Third-Generation (3G) Mobile

A status report

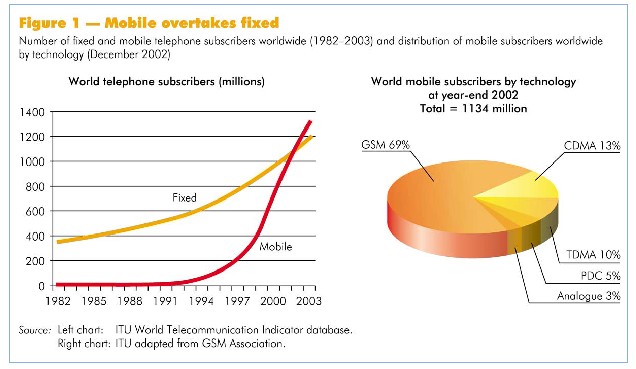

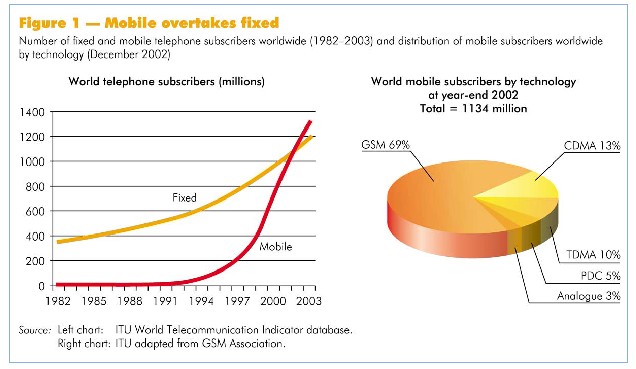

Since mobile cellular became commercially available in the early

1980s, it has advanced beyond imagination in terms of coverage, services,

technology, handsets and regulation. Perhaps the most revolutionary change is

that in the space of around 20 years, mobile subscribers surpassed

fixed-telephone line subscribers in 2002, making mobile technology the

predominant means of voice communications (see Figure 1, left chart).

A collection tracking the history of mobile

communications

ITU 030082/Siemens AG

|

First generation mobile cellular networks employed analogue

technology. Developments in digital technology led to second-generation (2G)

systems. By the end of the 1980s, 2G networks had been developed to provide

better quality services, greater capacity and additional functionality than

analogue systems. At the end of 2002, the world had almost completed the

transition to digital cellular networks, with analogue users accounting for a

mere three per cent of total mobile subscribers. There are four 2G digital

cellular radio technologies in use around the world (see Figure

1, right chart):

1

1 The Personal Handyphone System (PHS) is a digital system

launched in Japan in 1995. As a low-cost alternative to cellular, it has limited

coverage area. There were 5.6 million PHS subscribers, all in Japan, at December

2002.

-

Global System for Mobile Communications

(GSM). This is

the predominant technology worldwide and the predominant system in Europe. It is

also used in many nations in Africa, Asia, the Middle East and some countries in

the Americas. At December 2002, there were 788 million GSM subscribers on 467

networks in 169 countries.

-

Time Division Multiple Access (TDMA).

This is the

leading technology in the Americas with 109 million subscribers at December

2002.

-

Code Division Multiple Access (CDMA). At December 2002,

there were 147 million CDMA subscribers with 61 per cent in the Americas, 37 per

cent in the Asia-Pacific region and less than two per cent in Europe, the Middle

East and Africa.

-

Personal Digital Cellular (PDC). This system is

deployed only in Japan with 60 million subscribers at December 2002.

New generation liquid-crystal display (LCD) mobile phone

ITU 030084/Philips

|

A significant development with 2G systems has been the

increasing utilization of data-like services, for example, the short message

service (SMS), which allows text messages to be sent between mobile handsets.

Some 360 billion SMS were sent over GSM networks in 2002.2 Mobile handsets are

also increasingly being used to access the Internet. This has become successful

in countries such as Japan, where 80 per cent of cellular users subscribe to a

mobile Internet service provider.3 The growing use of mobile data has led to

demand for faster speed than the initial transmission rate of 9.6 kbit/s for GSM.

This is being accomplished by upgrading existing GSM networks with the

deployment of General Packet Radio Service (GPRS) technology. In the case of

cdmaOne networks, they are being enhanced with CDMA2000 1X technology. These

technologies offer speeds that are equivalent to, or even faster than,

conventional dial-up.

