrated World Telecommunication Day under the theme of "electronic commerce".

In February this year, European and United States policy-makers, business leaders and representatives of trade associations met in Brussels to discuss and assess the current e-commerce climate with specific reference to those sectors that are so far having the most success online. This one-day conference was organized by Forum Europe and World Online, with the support of the European Commission and the European Internet Industry Association.

It is clear from the topics discussed at this conference, that e-commerce will dominate the headlines for some time to come. Among the hot topics, according to the organizers, were: the extent to which European Union (EU) regulators are caught in the crossfire between consumer bodies demanding more protection for customers who buy on the Internet and business lobbies concerned that their investment could be under threat from too much regulation, the outlook for the approval and implementation of the EU's e-commerce directive, the role of Europe's national postal services in the online revolution — are they helping or hindering the development of e-commerce? With the Internet share-dealing and online banking growing fast, how are Europe's traditional financial institutions coping with the new challenges posed by the spread of e-banking? Can Europe now reach a clear-cut regulatory pact with the United States that would open the way to global e-commerce rules?

This article highlights trends in business-to-business and mobile e-commerce. It is compiled from summaries of two major reports by Analysys, a consultancy in telecommunications strategy (http://www.analysys.com).

According to the report Business-to-Business Ecommerce: Opportunities for Network Operators, network operators have been slow to enter a market predicted to be worth USD 1 trillion by 2002. Telecommunication operators (TO) have been held back by their general uncertainty about the Internet, and Internet service providers (ISP) have been too busy building out their basic networks to take decisive steps. Meanwhile, all operators' core business of supplying connectivity and transport services is becoming rapidly commoditized, threatening their future prosperity.

Network operators have been slow to enter a market predicted to be worth USD 1 trillion by 2002

Network operators need to act now, and act decisively, if they are to enter the business-to-business e-commerce market and compete with the established early entrants such as Cisco, IBM and Oracle.

There is an urgent need to diversify into areas where margins are higher, where there is more scope for service differentiation, and where customers can be more deeply engaged. Business-to-business e-commerce offers network operators a major opportunity to achieve this. Indeed, it has become necessary for their survival, claims the report. But there is a dilemma for network operators. As their current business models become less and less applicable, how can they leverage their core assets to maintain growth and profitability?

The application service provider (ASP) business model is said to offer the most attractive approach to network operators. This model places network provisioning in a central role in the e-commerce world, promising operators a powerful position from which they can launch into other areas as the need and opportunity arises.

Besides, the ASP model enables operators to enter the e-commerce market on an incremental basis, beginning with the provision of basic services, such as database and server hosting, that are already close to their core business offerings. Operators can then develop more complex services as their experience grows and the requirements of clients become more sophisticated.

However, the report warns that there are dangers in embracing the ASP model — because of the breadth of possible service offerings, there is scope for loss of focus, brand dilution, de-alignment of sales channels, and investment in unwanted services and technologies. To avoid these pitfalls, network operators must acquire a deep knowledge of their target markets and develop a consistent vision of what role they intend to play.

The report points out that the ASP business model is governed by achieving economies of scale and so all players will ultimately be looking to maximize their market share. As a result, it is likely that rapid consolidation will take place over the next two to four years, significantly raising barriers to entry. The future of e-commerce is happening now. The technologies and strategies that will ultimately become the dominant forces shaping industry structure are already in their infancy. If network operators are to be part of the e-commerce future, they will need to work hard to assemble the necessary competencies.

The report examines all the issues facing TOs and ISPs as they take on their rivals in the business-to-business e-commerce market. It analyses the overall market drivers and business trends, and assesses other business models which TOs and ISPs might adopt. It contains real profiles (covering financial details, services offered and infrastructure) of leading e-commerce players: Automotive Network eXchange (ANX), BT, Cisco Systems, Inc., Energis plc, Futurelink Distribution Corp., IBM and PSINet Inc.

Mobile portals, the route to riches?

The emerging mobile e-commerce market offers mobile operators a valuable opportunity to increase their revenues profitably by moving into new areas of the value chain and by expanding usage of mobile communications. However, many other types of players — banks, portals and brand-based companies — are keen to establish a dominant role in this rapidly developing market.

According to the report Mobile Ecommerce, released in February 2000, the likely winners in the battle to dominate the mobile e-commerce market will be those that can quickly develop strongly branded mobile portals.

Global mobile subscribers are expected to top one billion by 2003 — a staggering one in six of the world's total population!