2

See “GSM Statistics” on the GSM Association website at

www.gsmworld.com/news/statistics/index.shtml

3 See the “Internet Provider Services (Mobile Telephone)”

section of the “Number of Subscribers” report issued monthly by the

Telecommunication Carriers Association (TCA) of Japan. In December 2002, TCA

reported that there were 59.5 million subscribers to the mobile Internet

services known as i-mode (provided by the NTT DoCoMo Group), Ezweb (provided by

the au Group and the Tu-Ka Group) and J-sky (provided by J-Phone). This is out

of a total of 73.5 mobile telephone subscribers (see www.tca.or.jp/eng/database/daisu/yymm/0212matu.html).

A dual-band mobile phone of 1999. Its simple menu

and large display appealed to first-timers, especially youth. With the

young target group came music too A dual-band mobile phone of 1999. Its simple menu

and large display appealed to first-timers, especially youth. With the

young target group came music too

ITU 030083/Siemens AG

|

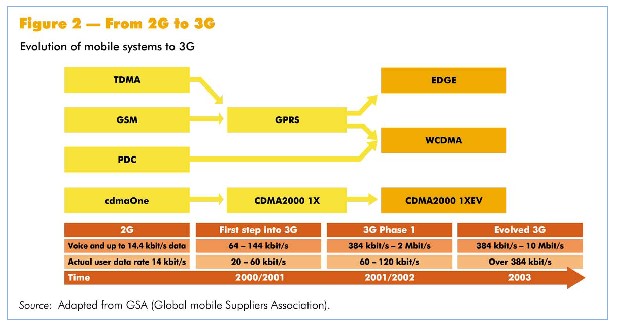

The development of 3G systems

The need for faster speed, global compatibility and multimedia

services has led to the development of 3G systems. In an effort to consolidate

existing incompatible mobile environments into a seamless global network, ITU

adopted a family of radio access methods at its Radiocommunication Assembly in

Istanbul in early May 2000. Known as International Mobile

Telecommunications-2000 (IMT-2000), this global standard was realized after

years of collaborative work between ITU and the global cellular community. At

the end of May 2000, the World Radiocommunication Conference (also held in

Istanbul) identified additional frequency bands for 3G (IMT-2000) use.4

IMT-2000 consists of five different radio access methods: W-CDMA (Wideband Code Division

Multiple Access), CDMA20001X, TD-SCDMA, EDGE (Enhanced Data Rates for GSM

Evolution) and DECT (Digitally Enhanced Cordless Telecommunications).

4 See ITU Press releases: “ITU gives final approval to

IMT-2000 radio interface specifications” (8 May 2000) at www.itu.int/newsarchive/press_releases/2000/10.html

and: “Thumbs up for IMT-2000” (30 May 2000) at www.itu.int/newsarchive/press_releases/2000/12.html

|

An innovative mobile phone with a built-in

rotating camera and colour screen, to be released in the GSM market in

2003

ITU 030088/Samsung

|

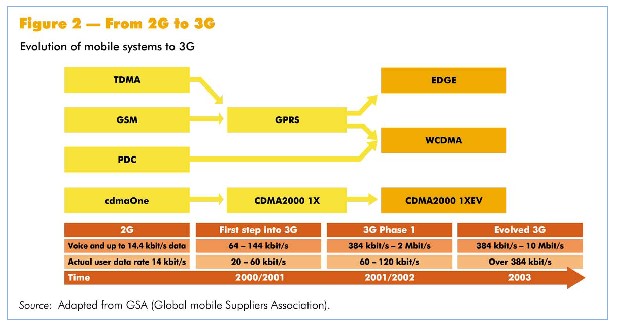

The evolutionary path from 2G to 3G has been mapped out for

existing networks (see Figure 2). Migration differs depending on the existing 2G

network. In general, W-CDMA would require a brand new network to be installed

whereas CDMA2000 1X requires less investment as an upgrade from existing

second-generation CDMA networks. Among the five radio access technologies

approved as IMT-2000, W-CDMA and CDMA2000 1X have gained the most support from

regulators, mobile network operators and equipment manufacturers.

At the end of 2002, there were 119 licences that had been

awarded to operators around the world for the use of IMT-2000 spectrum to offer

3G mobile services. An important consideration in the 3G licensing process is

exactly what is being offered. In most countries, the licensing includes the

needed spectrum, typically in the 2 GHz range. In some cases, particularly most

of Europe, the 3G radio interface was also specified. In other cases, there was

no explicit requirement for a specific radio interface as long as it was one

identified in the IMT-2000 standard. While auctions and beauty contests have

been the preferred licence allocation methods, some countries have automatically

granted 3G licences to incumbents. For example in Europe, 3G licences were

offered free of charge to the incumbent mobile operators in the Isle of Man,

Liechtenstein and Monaco.

The optimum method of allocating licences is subject to debate.

Proponents of auctions will argue that frequency is a scarce resource and its

pricing should be left to the market. Backers of beauty contests will argue that

their method avoids high auction prices that will eventually be passed on to

consumers. There are also political aspects since, in some instances, the

licence fees revert to the government budget.

Auction

In this method of licence allocation, a frequency range

identified for the use of 3G networks is auctioned. A number of licences are

made available depending on spectrum and market conditions. Successful

applicants are those that outbid others.

There has been great variation in the relative price paid for 3G

licences that have been auctioned. The average price per capita in Germany and

the United Kingdom amounted to EUR 615 and 644 respectively. In contrast,

Austria and Denmark collected an average licence price per capita of EUR 103

and 95. One reason is timing. Germany and the United Kingdom were among the

first to auction 3G licences. Euphoria was high, as were the prices. It is

possible that licences will be sold at or near their reserve price (i.e.,

minimum bid price) when the number of bidders is the same or less than the

number of licences available. Such was the outcome when Switzerland conducted

its auction in December 2000. Auctions can also be cancelled under such

circumstances, as was the case in Singapore and Slovenia where the bidders

simply paid the reserve price. In total, 77 licences for 3G have been granted in

19 economies via auctions, accounting for USD 101 billion (see Table

1).

Beauty contest

In a beauty contest, a fixed number of licences are awarded to

applicants that best meet certain criteria. The regulator issues an invitation

to all interested parties with guidelines and requirements. Successful

applicants are chosen based on specific pre-determined criteria presented in the

application. The selection criteria differ from country to country, depending on

the respective plans and objectives in establishing a 3G network. In general,

applicants are evaluated based on their financial capacity, business plan and

technical expertise. Criteria that are often used are commitments to rapid

roll-out and with high levels of land and population coverage. Other aspects

such as market concentration and technological specifications are also taken

into consideration.

Like a real beauty pageant, applicants are awarded points for

satisfying the specific criteria stipulated. Applicants with the highest scores

are awarded licences. Normally, licensees also pay a fixed licence fee, but some

countries, like Japan and Finland, waived this fee. In this method, licence

costs are significantly lower than the auctioned licences, yet France and Poland

were noteworthy for having high fees.

Some 41 3G licences have been issued in 13 countries via beauty

contests accounting for USD 6.9 billion (see Table 2).

A mobile handset using EDGE technology

as

an initial phase to launching further broadband applications in Malaysia

ITU 030080/Siemens AG

|

Regional analysis

Universal Mobile Telecommunications System (UMTS) is the term

Europe uses to refer to 3G networks. It maps out the migration path for GSM

networks to 3G. UMTS uses the IMT-2000 W-CDMA radio interface in the frequency

bands 1900—1980 MHz, 2010—2025 MHz and 2110—2170 MHz. In December 1998, the

European Parliament mandated that all European Union (EU) member countries adopt

UMTS. The decision imposed a specific timetable for UMTS, including a deadline

for licensing by 1 January 2000 and introduction of commercial services by 1

January 2002. All EU members had completed the 3G licensing process by May 2002.

Non-EU countries in Western Europe such as Norway and Switzerland have also

completed the 3G licensing process. In Central and Eastern Europe, the Czech

Republic, Latvia, Poland, the Slovak Republic and Slovenia have licensed 3G

operators. By 31 December 2002, some 26 countries and territories in Europe had

completed 3G licensing processes.

In the Asia region, economies such as Hong Kong, China; Israel,

Japan, the Republic of Korea, Malaysia, Singapore and Taiwan, China had issued

23 licences for 3G by December 2002.

In the Oceania region, Australia and New Zealand have allocated

spectrum and awarded licences for 3G.

Canada is the only country from the Americas region that has

auctioned 3G spectrum in the 2 GHz range. Several countries in the Americas have

already allocated licences for so-called Personal Communications Services (PCS)

that take up parts of the spectrum bands identified for 3G services. There are

several factors holding back the allocation of additional spectrum for 3G in the

region. One is that local operators have already invested heavily in building

their 2G networks (in the 1900 MHz band). Additional spectrum would require more

investments which operators are presently unable or unwilling to make. Another

factor is the plurality of different systems in the region (i.e., TDMA, GSM and

CDMA), which complicates the migration path from 2G to 3G.