The report highlights that it is not just the mobile operators which are competing for control. Established Internet portals such as Yahoo!, AOL and MSN, together with start-ups such as AirFlash, Indiqu and Saraide, are also positioning themselves to take advantage of mobile e-commerce. These are being joined by banks and equipment manufacturers, which also see establishing a mobile portal as a route to riches.

Different approaches are being taken to portal development. For example, Telia Mobile and NTT DoCoMo are developing mobile portals independently, while most other operators are forging partnerships with existing portal specialists. Such partnerships are producing a variety of agreements on branding, co-branding and developing different revenue sharing models.

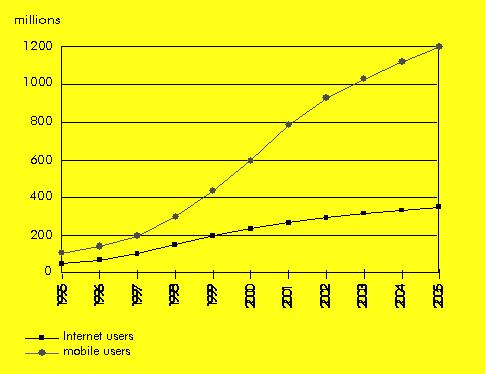

With global mobile subscribers expected to top one billion by 2003 — a staggering one in six of the world's total

population, it is clear why this market is attracting so much interest. If you can bring together a range of mobile

e-commerce services under one brand umbrella, then you establish a very powerful position. Figure 1 supports this

assertion, showing that mobile subscribers easily outstrip Internet users.

Figure 1 — Mobile subscribers and Internet users

Of course mobile operators would prefer to be the sole brand, the sole portal, that users of mobile e-commerce services see. But they need partnerships with Internet portals or specialist start-ups in order to build a strong portal quickly. Speed to market is critical in determining who will dominate.

The most successful mobile portals will be those that attract the largest number of users. To achieve this, they will not just have to add most value, but will need to have a strong brand themselves and be seen to attract a range of services from strongly branded merchants, says the report.

One of the greatest attractions for advertisers and merchants will be a portal's ability to offer location-based services that tailor responses to information requests according to where the subscriber is using the service.

The report "Mobile Ecommerce" answers key questions, such as:

It examines the various business strategies and revenue models being adopted in the mobile e-commerce market, particularly in Europe, East Asia and North America. The strengths and weaknesses of the various types of players are evaluated against the functions required to deliver mobile e-commerce, including portal services, content provision, payment processing and security services. Detailed case studies of the strategies of leading players are featured, including: AirFlash, Citigroup, AOL (Netscape Communications), NTT DoCoMo, SmarTone, Sonera and Visa International. — Analysys.

The Government of Singapore has announced that it is bringing forward by twoyears the date (starting 1 April 2000 instead of 1 April 2002) at which full market competition in the telecommunications sector would be introduced in the country. Direct and indirect foreign equity limits for all public telecommunications service licences, have been lifted with immediate effect.

As a result of this anticipated liberalization, the government will compensate StarHub and SingTel for any potential loss and the Infocommunications Development Authority (IDA) of Singapore will engage an international consultant to advise on the amounts payable to the two companies.

StarHub was awarded the second public basic telecommunication services (PBTS) licence in March 1998, to start operations on 1 April 2000, on the basis that there would only be two PBTS licensees, i.e. StarHub and SingTel, until 31 March 2002. SingTel, as the incumbent, has likewise made investment decisions based on the government's announcements that there would be a duopoly up to 31 March 2002. The government is also prepared to review StarHub's capital expenditure commitments.

Singapore aims to be a leading infocommunications hub in the Asia-Pacific region and to achieve this, the telecommunications market must be globally competitive, with many players offering innovative, high quality and cost effective services.

Singapore aims to be a leading infocommunications hub in the Asia-Pacific region and to achieve this, the telecommunications market must be globally competitive

The openness of the regulatory environment is a major factor in attracting new investments and players. The government is formulating the Information and Communications Technology 21 Masterplan.

New entrants are free to decide on the type of networks, systems and facilities they wish to build and own, and the type of services they wish to offer. Parties interested in entering the telecommunications market can contact IDA, which has released the licensing framework and licence application guidelines for the provision of telecommunication networks and services in Singapore, following the government's announcement. — Ministry of Communications and Information Technology, Singapore/IDA.