Table 1 — Outcome of 3G mobile licence auctions

Status at 31 December 2002

| |

Economy |

Auction

date |

Number

of winners |

Amount

(USD million) |

Remarks |

| 1 |

United

Kingdom |

April

2000 |

5 |

35

411 |

The four incumbents were

awarded licences plus a new entrant |

| 2 |

Netherlands |

July

2000 |

5 |

2515 |

All five incumbents won the

licences |

| 3 |

Germany |

August

2000 |

6 |

46

323 |

Four incumbents won licences |

| 4 |

Italy |

October

2000 |

5 |

10

084 |

Three of four incumbents won

licences |

| 5 |

Austria |

November

2000 |

6 |

716 |

All six bidders won licences,

including the four incumbents |

| 6 |

Switzerland |

December

2000 |

4 |

121 |

Four bids for four licences |

| 7 |

New

Zealand |

January

2001 |

5 |

60 |

Four licences were awarded

at auction and a fifth was set aside for the Maori people |

| 8 |

Canada |

February

2001 |

5 |

931 |

Five bidders won 52 regional

licences |

| 9 |

Belgium |

March

2001 |

3 |

418 |

Three bids received for four

licences on offer |

| 10 |

Australia |

March

2001 |

6 |

578 |

Two national and various

regional licences were awarded to six bidders |

| 11 |

Singapore |

April

2001 |

3 |

166 |

Auction cancelled since

there was the same number of bids as licences to be awarded. Each

licence was awarded for the reserve price |

| 12 |

Greece |

July

2001 |

3 |

414 |

Four licences had been on

offer. The three incumbents were awarded licences |

| 13 |

Hong

Kong, China |

September

2001 |

4 |

671 |

Bidders had to pre-qualify.

Only four bidders for four licences. Amount equals bid plus minimum

royalty payments for 15 years |

| 14 |

Denmark |

October

2001 |

4 |

496 |

Sealed bid where licence

price corresponded to the fourth highest bid in the auction |

| 15 |

Slovenia |

November

2001 |

1 |

90 |

Licence awarded to only

bidder (three licences had been offered) |

| 16 |

Czech

Republic |

December

2001 |

2 |

203 |

Two incumbents won with the

third not participating |

| 17 |

Israel |

December

2001 |

3 |

157 |

Won by the three incumbents |

| 18 |

Taiwan,

China |

February

2002 |

5 |

1397 |

Only three of six incumbents

won licences |

| 19 |

Latvia |

October

2002 |

2 |

19 |

Two incumbents bid for three

licences |

| |

Total |

|

77 |

100 771 |

|

Table 2 — Outcome of 3G mobile licence beauty contests

Status at 31 December 2002

| |

Country |

Date

licence awarded |

Number

of licences |

Amount

(USD million) |

Remarks |

| 1 |

Finland |

March

1999 |

4 |

– |

Administrative fee of EUR

1000 per 25 kHz |

| 2 |

Spain |

March

2000 |

4 |

444 |

Amount does not include

yearly radio spectrum fees |

| 3 |

Japan |

June

2000 |

3 |

– |

Two W-CDMA and one CDMA2000

1X |

| 4 |

Norway |

December

2000 |

3 |

45 |

In addition, each licensee

is expected to pay USD 2.2 million per year as frequency usage charge |

| 5 |

Portugal |

December

2000 |

4 |

360 |

Not including annual

spectrum fee |

| 6 |

Poland |

December

2000 |

3 |

1839 |

Awarded to three incumbents |

| 7 |

Korea

(Republic of) |

December

2000

August 2001 |

3 |

2886 |

KTF and SK Telecom awarded

W-CDMA licences followed by LG Telecom (CDMA2000 1X) |

| 8 |

Sweden |

December

2000 |

4 |

– |

Spectrum use fee and 0.15

per cent of turnover |

| 9 |

France |

July

2001

May 2002 |

3 |

1042 |

Bouygues Telecom was awarded

a 3G licence, at a lower price, after the two incumbents, France Telecom

and SFR |

| 10 |

Luxembourg |

May

2002 |

3 |

– |

Annual spectrum usage fee of

0.2 per cent of turnover or a minimum of EUR 200 000 |

| 11 |

Ireland |

June

2002 |

3 |

173 |

Two incumbents awarded

licence plus new entrant |

| 12 |

Slovakia |

June

2002 |

2 |

67 |

Three licences had been

awarded but one was later withdrawn |

| 13 |

Malaysia |

July

2002 |

2 |

26 |

Additional maintenance fees

based on the number of transmitters set up in each licensee’s 3G

network |

| |

Total |

|

41

|

6882

|

|

Table 3 — Regional distribution of 3G licences and deployments

Status at 31 December 2002

| 3G

licences1 |

CDMA2000

1x2 |

Total |

| Region |

Number of countries |

Number of licences |

Licence fees (USD million) |

Number of country launches |

Number of operator launches |

Number of country launches |

Number of operator launches |

Number of countries |

Number of launches |

| Africa |

– |

– |

– |

– |

– |

– |

– |

– |

– |

| Americas |

1 |

3 |

931 |

– |

– |

9 |

20 |

9 |

20 |

| Asia |

7 |

23 |

4310 |

1 |

3 |

3 |

5 |

4 |

8 |

| Europe |

26 |

83 |

100 588 |

3 |

4 |

3 |

3 |

6 |

7 |

| Oceania |

2 |

10 |

673 |

– |

– |

2 |

2 |

2 |

2 |

| Total |

36 |

119 |

106 502 |

4 |

7 |

17 |

30 |

21 |

37 |

1 Where there was a formal 3G licence process.

2 Launched as an extension of existing networks.

Source: ITU.

A 1992 mobile phone — a model that was

especially popular with architects, construction site managers and

surveyors

ITU 030090/Siemens AG

|

In some countries, spectrum in the IMT-2000 bands cannot be made

available as it is used for national security purposes. Finally, existing

spectrum bands (1850–1990 MHz) can be used to provide 3G-type services and

operators in the region with CDMA networks are choosing to evolve to CDMA2000 1X

(recognized as an IMT-2000 standard) without the need for additional spectrum.

No African country has issued licences for IMT-2000. In most

African countries, there are already many more mobile than fixed telephone

subscribers, so 3G could be a key technology for enhancing Internet penetration

in the region. While no formal IMT-2000 licensing has taken place, it could be

that operators in some African countries may introduce 3G-like services within

existing frequency allocations. These include fixed wireless operators using

CDMA that hope to introduce a mobility mode. For example, a Nigerian

telecommunication operator has announced plans to launch a CDMA2000 1X network.5

5 See Ericsson’s Press release of 2 April 2003: “Ericsson

and Nigeria’s RelTel Sign CDMA2000 1X” (www.ericsson.com/press/20030402-083853.html).

The rotating camera phone

ITU 030091/Samsung

Roll-out of 3G networks is in theory guided by timetables stated

in the licence conditions such as required minimum coverage by a specified date.

However, market demand and handset availability have impacted deployment

schedules and many networks have been delayed.

In Asia, SK Telecom of the Republic of Korea launched its CDMA

2000 1X network in October 2000.6 Japan’s NTT DoCoMo pioneered the deployment

of W-CDMA, launching its 3G service commercially in October 2001.

6

See “SK Telecom Launches Commercial cdma 2000 1x Service”,

Press release of 30 September 2000 (www.sktelecom.co.kr/english/newspr/news/2002/06/01/219,1012,0,0,0.html). SK Telecom was awarded a 3G licence but

for a network using W-CDMA technology. Republic of Korea mobile operators

consider CDMA2000 1X to be a 2.5G network. For example, LG Telecom, a Republic

of Korea mobile operator states on its website that “CDMA2000 1X is a 2.5

generation Mobile Communication Service” (see (www.lg019.co.kr/docs/eng/imt/imtcdma01.jsp).

In Europe, commercial 3G services based on W-CDMA were not

available by 1 January 2002, as had been called for in the EU guidelines.

Nascent 3G networks established in Austria, Finland, the Isle of Man and Monaco

initially provided trial services.

Manx Telecom, on the Isle of Man launched Europe’s first 3G

network in December 2001, and services became commercially available in July

2002. Although Finland was the first country in the world to license 3G, and

incumbent operator Sonera met licensing conditions by having its network

available on 1 January 2002, commercial service was not available until

September due to lack of handsets. Austria’s Mobilkom launched its 3G network

on 25 September 2002. In March 2003, Hutchison commercially launched 3G services

in the United Kingdom and Italy, as well as in Australia in April and in Sweden

in May.

Mobile phone production:

The final testing of a handset

ITU 030089/Nokia

|

Overall, uptake of 3G services based on W-CDMA has been slower

than initially announced. Handset availability and network interoperability have

been cited as reasons for the sluggish 3G market. Low market interest has

further exacerbated this scenario. The only other W-CDMA launches have been in

Japan, where in addition to NTT DoCoMo, J-Phone launched a W-CDMA network in

December 2002. These two operators had a combined 153 200 3G subscribers at

year-end 2002.

The use of CDMA2000 1X in existing mobile frequencies as an IMT-2000

standard has led to more rapid launches. Except for Japan, all CDMA2000

1X networks have been launched without the need for a new licence as they

operate in existing licensed radio frequencies. By the end of December 2002,

there had been 30 commercial CDMA2000 1X launches in 17 countries.7 The number

of CDMA2000 1X subscribers at December 2002 was 32.6 million with the vast

majority in the Republic of Korea and Japan.

7 See the “Operators” section of the 3G Today website for

updated listings of commercial CDMA2000 1X launches (www.3gtoday.com/operatorsflash.html).

Conclusion

There have been considerable delays in the introduction of 3G

and market penetration of licensed systems was less than 0.4 per cent of total

worldwide mobile subscribers, some four years after the licence process began.

Few EU countries met the directive of launching commercial 3G services by 1

January 2002. In retrospect, 3G licensing can be questioned on two grounds. One

was the EU process that compelled members to abide by a specific timetable. It

is debatable whether this was practical for a brand new service where

infrastructure availability and reliability was unknown and market demand was at

best, sketchy. This is particularly relevant in the GSM world, where at the time

of licensing, few operators had experience with high-speed data networks. The

second issue relates to the fact that CDMA networks can be upgraded to CDMA2000

1X without operators having to apply for a 3G licence. This has given CDMA

network operators an advantage over GSM operators. On the other hand, there is

confusion about whether CDMA2000 1X is truly 3G, especially since operators that

have launched those networks refer to them as 2.5G. A CDMA2000 1X network offers

data speeds of 144 kbit/s versus 384 kbit/s for W-CDMA.

Demonstrating location-based services at ITU

TELECOM

ASIA

2002

(Hong Kong, China). A number of these services are expected to use Demonstrating location-based services at ITU

TELECOM

ASIA

2002

(Hong Kong, China). A number of these services are expected to use

IMT-2000 systems

ITU 026120/A. de Ferron

|

The majority of countries in the world have yet to license or

deploy 3G networks. The contrast is even starker between developed and

developing nations. Countries that have not yet licensed IMT-2000 networks have

several options, based on the benefit of hindsight. One is that there may be no

hurry to license 3G. The first W-CDMA 3G networks have only recently been

deployed at great cost — and all in developed nations. At this point in time, it

may prove difficult for many developing countries to find investors willing to

invest in a brand new 3G network. Instead, countries might consider upgrades to

existing networks, evolving them to 2.5G as a first step to 3G. For GSM

networks, this means the deployment of GPRS while for cdmaOne networks it

involves the installation of CDMA2000 1X. This would provide faster speeds and

greater functionality for the development of mobile data services. If these

upgrades do not require changes to existing frequency allocations, then it may

be wise to encourage such enhancements without requiring a new licence. If

additional spectrum is required within the same frequency, regulators should be

encouraged to act favourably upon this request in the light of the benefits such

spectrum could bring. If new 2G mobile licences are to be issued, then the

authorities may wish to encourage operators to install their networks as

2.5G-ready.

| Contributed by Michael Minges and Pratikshya Simkhada of the “Market,

Economics and Finance Unit” of the ITU Telecommunication Development Bureau (BDT).

This Unit was formerly called “Telecommunication Data and Statistics Unit.” |

|

A dual-band mobile phone of 1999. Its simple menu

and large display appealed to first-timers, especially youth. With the

young target group came music too

A dual-band mobile phone of 1999. Its simple menu

and large display appealed to first-timers, especially youth. With the

young target group came music too

Demonstrating location-based services at ITU

TELECOM

ASIA

2002

(Hong Kong, China). A number of these services are expected to use

Demonstrating location-based services at ITU

TELECOM

ASIA

2002

(Hong Kong, China). A number of these services are expected to use